What happened

Shares of fertilizer giant Mosaic (MOS 4.46%) tumbled 10.3% through 9:45 a.m. ET on Tuesday, erasing two weeks of gains in the space of just 15 minutes of trading.

Now investors are worrying: Is this a bump in the road, or a buying opportunity?

Image source: Getty Images.

So what

There's no hard news to explain why Mosaic stock is falling, but in a note out this morning, StreetInsider.com pointed to a likely catalyst: peace talks between Ukraine and Russia as negotiations begin in Turkey, and Russia's promises to "reduce military action" in the northern parts of Ukraine, reports TheHill.com today.

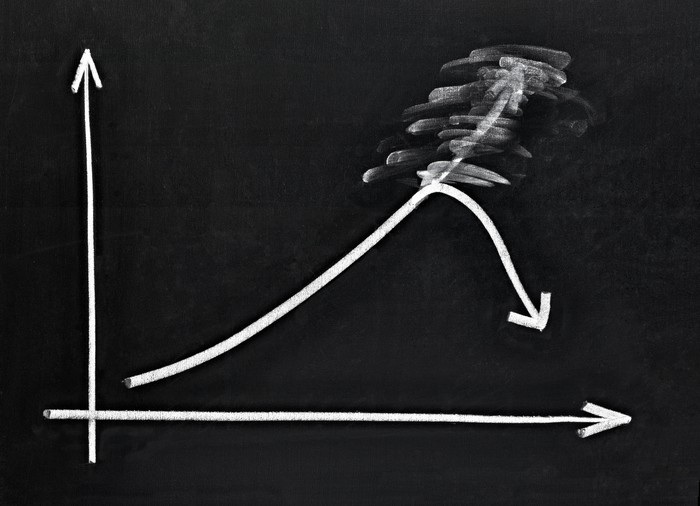

The conflict in Ukraine and the resulting sanctions on Russia have combined to send the prices of natural gas (used to produce nitrogen fertilizer), fertilizer itself, and fertilizer stocks up sharply since last February. Bloomberg yesterday even reported a one-day 43% spike in the cost of ammonia to $1,625 per metric ton. And a chart of the change in spot prices of other fertilizers, such as potash (used in agriculture, and produced by Mosaic and others), is pretty dramatic as well.

Potassium Chloride (Muriate of Potash) Spot Price data by YCharts.

Now what

The skyrocketing cost of fertilizer is one thing investors should focus on today. Potash prices up nearly double in the space of one month is going to make Mosaic tremendously profitable in the short term -- where "short" is defined as "for as long as sanctions continue" -- and I suspect that's going to be a long time, regardless of how the peace talks progress.

The other thing to keep in mind, of course, is the skyrocketing price of Mosaic's own stock. Despite today's decline, shares of Mosaic are still up roughly 35% since late February. Is Mosaic stock a good bargain, though, after a 35% increase in its stock price, but a potential 100% or better increase in revenue from the products it sells?

Simple math tells you that it must be. At 14.5 times trailing earnings, and a forward P/E ratio of less than half that, there's still plenty of room to run in Mosaic stock -- and today's sell-off looks like a buying opportunity.