Buying on the dip can lead to some solid long-term gains for investors. But in many cases, a stock is down for good reasons, and investors are better off ignoring that company rather than investing in it and inheriting all the problems that come with it. Two such examples of this right now are GoodRx (GDRX -6.03%) and Starbucks (SBUX 0.28%).

They are both down more than 20% in the past year, but I wouldn't count on a rally just yet. And there's a good chance both stocks could continue to fall in the months ahead.

Image source: Getty Images.

1. GoodRx

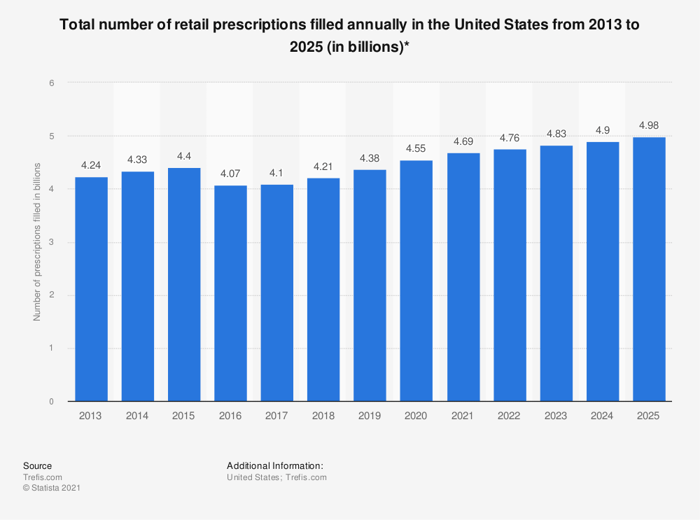

I've never been particularly excited about a business that competes on cost and goes head-to-head with low-cost businesses like Amazon and Walmart. That's what GoodRx does -- consumers use its app to save on prescription medication. But Amazon Pharmacy is another low-cost option for consumers, as is Walmart, which has been focusing on offering more affordable healthcare options for consumers through its Walmart Health division. Competing on cost against these companies isn't likely to prove successful over the long term for GoodRx, especially since there's isn't much growth expected in retail prescriptions, including drugstores and pharmacies (see chart below).

The one tempting reason to buy GoodRx despite these challenges may be that it's cheap. In the past year, it has seen its price get cut in half, and a disappointing performance in the fourth quarter didn't help matters. Although revenue grew by 39%, its sales of $213.3 million missed expectations, and its forecast for 2022 was even more modest, projecting growth of just 23%. But for GoodRx to be a buy, its price would still need to fall significantly. At a forward price-to-earnings (P/E) multiple of more than 45, investors are still paying a steep premium for the stock -- that's nearly three times the forward P/E that investors are paying for a stock in the Health Care Select Sector SPDR Fund.

A premium is justifiable if a business is growing rapidly. However, a slowing growth rate at a time when inflation is high and consumers are eager to find ways to save on prescriptions (and anything else) should raise some eyebrows for GoodRx investors. And a big part of the problem is that GoodRx needs to spend a lot on promoting its business, with sales, marketing, and general and administrative costs representing two-thirds of its revenue.

That doesn't leave much when factoring in other expenses. Plus, interest expenses are also likely to rise this year, with GoodRx carrying $655.9 million in debt, which is 79% of its equity. Last year, interest expenses totaled $23.6 million and were more than double the company's operating profit of $13.4 million. In an environment with rising interest rates and lackluster margins, it could be difficult to get investors bullish on this healthcare stock, so it shouldn't be a surprise if GoodRx's valuation falls further down this year.

2. Starbucks

Down 26% over the past year, Starbucks hasn't been crashing nearly as hard as GoodRx has. But it is also facing headwinds of its own that could lead to more of a decline in the months ahead. There are two in particular that investors should worry about.

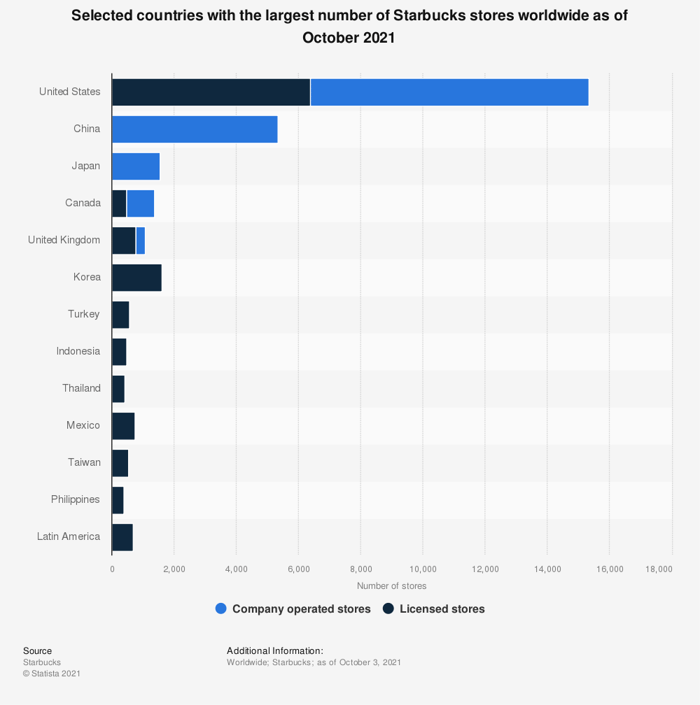

The first is the impact of China, where rising COVID-19 case numbers have resulted in lockdowns in Shanghai. In its latest quarterly results, the company noted that its comparable-store sales in China declined 14% due to pandemic-related restrictions. That was for the period ending Jan. 2, and things have gotten worse since then. China is home to the highest number of Starbucks locations outside of the United States (see chart below).

Although international sales rose by 12% last quarter, the company says this was due to 774 net new store openings instead of organic growth. During the period, international revenue of $1.9 billion made up a little less than one-quarter of all sales.

The second problem for the company, and one that could potentially alter the long-term economics of the business, lies in the domestic market, where more Starbucks locations are unionizing. A ninth store voted in favor of unionizing in New York City this month. While that is minimal given the number of Starbucks locations there are in the country, it's a potential challenge for the company if the trend gains momentum. It was just this past December that the first store unionized in Buffalo, NY. Unionizing would bring more labor-related expenses to Starbucks, which could chip away at its margins. It isn't a huge risk right now, but it's another one that investors will want to keep a close eye on, and it could certainly weigh on the company's earnings. Between that and the headwinds in China, Starbucks is another stock that could be in trouble this year.