What happened

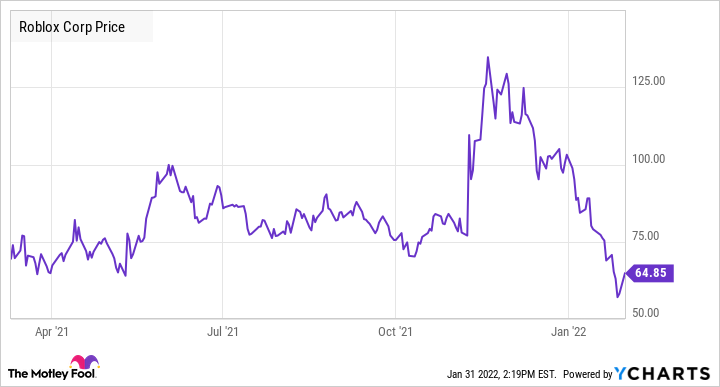

Shares of Roblox (RBLX 3.35%) were trading up 12.3% as of 1:24 p.m. ET on Monday. The only news that would impact the stock was a price target cut at Stifel. The analyst brought the near-term price target down to $110, but that is still nearly double where this top metaverse stock has been trading in the last week.

For long-term investors, the recent dip could be a great buying opportunity, as Roblox builds momentum in gaining more brands to invest in the platform.

RBLX data by YCharts.

So what

Roblox released data on Jan. 26 that showed just how far this gaming platform has come over the last year. Its community of users reached nearly 50 million across 180 countries to end 2021, up from 32.6 million in 2020.

The rate at which the platform is growing looks too good for a stock trading at a price-to-free-cash-flow ratio of 53. Roblox has a highly engaged base of users that spend quite a bit of time customizing their digital avatar. Some of these digital items are free, and some can only be acquired with virtual currency (Robux). Roblox reported revenue of $509 million in the third quarter, up 102% year over year.

Image source: Getty Images.

Now what

Roblox has seen some major brands launch their own experiences on the platform, including Kering's Gucci, VF Corp's Vans, and Nike. In October, Chipotle Mexican Grill opened a virtual restaurant on Roblox that allowed fans to win $1 million in burritos.

The engagement trends highlight a big opportunity over the long term to get more brands onto the platform. This will only fuel more user growth, engagement, and revenue for Roblox.