As we're getting close to the end of the year, it's safe to say that the stock market has performed pretty well in the past 11 months. That's especially true considering the economy has yet to recover from the effects of the ongoing coronavirus pandemic.

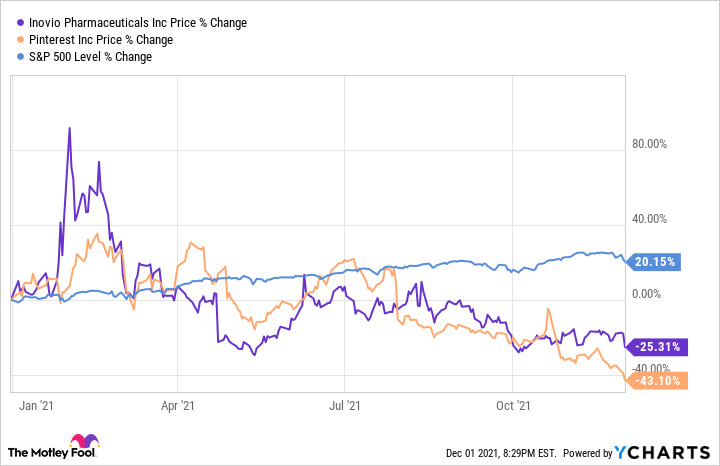

Alas, it has been a mixed -- and downright terrible -- showing for some companies. Here are two stocks that are down by more than 50% from their 52-week highs: Inovio Pharmaceuticals (INO -38.08%) and Pinterest (PINS -0.03%). Let's look into what's gone wrong with these two companies and whether they are worth buying right now.

1. Inovio: down 65% from its 52-week high

Inovio started last year on a tear as it joined the hunt for a coronavirus vaccine. But while companies such as Moderna and the team of Pfizer and BioNTech were able to advance rapidly through the development stages of their respective candidates, Inovio's efforts stalled. What happened?

First, the company hit a major regulatory setback in September 2020. Health authorities in the U.S. put a hold on Inovio's planned late-stage clinical trial for its coronavirus vaccine, INO-4800, due to concerns regarding Inovio's Cellectra 2000. The biotech uses this proprietary, handheld device to directly administer INO-4800 into a patient's skin.

Second, on April 23, the company announced that the U.S. Department of Defense had decided to discontinue funding for the company's planned phase 3 clinical trial for INO-4800. Inovio does not have any products on the market. Developing life-saving vaccines isn't cheap. That's why this news was such a blow for Inovio and its shareholders.

Inovio is looking to recover from these headwinds. The company is gearing up to run a phase 3 study for INO-4800 in several countries outside the U.S. It plans to target nations where vaccination rates are low. And the U.S. Food and Drug Administration (FDA) recently lifted the clinical hold on its planned late-stage study for INO-4800, which means the biotech is free to add the U.S. to the list of countries in which it will conduct a pivotal study for its potential COVID-19 vaccine.

With the rise of the omicron variant, Inovio will test INO-4800 -- as well as another vaccine in its pipeline called INO-4802 -- against this new strain of the virus that causes COVID-19.

Image source: Getty Images.

It is too early to say whether Inovio's coronavirus strategy will bear fruit. The company might run into more regulatory setbacks, and those could only sink its stock further. Sure, there is the chance that INO-4800 or INO-4802 could prove effective against COVID-19, including the omicron variant. But that's still a big "if," and there are plenty of other companies that already dominate this market.

Whether Inovio will successfully carve out a niche for itself is, at this point, anyone's guess. The company does have other pipeline candidates. The most advanced of the bunch is VGX-3100, an investigational vaccine for a human papillomavirus (HPV)-associated precancerous condition called cervical dysplasia. VGX-3100 is undergoing a pair of phase 3 studies.

This candidate is going after a vast market. The annual incidence of cervical dysplasia in the U.S. and Europe stands at 428,000 people. Yet it faces many of the same clinical and regulatory risks as INO-4800. In my view, VGX-3100 is at this stage not enough to push Inovio into the "buy" column.

In short, this biotech stock remains too risky, even at current levels, and I think investors had better stay away.

2. Pinterest: down 60% from its 52-week high

Like many social media companies, Pinterest performed well last year amid the worst of the pandemic. With scores of activities out of the question for much of the year, people turned to other forms of entertainment -- including social media -- much more than they otherwise would. But this has been a very different year for Pinterest, and its shares have significantly lagged the market.

One of the reasons is Pinterest's sequential drop in monthly active users (MAUs). In the first quarter, Pinterest recorded 478 million global MAUs. That metric dropped to 454 million in the second quarter and then to 444 million in the third quarter. It seems that as people spend less time stuck at home, they are also using Pinterest less than they did during the pandemic. That's a legitimate worry.

Pinterest makes its money through ads on its platform. The more users it has, the more it attracts companies looking to reach customers on its website. A decrease in Pinterest's MAUs presents a legitimate threat to the company. But it's important to put things in context. The pandemic accelerated Pinterest's user growth. As CEO Ben Silbermann said during the company's second-quarter earnings conference call: "Stay-at-home orders significantly increased usage of Pinterest."

Image source: Getty Images.

What the company is experiencing now in terms of user growth (or lack thereof) could be a case of correcting last year's abnormal gains. Meanwhile, Pinterest continues to offer a very different experience from other social media platforms. Its "image discovery" focus helps its users (known as Pinners) discover ideas and find inspiration to fuel various creative endeavors like fashion, cooking, crafts, and home decorating.

For advertisers, Pinterest continues to add new features to help them better reach their target market. In October, the company announced a slew of updates, including "slideshow for collections," which chooses a set of products from a company's catalog and turns it into a video ad. Pinterest users love videos and, on average, have an 85% bigger "shopping basket" -- items they have purchased through ads -- than users of other social media platforms, according to the company.

In my view, Pinterest will start adding users again once things fully go back to normal. And with updates that improve its platform, Pinterest's monetization efforts will continue to bear fruit. That's why I believe the company's stock is worth buying today. While it could remain volatile in the short term, it is an excellent choice for those willing to stay the course.