Just over a quarter of 2022 is now in the books, and investors have had a lot to chew on thus far. Factors including high inflation, rising interest rates, and geopolitical uncertainties have made the market much more risk-averse, and that's prompted dramatic valuation pullbacks for stocks with growth-dependent valuations.

On the other hand, recent market volatility has presented opportunities to build positions in companies that are expanding at incredible rates and are on track to shape their respective industries. With that in mind, read on to see why taking advantage of recent sell-offs and buying these two hyper-growth stocks could supercharge your portfolio.

Image source: Getty Images.

1. CrowdStrike

CrowdStrike's (CRWD 3.63%) Falcon software helps protect mobile devices, computers, and other endpoint hardware from being used to exploit internet networks. The company is a clear leader in cloud-based endpoint security services, and it's been serving up stellar growth as business customers have needed to ramp up protections and meet the challenges of the evolving cybersecurity climate.

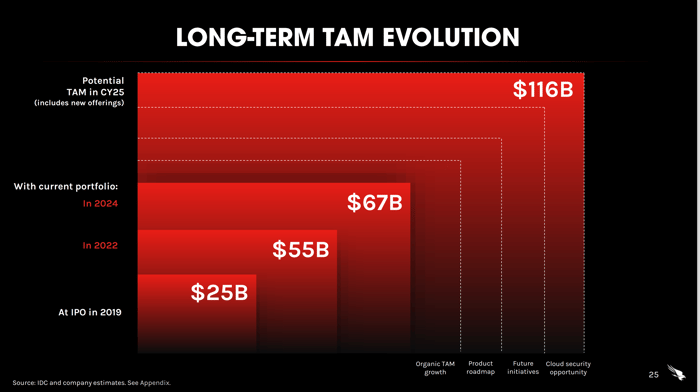

CrowdStrike's revenue surged 63% year over year in the fourth quarter to reach $431 million, pushing its full-year revenue up 66% annually to reach $1.45 billion. The company delivered fantastic performance last year, and it looks like its growth story is just getting started. Take a look at the company's estimate for its total-addressable-market (TAM) expansion in the chart below:

Image source: CrowdStrike.

CrowdStrike's revenue in its recently completed fiscal year came in at just 2.65% of the company's estimated TAM of $54.8 billion in the year. The company estimates that its TAM will grow at an 11% compound annual growth rate to reach $67 billion. It then sees it potentially jumping to $116 billion in 2025 thanks to new products, initiatives, and opportunities in cloud cybersecurity services. Demand for endpoint-protection software will only increase, and CrowdStrike stock looks attractively valued, trading down roughly 27.7% from its 52-week high.

2. Unity Software

Unity Software (U 0.92%) is best known for its platform-agnostic game-engine software, which developers can build on top of to create video games and mobile applications. However, the company also provides analytics and advertising services that can help developers and publishers better understand user data and monetize their content.

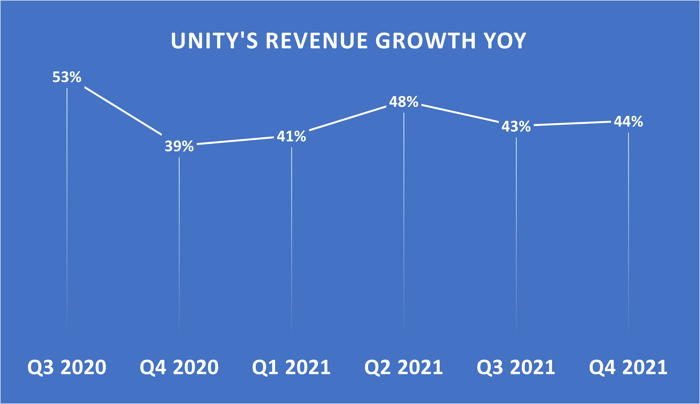

Data source: Unity. Chart by author. YOY = year over year.

The company estimates that more than two-thirds of augmented reality (AR) and virtual reality (VR) experiences are created using its software. AR, VR, and the metaverse are technology trends that are just starting to unfold, and Unity is providing services that are helping power their growth.

The interactive entertainment and visual-content markets are still poised for huge expansion over the long term, and Unity stands out as an excellent pick-and-shovel play for benefiting from their growth. The software specialist ended last year with a non-GAAP (adjusted) gross margin of 80%, and it looks well-positioned to shift into profitability and big earnings growth as it attracts more customers and sells expanded services to existing clients. With Unity stock trading down roughly 56% from the high that it hit last year, investors have a chance to build a position in the content-creation specialist at a big discount.