When Verizon (VZ -0.53%) spent $52.9 billion on C-Band spectrum (which will be used for 5G networks) in March 2021, many investors thought the move was crazy. 5G spectrum was necessary, but the sheer outlay was mind-boggling for what may have been a marginal increase in network performance for smartphones.

Early this month, Verizon showed exactly why it made the 5G investment by announcing 5G will be available to 100 million people this month. But this isn't just about faster smartphone service. Verizon also announced it is offering 5G Home for as little as $50 per month, aiming to replace the physical internet connections that have been standard for decades. This could be a huge boost for a telecommunications stock that has been in a rut for most of the last decade.

Image source: Getty Images.

Why 5G is a critical step for Verizon

Cellular wireless networks have been getting faster for more than two decades, but have never been able to match the speeds available from phone, cable, or fiber lines. 5G changes that by offering speeds that can beat cable internet at a lower cost.

When Verizon won the spectrum auctions in 2021, management said it could offer fixed wireless household coverage to 50 million people by the end of 2025, opening up a potentially large home internet market. But it appears that timeline was beaten by a wide margin, with management having said it will cover 100 million people in January 2022.

Let's use my home as an anecdotal example. I've been eyeing 5G broadband for a few years because I pay $100 per month (plus taxes and fees) for internet service from Comcast (CMCSA -0.37%) with no real alternative. When 5G was switched on in my area I could suddenly get faster speeds from my iPhone hotspot than from my Comcast cable line. For me, making the switch to Verizon is a no-brainer at those speeds.

Cable is in trouble

I think 5G home internet will be a boon for Verizon, but it may also be a big challenge for cable companies like Comcast and Charter Communications (CHTR -0.60%). Cable companies are dealing with users ending cable TV subscriptions in favor of streaming, but they've largely been able to grow broadband internet revenue because of the need for fast internet.

Having a wireless alternative, or multiple alternatives in some locations, will be a big threat to cable companies. They won't have pricing power in broadband, and in locations where there's an agreement with a municipality to be the sole cable provider, they now have real competition.

Adding home internet could also give Verizon an incentive to bundle multiple services together. Smartphone and home service would go well with streaming services in what could be the new "triple play."

Verizon is cheap today

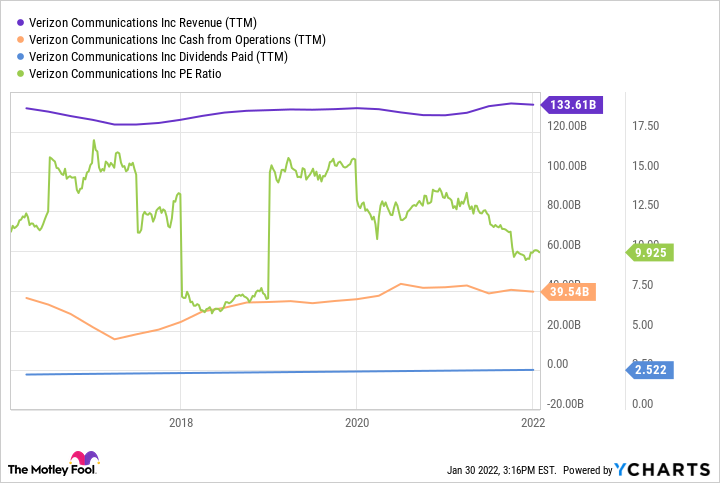

From an investment perspective, there's a lot to like about Verizon. The company is a steady cash flow generator, and if 5G Home becomes an incremental source of growth this could be a slow and steady growth stock.

VZ Revenue (TTM) data by YCharts

With a low price of just 10 times trailing earnings and a dividend yield of 4.8%, this is a value stock with growth potential. The $136.7 billion debt load is certainly a concern, but I think the steady operations of this telecom giant make the risk well worth the reward at today's price.