Corsair Gaming (CRSR 0.11%) is one of the latest additions to the list of meme stocks whose share prices are being strongly influenced by discussions in online forums and the psychology of the fear of missing out. Chatter on online platforms such as Reddit can trigger rallies in such stocks, which are often heavily shorted. Retail traders pile into them in hopes of causing short squeezes, which can send their share prices soaring.

Corsair Gaming experienced precisely that phenomenon in mid-June. Shares of the video gaming hardware and peripherals maker took a big single-day leap skyward, despite the absence of company-specific news. However, it is worth noting that 18% of the company's share float was sold short at the end of May. That high degree of short interest was probably what drew the attention of traders on the Reddit forum Wallstreetbets, where one poster has asserted that the company "will swallow the gaming industry and be a 'millionaire maker' stock."

Image source: Getty Images.

While it's generally not a good idea to bet on stocks whose prices are being driven more by fads than fundamentals (GameStop, for example), Corsair Gaming looks like an exception. That's because it's poised to take advantage of fast growth in a segment of the tech world where it enjoys a solid market share. As a result, it has been delivering terrific financial growth that may last for many years.

The video game hardware business is booming

Corsair Gaming has been on fire ever since it made its stock market debut less than a year ago. Its share price has more than doubled since its IPO on the back of spectacular growth in its revenue, margins, and earnings.

CRSR data by YCharts

Last year's outstanding momentum has continued into 2021. In Q1, Corsair's revenue grew 72% year over year to $529 million, while adjusted earnings per share more than quadrupled to $0.58. On the May earnings conference call, Corsair management pointed out that market share gains across several segments were the keys to that growth. "We're also very pleased to see that in Q1, we were the No. 1 market share position in every gaming components category," CEO Andy Paul said.

For instance, Corsair's share in the market for gaming PC (personal computer) cases was 28% in Q1, 9 percentage points higher than its nearest rival. It was also the leader in video capture cards and lighting, while the new microphone product it launched last year has rapidly gained market share.

In fact, Corsair occupies first place in key verticals of the gaming components and systems market in the U.S., among them PC cases, memory, power supply units, and cooling solutions. Meanwhile, it is among the top three players in different segments of the gamer and creator peripherals space such as keyboards, mice, controllers, and streaming peripherals. The company also occupies fourth place in the headset market, according to the NPD Group.

All of this should position it for long-term growth. Citing estimates from Jon Peddie Research, Corsair management estimates that the company has a total addressable market opportunity worth $46 billion spread across gaming peripherals, streaming gear, gaming systems and components, and related software.

Corsair is just scratching the surface of that massive opportunity, with trailing 12-month revenue of just $1.9 billion. As such, it won't be surprising to see the company clocking high growth rates in the coming years as it digs deeper into its end markets, whose growth will be aided by trends such as esports and the increasing demand for gaming PCs.

Robust fundamentals

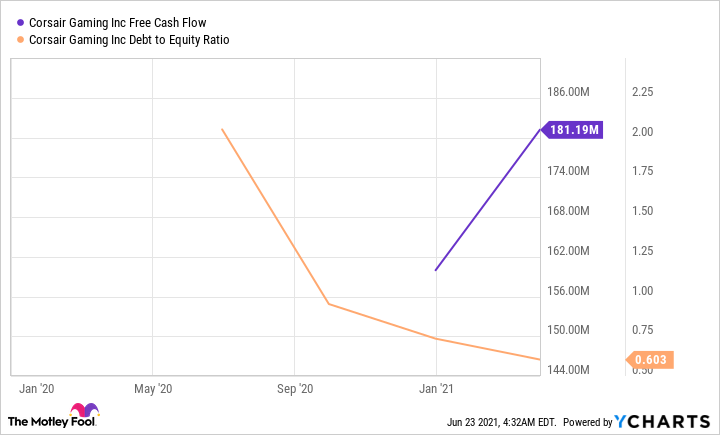

Corsair Gaming is not just delivering eye-popping growth -- it also sports solid fundamentals that make it more than just a meme stock. For instance, thanks to the impressive bottom-line growth it has been registering, its free cash flow has been heading north of late despite management's decision to pay down debt.

CRSR Free Cash Flow data by YCharts

Corsair exited Q1 with $121 million in cash and total debt of $299 million. The good part is that it reduced its debt by $28 million in that quarter and expects to knock another $72 million off the books by the end of this year, which will lead to a further reduction in interest expenses.

All of this indicates that Corsair Gaming is pulling the right strings to position itself for high rates of growth in the long run. That's why investors should consider investing in this growth stock now, while it's still trading at around 20 times trailing earnings. That's significantly cheaper than the P/E ratios over 45 it sported late last year.