Moderna (MRNA 0.66%) has been one of the hottest buys on the stock market over the past few years due to its COVID-19 vaccine. Since the start of 2020, its shares have skyrocketed more than 1,700% while the S&P 500 has risen by a more mortal 43%.

Investors having been jumping on the healthcare stock's bandwagon as its rapid ascent in popularity makes its story a lot more exciting than that of another big pharma company (think Johnson & Johnson or Pfizer) making a vaccine. Retail investors are big fans of Moderna, and even if it generates underwhelming results next year, it could still produce great returns -- largely because it could be the next big meme stock.

Image source: Getty Images.

What is a meme stock?

A meme is something that is exceeding popular on the internet. Investments that rise in popularity on Reddit and social media platforms are known as "meme stocks" and can surge in price even though their performance isn't strong or there are risks facing the business.

And in some cases, that risk can make them popular underdogs to bet on. Two examples of that are video gaming retailer GameStop and movie theatre operator AMC Holdings. In an era of lockdowns and consumers buying games online, neither of these stocks should have been as popular as they have been this year, but both are up more than 900% in 2021 (the S&P 500 has risen by 23%).

Moderna isn't in the same boat as those two businesses because it has been doing exceedingly well thanks to its COVID-19 vaccine; sales of $11.3 billion through the first nine months of the year have exploded from the $232 million that the company's top line totaled over the same period last year.

Why Moderna could be a popular meme stock in 2022

Despite the strong results, there is risk for Moderna moving forward, because if the U.S. Food and Drug Administration (FDA) ends up approving Novavax's vaccine (the healthcare company plans to make a submission to the agency before the end of the year) and more people opt for the COVID pill instead of a vaccine, then Moderna's market share could shrink, hence the potential for it to be an underdog that retail investors rally behind. In November, Moderna already announced a reduction in its forecast for COVID-19 vaccine sales for this year from $20 billion to between $15 billion and $18 billion. And for 2022, it anticipates anywhere between $17 billion and $22 billion in revenue.

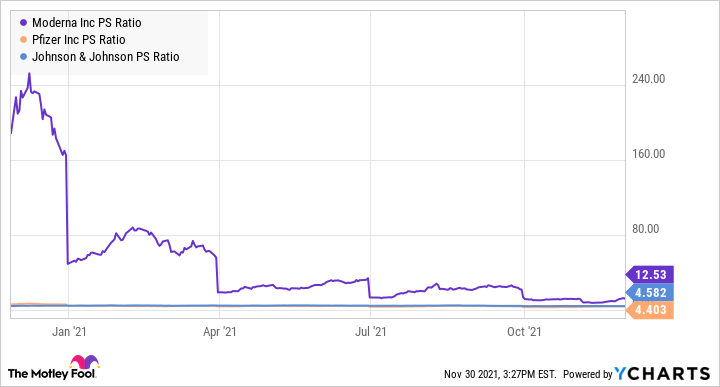

Another sign that the stock is exceedingly popular -- investors are paying a large premium for it. Moderna's stock trades at a price-to-sales (P/S) multiple of just under 13 while other COVID-19 vaccine stocks are trading at significantly smaller ratios:

MRNA PS Ratio data by YCharts

Investors are also quick to jump on any positive news. The company recently announced that it could have a vaccine ready for the new omicron variant by early next year, even though it's too early to tell if that will even be necessary since its current vaccine may suffice. Nevertheless, shares of Moderna jumped as much as 28% on Friday when news of the variant hit the markets. By Monday, the stock had hit highs of more than $375 -- the last time it did so was on Sept. 30, when its shares reached a value of over $390.

While the risk of omicron shouldn't be dismissed, the rapid ascension in Moderna's stock price may be a little premature.

One element that's still missing

To be a hot meme stock, the one necessary ingredient is significant short interest and many people betting against it. Compared to other COVID-19 stocks, Moderna does have a relatively higher short percentage with respect to its float, but it's nowhere near the level of GameStop or AMC:

MRNA Percent of Float Short data by YCharts

However, if Moderna's share price continues to climb, there could soon be more people who decide to short the stock, driving that percentage up.

Investors should tread carefully with Moderna

Moderna makes for an attractive investment story because it's the healthcare stock that's come out of nowhere to be worth more than industry giant Bristol Myers Squibb. But whether it is worth its near-$150 billion valuation is questionable, especially given that its future post-COVID remains a big question mark.

A stock that moves as quickly and suddenly as Moderna does is a risky investment to be holding in any portfolio. And before you consider buying it, you should assess whether you're willing to accept the volatility that comes with the stock, as it could lead to unpredictable returns.