Investors should always be seeking a margin of safety in their investments, whether they're looking at growth stocks, value stocks, or dividend stocks. It's a bonus when that relatively safe stock also happens to be available at a bargain price.

In today's market, where price-to-sales multiples have exploded and unprofitable companies are worth billions, it can be hard to find bargain stocks. But there's a lot to like about General Motors (GM 0.26%), Sherwin-Williams (SHW -0.58%), and Verizon (VZ 0.59%) given not only their value but also their long-term growth potential.

Let's learn a bit more about these three bargain stocks you can buy right now.

Image source: Getty Images.

1. General Motors: An automaker with big upside

The auto manufacturing business has traditionally been very volatile for investors, with boom-and-bust cycles following economic expansions and contractions. GM has been through those cycles, and after going through a painful bankruptcy during the Great Recession, I think the company has now constructed a business that's built to not only survive but thrive in the future.

First, GM is generating a solid profit despite all of the threats from Tesla and other electric vehicle (EV) start-ups. And that profit foundation is built on trucks and SUVs that EVs haven't been able to disrupt quite yet.

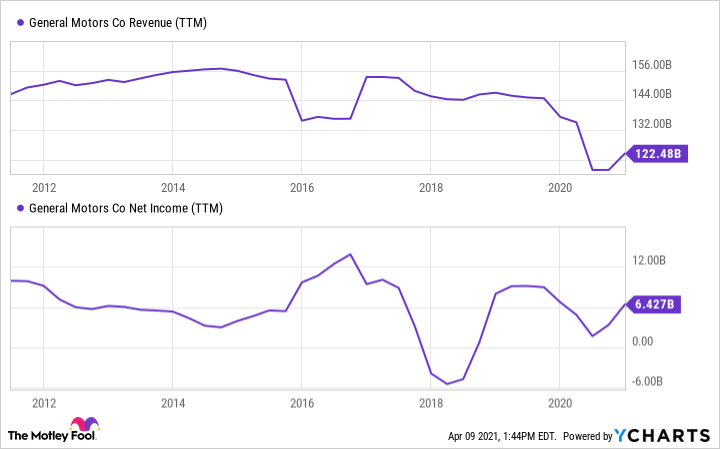

GM Revenue (TTM) data by YCharts.

That solid foundation is also helping GM build an electric vehicle future that could make it an industry leader. Management has said the company will make only electric vehicles by 2035, and it's starting with the Chevy Bolt, the Hummer EV, the Cadillac LYRIQ, and even an EV version of the Silverado. These investments in electric vehicles should make its core manufacturing business competitive and potentially profitable for the foreseeable future.

What I'm really excited about for GM is the company's controlling stake in Cruise, the autonomous vehicle company. Cruise is aiming to bring a fully autonomous ridesharing service to market and will rely on GM to build custom vehicles. The first design is called Cruise Origin, a vehicle without a driver that's made to be low-cost to operate and fully electric. If Cruise can make autonomous ridesharing a widely adopted service, this could be a truly disruptive company.

GM's shares aren't terribly expensive, with a P/E ratio of 13.9 and a 2.5% dividend yield, and if Cruise turns out to be a revolutionary company in transportation, this could be a huge winner long-term.

2. Sherwin-Williams: Paint is about as safe as it gets

One of the more underappreciated businesses today is paint and precision coatings, which is where Sherwin-Williams is a market leader. The company makes paint under the Sherwin-Williams and Valspar brands, and that's the core business and what consumers see.

What may be less appreciated are its performance coatings for bridges, auto painting, industrial equipment, packaging, high-performance flooring, and much more. The combination of these products has driven consistent growth in revenue and net income.

SHW Revenue (TTM) data by YCharts.

What I think investors should be impressed by is the steady increase in operating margin (see chart above). Greater scale and pricing power drive better margins and earnings, and I don't see the trend reversing anytime soon.

Shares of Sherwin-Williams are reasonably priced at 35 times earnings and just 3.7 times sales. The 0.9% dividend yield isn't high, but in an environment of low interest rates, it's a decent payout for long-term investors.

3. Verizon: The best way to play 5G wireless

Telecommunications stocks have become slow-growth dividend payers for investors, but Verizon could have a brighter future than some folks think. You can see below that the company is a cash flow machine, and that will continue as long as wireless connections are in demand.

VZ Cash from Operations (TTM) data by YCharts.

After spending $45 billion on additional 5G spectrum, I also think there are reasons Verizon will enter a growth phase. Management recently outlined a plan to cover 15 million households with fixed wireless by the end of this year and 50 million households by the end of 2025. Fixed wireless will compete with broadband internet and allow Verizon to bundle wireless plans with home internet. These incremental connections should be high-margin revenue for Verizon in a market it typically hasn't competed in nationwide.

Verizon's P/E ratio is a very low 13.4 and its dividend yields 4.4% right now. If 5G turns this into a growth stock, it has a lot of upside ahead.

Growth with a margin of safety

GM, Sherwin-Williams, and Verizon are all relatively cheap stocks with growth potential if some innovations work in their favor. And that's the kind of low-risk upside bargain-hunting investors should be looking for in a market that seems overvalued in nearly every corner.