Investors had high expectations heading into the fourth-quarter earnings report from Bed Bath & Beyond (BBBY). The struggling specialty retailer has been shrinking its portfolio and restructuring the business following brutal operating results in both fiscal 2019 and 2018.

The good news is that Bed Bath & Beyond is emerging from the pandemic with improved sales trends and some valuable competitive assets. Yet investors should still brace for a tough few years ahead.

Let's take a closer look.

Image source: Getty Images.

Growing and shrinking

Management touted Bed Bath & Beyond's 4% comparable-store sales increase, which marked the company's third straight positive result after two consecutive years of declines. The chain benefited from robust demand in its core home furnishings niche, and from a digital selling platform that's competing with some of the best in the industry. E-commerce sales rose 86% through late February.

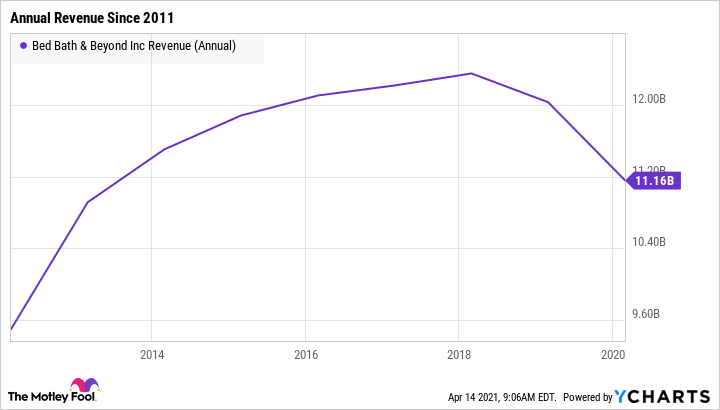

It's important to note that these growth figures strip out the impact of management's restructuring plan, which has removed hundreds of stores from the selling footprint. Accounting for those losses, sales declined sharply to $9 billion compared to over $11 billion a year ago. That marked the third straight year of falling revenue.

BBBY revenue (annual) data by YCharts.

Cutting costs

The profit picture is just as challenged. Gross margin fell to 32% of sales from 31% this quarter. Bed Bath & Beyond held the line on other expenses, though, so that overall operating loss was cut by more than half to $337 million in 2020.

Executives stressed that improving loss trend as key to their turnaround plans. "We are excited to start fresh in 2021," CEO Mark Tritton said in a press release, "with our sharpened size and scale [and] a stronger financial position."

Bed Bath & Beyond was cash flow positive for the year and has plenty of cash on its books. Its debt level is high, though, at more than 3 times adjusted annual earnings.

Three years of change

One of management's core financial goals is to get that debt burden down over the next three years while it continues shrinking the business to a smaller, more profitable scale. Revenue should land at $8 billion in 2021, management estimated, compared to the company's peak production of over $12 billion in 2017.

The retailer has valuable assets it can lean on during its transition over the next few years. The biggest is its connection with shoppers in the home furnishings space. Millions of people turned to the Bed Bath & Beyond brand during the pandemic, and many of them were impressed with its omnichannel offerings. The chain isn't likely to face a cash crunch, either.

But Bed Bath & Beyond is just beginning what management described as a three-year plan to transform the business and rebuild the brand's authority in a niche that's being targeted by deeper-pocketed rivals, from Wayfair to Home Depot.

Unlike these high-performing peers, the retailer is aiming to shrink (not expand) its addressable market as it works to end a multiyear streak of net losses. That situation should have investors staying cautious about this stock, which has soared through the pandemic.

Sure, Bed Bath & Beyond seems cheap on measures like price-to-sales. But a lot is riding on the chain completely reinventing its business over the next few years. If you don't have the risk appetite for that volatility, you might want to invest in other, sturdier retailers.