What happened

Shares of AeroVironment (AVAV 1.87%) traded down more than 9% for the week as of Friday morning as investors reacted to the drone maker's earnings report. The results came in ahead of expectations, but guidance for the full fiscal year failed to impress.

So what

AeroVironment is a longtime maker of small, backpack-size drones used primarily by the military. The company has been branching out of late, doing a series of deals to expand its artificial intelligence capabilities and to build up its ground-based robotics offerings. And earlier this year, it also acquired Arcturus UAV, expanding its drone portfolio into larger aircraft.

An AeroVironment drone about to take off. Image source: AeroVironment.

The company's fiscal first-quarter results, announced this week, suggest that the deals are beginning to pay off. Revenue grew 16% year over year to $101 million, beating analyst estimates by about $2 million. AeroVironment reported a loss of $0.17 per share for the period, which was about $0.08 better than expectations.

AeroVironment's backlog of future business grew to $257.7 million as of July 31, up more than 20% from the $211.8 million reported on April 30. On a post-earnings call, CEO Wahid Nawabi attributed that growth in part to the company's recent acquisitions.

But investors were more focused on the guidance, which suggested there might be some downside to analyst expectations. AeroVironment said it expects to report adjusted earnings of $2.50 to $2.70 per share, with the lower part of the range well below the $2.64 consensus estimate. Similarly, the company's full-year revenue guidance of $560 million to $580 million suggests it might not hit the $569 million consensus.

Now what

There's nothing wrong with AeroVironment, but the guidance suggests that as the company is maturing, its profile might be changing slightly. The larger drones it acquired in the Arcturus deal tend to have lower profit margins than the smaller aircraft that have long been AeroVironment's mainstay. Management said it expects its product mix to shift toward higher-margin sales as the year goes on, but based on the guidance and expectations, it might not shift enough to generate the results that analysts had hoped for.

Cathie Wood remains a believer. Her ARK Invest exchange-traded funds bought 69,000 shares of AeroVironment as the stock fell.

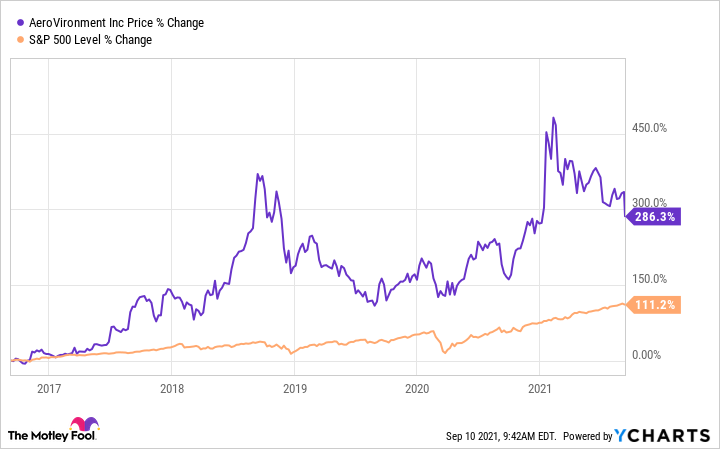

AVAV data by YCharts.

AeroVironment shares have climbed more than 288% over the past five years, beating the S&P 500 by more than 170 percentage points. But the stock has been volatile during that time. As the company grows and matures, it is likely to be a lot less volatile and a lot more predictable. But that might also mean that its growth rate will moderate somewhat.

If this week's trading is any indication, there could be some turbulence as investors adjust expectations.