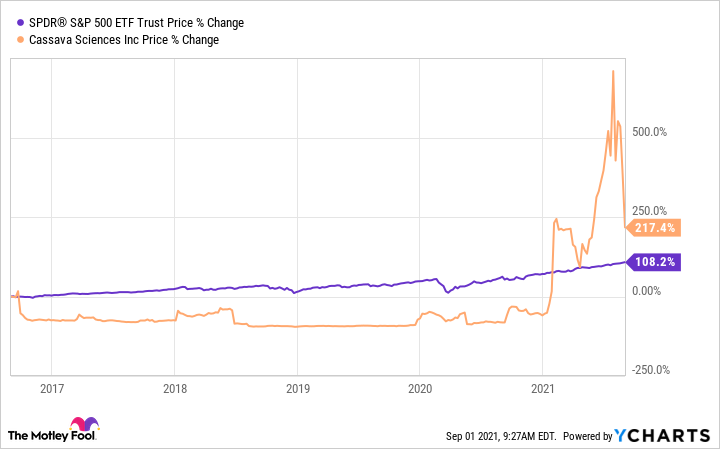

When I first noticed Cassava Sciences (SAVA -0.38%) in July, the stock had already gone up by more than 1,000% over six months, from $7 per share to $90. What does that dramatic price shift say to you? To me, it says two things. First, "something amazing is happening with Cassava." And second, "the market does not know how to value this stock."

I made a small investment in Cassava at $91. The stock immediately ran up to $113. ("I am so right.") Then it dropped to $80. ("Oops.") Then it ran up to $146. ("I knew I was right.") Then it dropped to $65. ("What the heck!?") Then it ran up to $124. ("I told you I was right.") This week, it dropped all the way to $49. ("Bleep.")

If I had gone in for a thousand shares with my initial investment, I imagine I'd be kind of moody right now. And I'm sure there are some Cassava investors out there who are stressed out by all this volatility. But I'm not one of them. Here's why.

image source: Getty Images

1. My initial investment is tiny

On Friday, when Cassava dropped 17%, I almost didn't notice. Overall, my family portfolio was up by more than 1%, almost double the market's gains that day. It was only when I scrolled down that I noticed that Cassava's stock was getting creamed (again). Cassava is at the bottom of that particular portfolio because it's our smallest position. It was less than 1% of the portfolio when we bought our shares, less than 1% after it jumped up to $146, and it's still less than 1% now.

That's one way -- a cautious way -- to approach a high-risk investment. Just dip your toe in the water, and buy a small number of shares. It makes volatility interesting, and kind of fun -- like a soap opera. What the heck is going to happen with Cassava tomorrow? I don't mind owning a battleground stock, and it's certainly not boring.

You might say, "Why bother with such a small stock purchase? Why are you wasting your time?" And the answer is: because the potential upside is amazing.

I'm not looking for a quick double, and I'm not worried about a 50% haircut. That's a short-term outlook, and it's not the Foolish way that preaches long-term thinking. Long-term investors may think, "this stock might go to zero, or this stock might go up 10,000% -- eventually." When you expand your time horizon, day-to-day price movements can be interesting, but they're mostly irrelevant.

This story of this biotech is just getting started. Cassava has an Alzheimer's drug candidate, simufilam, in clinical trials, and it delivered positive data from its phase 2 studies. It's starting two phase 3 trials later this year. Simufilam is showing promise, with positive biomarker data and some patients actually getting better. Cognition scores were up 10% and behavior scores were up 29%. The market is understandably excited because the potential market for Alzheimer's treatments is massive, maybe $100 billion or more annually.

The company that finds a drug that actually helps people with this condition will make a lot of money. I'm hopeful that Cassava will be that company.

2. You scared me with "might go to zero"

Alzheimer's research has been a disappointing arena for Big Pharma. More than 130 drug candidates have failed in the lab or in clinical trials since 1998. That long track record of failure has scared many investors away from this sector. And patients are desperate for new treatments. It's gotten so bad, the Food and Drug Administration (FDA) recently approved an Alzheimer's drug that failed to beat placebos.

Why has there been so much failure?

In 2019, STAT published an eye-opening investigation. At top research universities, the dogma has always been that amyloid plaques in the brain cause Alzheimer's. Other ideas and scientific research into alternative theories was always shut down. Some frustrated researchers left the field because it was like butting their heads against a brick wall. Neurobiologist Rachael Neve -- one of the co-authors of the 1987 study that inspired the focus on amyloid plaques -- has called this "one of the most tragic stories [in] disease research."

I'm not a scientist, but I don't want to invest in any drug company following the belief that amyloid plaques cause Alzheimer's. 0-for-130 is enough failure. Let's try something new.

3. Does inflammation cause Alzheimer's?

The National Institutes of Health (NIH) is now funding research that doesn't follow the amyloid hypothesis. For instance, a new theory being explored suggests that the cause of Alzheimer's may be inflammation in the brain. It might be that the brain's immune system gets out of whack and starts killing healthy neurons.

INmuneBio (INMB 4.39%) is focused on inflammation, though I don't own shares. That's because my initial research indicated that INmuneBio seems to think that inflammation causes everything. Among other things, they're pursuing potential drugs for COVID-19, Alzheimer's disease, treatment-resistant depression, NASH, and cancer. That kitchen-sink approach didn't sit well with me.

But the main reason I'm buying Cassava in particular, rather than a basket of stocks in this area, is that neither INmuneBio nor Annovis Bio (ANVS 9.57%) -- another biotech with an Alzheimer's drug -- have enough money on hand to conduct phase 3 trials, and both are years behind Cassava in their drug development. Those are the biggest danger signs for them.

4. Is there a genetic basis for Alzheimer's?

The NIH also funds Cassava's research, which is focused on the potential genetic causes of Alzheimer's. Specifically, the company believes that a faulty protein, Filamin A, is the root cause of Alzheimer's, and that restoring its form and function will help patients. Simufilam was designed to do just that.

What's interesting is that while simufilam binds to a single target, it has a dual mechanism of action: it reduces brain degeneration and inflammation. So if inflammation is indeed the root cause of Alzheimer's, Cassava's drug might still work.

While it's very early, investors are right to be excited about Cassava's drug. The safety record, the positive data, the upcoming phase 3 trials, all suggest the possibility that the company might have a blockbuster.

Indeed, last week anonymous people retained an attorney to file a petition with the FDA to halt Cassava's phase 3 trial. I'm convinced these people are motivated by money and have no interest in finding out if the drug actually works or not. (On August 25, the law firm, Labaton Sucharow, acknowledged that their clients have short positions in Cassava's stock.)

For me, I remain optimistic about Cassava Sciences' work in the Alzheimer's space and am hanging on tight to my small position. I'll also consider buying more shares as the company progresses.