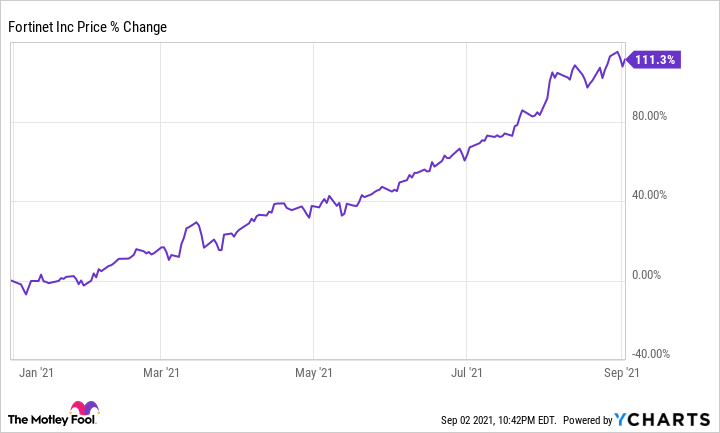

Fortinet (FTNT 3.03%) has sizzled on the stock market in 2021. Shares of the cybersecurity specialist have shot up more than 110% so far on the back of consistently strong quarterly results.

The growing demand for cybersecurity solutions in the wake of the novel coronavirus pandemic has supercharged Fortinet. So it wasn't surprising to see the company deliver growth once again when it released its second-quarter results at the end of July. Fortinet's Q2 revenue jumped 30% year-over-year to $801 million, while non-GAAP earnings rose to $0.95 per share from $0.83 per share in the prior-year period.

Wall Street was looking for $0.88 per share in adjusted earnings on revenue near $744 million. The company easily exceeded those expectations thanks to robust growth in product revenue, which was driven by cybersecurity upgrades in data centers.

More importantly, Fortinet set up bullish revenue guidance for the third quarter and full year. Third-quarter sales were aimed at approximately $907 million, and the top-line take for fiscal year 2021 got a target range between $3.21 billion and $3.25 billion. The Street estimates at the time stopped at $779 million and $3.11 billion, respectively.

Fortinet's solid outlook indicates that the company can continue to grow at an attractive pace and deliver more upside. Let's look at the reasons why the stock's hot rally should be sustainable.

Image source: Getty Images

Fortinet's metrics point toward bright days ahead

Fortinet expects $800 million to $815 million in revenue this quarter. Adjusted earnings are expected to be between $0.90 and $0.95 per share. Fortinet recorded $651 million of revenue in the third quarter of 2020, so it is on track to deliver 24% year-over-year top-line growth this quarter. However, there's a good chance of Fortinet blowing past expectations once again, considering the robust deal activity it is witnessing right now. An active data center firewall refresh cycle gives Fortinet a chance to win business from its rivals.

For instance, Fortinet saw a nice jump in the number of large deals in Q2. The number of transactions valued above $1 million increased 34% year-over-year to 79. In addition, the number of entry-level deals also increased -- the number of transactions valued above $50,000 jumped to 2,856 in Q2, an increase of 35% from the year-ago period.

More importantly, 36.9% of deals for Fortinet's FortiGate next-generation firewall (NGFW) were from high-end customers, up from 35.2% in the prior-year period. The number of entry-level deals for FortiGate increased to 25.5% of the total, compared to 20.4% in the year-ago period. These data points indicate that the company is not only witnessing an increase in spending for high-end products, but it is also bringing new customers into its fold.

It is also worth noting that customers are signing longer contracts with Fortinet. The company's average contract length during the quarter increased to 28 months from 26 months in the year-ago period. Additionally, Fortinet ended the quarter with deferred revenue of $2.91 billion, an increase of 27% from the prior-year period and equal to the company's trailing-twelve-month revenue.

A healthy deferred revenue pipeline is a positive for Fortinet, as the metric refers to the money collected in advance for services that will be delivered in the future. Deferred revenue is recorded as a liability when the money is collected. The revenue is recognized on the income statement once the actual service delivery happens.

Built for long-term growth

Fortinet sees an opportunity to expand its business as data center operators upgrade their firewalls. CFO Keith Jensen pointed out on the July earnings conference call that the refresh is "an opportunity to displace the incumbents as compared to Fortinet that has 500,000 customers in 70 different firewall models. [...] some of the competitors, the legacy players have a shorter list of customers and a shorter list of products, and maybe you're not doing as well in Gartner Magic Quadrants as we are. So we view that as an opportunity."

Mordor Intelligence estimates that the next-generation firewall market could be worth $5.5 billion by 2026 as compared to $2.8 billion last year, clocking a compound annual growth rate of 12%. Winning market share from rivals could help Fortinet grow at a faster pace than the overall market, and the company is trying to achieve that with the help of products that it claims are better than rivals' offerings.

On the other hand, the SD-WAN (software-defined networking in a wide area network) space is turning out to be a happy hunting ground for Fortinet. The SD-WAN space accounted for 19 deals worth over $1 million last quarter, up from 13 in the year-ago period. The global secure SD-WAN market is expected to record annual growth of 20% through 2024, hitting $859 million in revenue as per a third-party estimate.

As such, Fortinet could continue enjoying healthy growth in the SD-WAN market in the future. All these tailwinds are expected to drive solid growth in Fortinet's top and bottom lines and help the stock deliver more upside.

FTNT Revenue Estimates for Current Fiscal Year data by YCharts

Throw in the fact that Fortinet has an impressive balance sheet with more than $3.1 billion in cash and just over $1 billion in debt, and you'll see another reason to buy this cybersecurity stock, which could deliver long-term upside on the back of consistent growth in its revenue and earnings.