If you're a retiree, you probably don't want to be spending your time constantly checking up on stocks, worrying about whether your nest egg is safe. And that's why you are better off avoiding the volatility in the markets and sticking to blue chip investments that offer safety and can provide a good source of recurring cash flow. They can help you pay your bills or fund that next vacation.

One stock that could meet those needs is Medtronic (MDT 0.18%). Although it has underperformed the S&P 500 over the past year, rising only 32% while the index has soared more than 55%, it's still a terrific buy for retirees. Here's why.

Image source: Getty Images.

It's a Dividend Aristocrat

Dividend Aristocrats are stocks that have increased their payouts for at least 25 consecutive years. Medtronic's streak currently sits at 43 years. The company announced its most recent pay hike in March, boosting its dividend payment by 7.4% to $0.58 every quarter. That puts its yield at just under 2%. Although that isn't a huge percentage, it's still better than the S&P 500's average yield of around 1.5%. And if Medtronic were to continue increasing its dividend payments by at least 7% every year, in about 10 years it would be paying you double what it is right now.

If you had a $100,000 investment, Medtronic's current yield would bring in approximately $1,960 over the course of a year. At double that rate (which assumes you hang on to the stock and the company continues increasing its dividend payments), you would be collecting more than $3,900. As you can see, investing in the stock is an easy way to supplement your income. And you also don't have to worry about Medtronic's dividend despite its payout ratio sitting at over 100%.

This past year has been a tough one for many healthcare companies, and Medtronic is no exception, as its profits over the past three quarters have fallen by 46% due to declining sales and rising product costs. But the silver lining here is that even amid such an awful year, the company has generated $4.6 billion in free cash flow over the trailing 12 months -- which is much more than the $3.1 billion it paid out in dividends during that time. The company's payouts are safe, and so is the stock.

Medtronic is a low-volatility stock

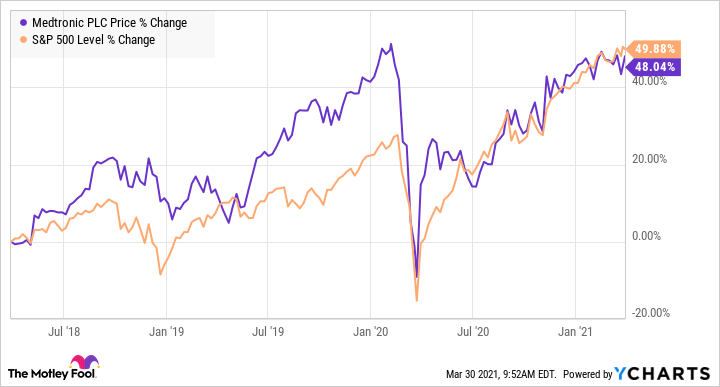

Another great reason retirees will love Medtronic stock is that it won't take you on a roller coaster ride. Over the past three years, it has averaged a beta of 0.77. Beta is a measure of how closely a stock moves with the markets. A beta of 1 would indicate that a stock has followed the market's movements closely. The lower the number, the less volatile the stock. That often means missing out on some bullish activity, but in return, investors don't have to worry about the market's wild swings:

The stock's returns over the past three years have been very comparable with the overall market -- and this is with Medtronic having a rough performance in 2020. But the stock is likely to do better as concerns about the pandemic start to fade because it is in a great position to benefit as demand recovers.

The underlying business is rock solid and will likely rebound in 2021

If you want to buy and forget about an investment, you need to feel comfortable that the business is sound and won't run into trouble. And given that Medtronic has posted a profit and generated enough cash to fund its dividend during a pandemic, that should give investors some assurance that it can withstand difficult years.

In each of the past five fiscal years, Medtronic has posted a profit margin of at least 10% or better. One of the reasons it can deliver strong numbers is due to its high gross margins, which typically are at least 60%. With high margins, a business can more easily cover its operating expenses and fixed costs. And that means a good chunk of any incremental revenue will help boost the company's overall profitability.

On Feb. 23, Medtronic released its third-quarter results for the period ending Jan. 29. Sales of $7.8 billion were up a very modest 1% as the company was showing signs of recovery. Management noted that there was a "resurgence on procedure volumes" toward the end of last year and the early part of 2021. As hospitals start to resume their normal day-to-day operations, that can help boost demand for Medtronic's medical devices and help strengthen its sales and profit numbers.

Should you buy Medtronic's stock today?

If you're a retiree or just want a safe stock to put in your portfolio, Medtronic is an investment you will want to consider. The company plays an important role in the healthcare industry, providing medical devices worldwide that can help treat patients with varying issues. Those aren't expenses hospitals are going to cut back on, certainly not amid the pandemic and the possible long-term consequences of contracting the coronavirus.

Medtronic's place in the industry looks safe, and with strong profits, it definitely is a stock you can safely store in your portfolio for many years. With a dividend that's likely to increase over time, there's even extra incentive to buy and hold.