Many smart investors choose to diversify their portfolios as a way of reducing risk. Part of this strategy can involve adding a few international stocks to your portfolio. The markets and economies of different countries are affected by various factors, from politics to weather, and diversifying across geographies can help blunt the impact of an economic downturn in any single country.

With that in mind, Canadian-based Shopify (SHOP 4.90%) and Argentina-based MercadoLibre (MELI 1.96%) look like solid long-term investments. Here's what investors should know about these two international tech stocks.

1. Shopify: The Canadian commerce giant

Many great businesses start by solving a critical problem. That's the case with Shopify. The company launched in 2006 after co-founders Tobias Lutke (the current CEO) and Scott Lake found it surprisingly difficult to build an online store for their snowboard business. Seeing an opportunity, they shifted from snowboards to software, and Shopify was born.

Image source: Getty Images.

Today, Shopify's platform provides an end-to-end solution for merchants, allowing them to build and manage a retail business across physical and digital channels like web, mobile, and social media. Shopify also provides products that help merchants accept digital payments, manage their inventory, fulfill and ship orders, and connect with their customers.

One of Shopify's greatest advantages is the company's alignment with its merchants. Rather than pulling sellers into one marketplace like Amazon, Shopify empowers merchants to build their own storefront, grow their own brand, and develop relationships with their customers. In other words, Shopify puts its merchants first, and that mentality has been a powerful growth driver for the e-commerce company.

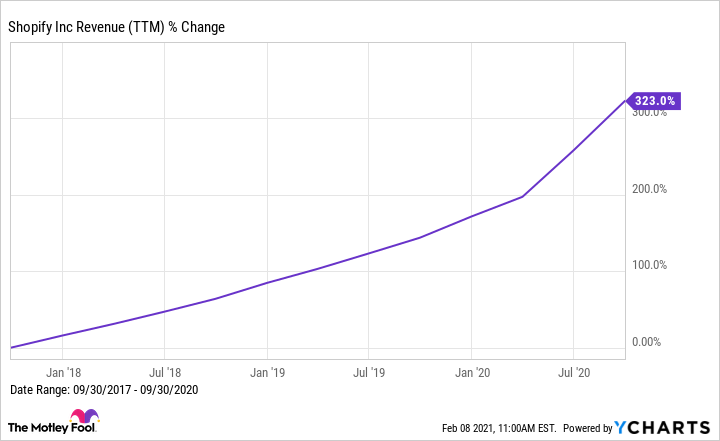

SHOP Revenue (TTM) data by YCharts

For investors nervous about diversifying internationally, Shopify could be a good place to start. The company is based in Canada, but more than half of its clients were in the United States as of Dec. 31, 2019. Moreover, Shopify's business should benefit greatly in the coming years as e-commerce continues to gain traction around the globe.

2. MercadoLibre: The Latin American disrupter

MercadoLibre has disrupted several different industries in Latin America. In 1999, the company launched as an e-commerce marketplace, but it has since expanded into digital payments, credit solutions, logistics, and other markets. Put simply, MercadoLibre has developed a comprehensive ecosystem that supports both merchants and consumers in over a dozen countries.

Moreover, the company is the clear leader in the e-commerce and digital payments markets in the region. And as MercadoLibre continues to add new merchants and consumers to its platform, the network effects that protect its business get even stronger. This gives the company a durable long-term advantage, making it difficult for smaller start-ups to compete.

Prior to the pandemic, MercadoLibre was already a thriving business with a big market opportunity. But like Shopify, the company's growth accelerated in 2020, driven by the rapid adoption of digital solutions in Latin America.

MELI Revenue (TTM) data by YCharts

Even so, MercadoLibre still has plenty of opportunity left. Internet penetration (the percentage of people with internet access) in the company's core markets -- Brazil, Mexico, and Argentina -- is much lower than in the United States. As a result, e-commerce adoption is also much lower. But according to eMarketer, Latin American e-commerce sales surged over 36% last year, growing faster than any other region in the world. Moreover, online sales are expected to grow from $84 billion in 2020 to $116 billion by 2023 -- that's about 12% per year. And as the market leader, MercadoLibre is well positioned to benefit.

Additionally, the growth in e-commerce should also spark an uptick in digital payments. And since a large portion of the Latin American population is unbanked, the company's Mercado Pago fintech solutions should be in high demand, whether by providing payment processing services for merchants or prepaid cards and mobile wallets for consumers.