Companies at the forefront of medical or technological innovations are often rewarded for their efforts, both in terms of financial results and as it pertains to stock market performance. That's why many investors actively look for such companies: Getting in on the ground floor could translate to market-shattering returns in the long run.

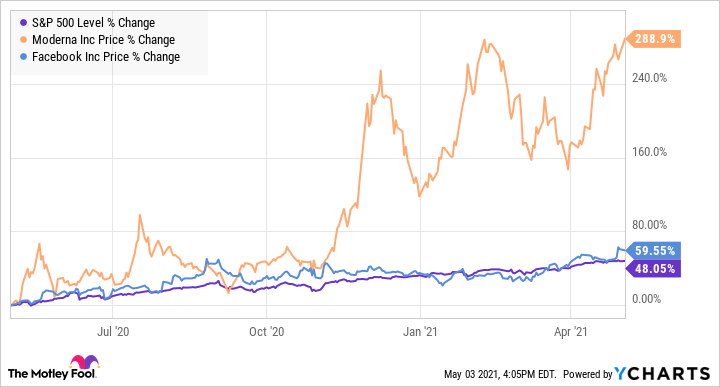

But even if such a company has already made quite a few investors rich, it may still be worth purchasing its shares if it has enough growth left in its engine. With that in mind, let's turn our attention to two revolutionary stocks that have turned $200,000 into more than $1,000,000 (that's a return of more than 500%): Moderna (MRNA 0.66%) and Facebook (META 0.73%). Here's why both of these companies could still have a long runway for growth.

1. Moderna: 900% return in the past 2.5 years

Moderna went public in December 2018, and until last year, it was a relatively unknown company. The biotech made a name for itself thanks to its efforts to develop a COVID-19 vaccine, mRNA-1273. But even as the market cheered Moderna's work and sent its shares soaring through the roof, I remained highly skeptical. Recently, I have been forced to reconsider my position.

Moderna focuses on developing messenger RNA (mRNA) vaccines. Unlike most traditional vaccines, those of the mRNA variety don't confer immunity by injecting a harmless form of a virus into patients' bodies. Instead, mRNA vaccines work by delivering genetic instructions into the body that help the immune system respond appropriately once it encounters the actual virus.

This technology isn't new, but no such product had been granted emergency use authorization (EUA) by the U.S. Food and Drug Administration (FDA) until December 2020. Once the regulatory agency gave the green light to the COVID-19 vaccines developed by Moderna and Pfizer/BioNTech (which is also an mRNA) vaccine, this technology reached a new level of recognition.

Image source: Getty Images.

On average, analysts expect Moderna to generate $17.42 billion in revenue this year, which isn't bad for a company that had no products on the market until just a few months ago. This windfall will help the biotech fund its more than a dozen clinical programs, most of which are mRNA vaccines for infectious (and many serious) diseases.

According to Moderna, of the more than 80 new viruses discovered in the past 40 years, only 4% have a vaccine that is approved in the U.S. In other words, there is a large and unmet need in this market. Thanks to its mRNA platform and the money it will generate with the sales of mRNA-1273, the company is well-positioned to be successful in its efforts to develop and market a raft of vaccines.

In my view, the company's master plan post-coronavirus has a multibillion-dollar potential, and that should help steer the company's growth trajectory in the right direction, making it an excellent biotech stock to consider buying today.

2. Facebook: 740% return in the past nine years

In many ways, Facebook revolutionized the way we socialize. And although the company's namesake website is still a core part of its business, the tech giant has expanded its suite of social media platforms. Facebook acquired Instagram and WhatsApp, and the company added Facebook Messenger to its arsenal as well. Overall, these services had a combined 3.45 billion monthly active people as of March 31.

Naturally, Facebook's pioneering efforts in the social media landscape haven't gone unnoticed, but the company has also had its share of struggles. Facebook has been involved in data breach scandals, and more recently, many have condemned its stance on political advertising and hate speech on its platform. Further, Facebook and other big names in the tech industry have come under the scrutiny of lawmakers for alleged monopolistic practices.

Image source: Getty Images.

These headwinds may scare away some investors, but as a shareholder, I have no intention of jumping off this ship anytime soon. One major reason why is that Facebook's network is far too attractive to advertisers. After all, nearly half of the world's population visits one of the company's platforms at least once every single month. Facebook's user base will likely continue to grow, and that can only mean good news for its advertising revenue, which makes up the overwhelming majority of its top line.

In the first quarter, Facebook generated $26.2 billion in revenue, a 48% year-over-year increase. The company's advertising revenue came in at $25.4 billion, 46% higher than the year-ago period. On average, analysts see the company's top line growing at an annual rate of 21.5% over the next five years. Note that Facebook still generates most of its sales from its namesake website and Instagram.

The company has yet to fully monetize WhatsApp and Messenger, which gives the tech giant yet another long-term opportunity. In short, for those who have yet to purchase shares of Facebook, it isn't too late to do so.