If you're a cannabis investor, then you're probably familiar with the top stocks in the sector, such as Aurora Cannabis, Trulieve Cannabis, and Curaleaf Holdings. These stocks have large followings and their shares are active, reflecting that.

However, investing in less popular cannabis stocks can be a way to find some good value. Two names that won't be as common unless you've spent a lot of time looking at the sector are Fire & Flower (FFLW.F -44.37%) and Verano Holdings (VRNO.F 7.66%). And they've both been growing at impressive rates.

Image source: Getty Images.

1. Fire & Flower

Cannabis retailer Fire & Flower is a dominant player in the Canadian pot market, with the company owning 85 stores in the country as of last month. Excitingly, it has also found a way to penetrate the U.S. market through a licensing agreement with cannabis company American Acres -- which now goes by Fire & Flower U.S. Holdings. Although Fire & Flower isn't technically in the U.S., its brand is, with a store now sporting its name and logo in Palm Springs.

If and when the U.S. legalizes marijuana (which could still be years away from being a reality), Fire & Flower could accelerate its growth even further. A key investor in the company is fast-growing retail operator Alimentation Couche-Tard, which has more than 14,000 stores all over the globe.

But even today, Fire & Flower is delivering some strong numbers. For the period ending July 31, its sales of 43.3 million Canadian dollars grew 51% from the prior-year period. That was also the fifth straight quarter where the company recorded positive adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA).

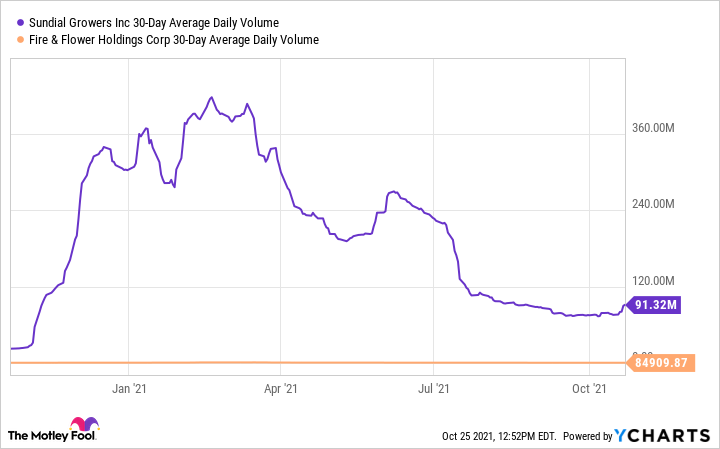

And yet, the pot stock trades at just 1.3 times its revenue, which is a bargain compared to the 21 times sales that cannabis company Sundial Growers trades at (it has recently gotten into the retail pot business). Undoubtedly, this is largely because Sundial is simply a more popular stock:

SNDL 30-Day Average Daily Volume data by YCharts

However, there's no doubt that Fire & Flower is the better buy overall.

2. Verano Holdings

Another stock that doesn't get as much respect as it should despite producing strong numbers is cannabis producer Verano Holdings. The stock only went public in February, so part of the struggle may be that it's still a bit too early for the company to amass much of a following.

But make no mistake, Verano is definitely worth keeping a close eye on. In September, the company opened its 86th location in the country. The company is active in 14 states, including New Jersey, which passed recreational marijuana legislation earlier this year and could be selling adult-use pot next year.

Like Fire & Flower, Verano is already generating some great numbers even before bigger opportunities open up for its business. For the quarter ending June 30, sales of $199 million were a record high and up 39% from the previous period. The company also recorded gross margins (before fair value adjustments of biological assets) of more than 50%, leaving plenty of room for the business to post a profit. Its adjusted EBITDA last quarter was $81 million, representing an impressive 41% of revenue.

With its solid margins combined with incredible growth, investors have been starting to take note of Verano:

VRNOF 30-Day Average Daily Volume data by YCharts

The stock is growing in popularity and while it is still an underrated buy, it may not stay that way for long. For growth investors who want exposure to the U.S. pot market, Verano is an investment worth considering.