When you're looking for high-yielding dividend stocks, there's always the danger of getting too far into risky territory and ending up with a payout that gets cut or stopped entirely. But not all high yields are dangerous ones. And there are many stocks you can count on for the long haul that pay more than 4%, which is better than two times the S&P 500's average of around 1.4%.

A couple of the top ones worth considering today are Walgreens Boots Alliance (WBA -0.09%) and Canadian Imperial Bank of Commerce (CM -1.04%). Not only are they safe buys, but their payouts are also incredibly generous.

Image source: Getty Images.

1. Walgreens

Nothing screams stability in the dividend world like a Dividend King that has not just paid but increased its payouts for 50 years in a row. Walgreens isn't quite in that category just yet, but with a streak of 46 straight years, it looks like a sure thing for the company to get there later this decade. It's hard to imagine what could derail the streak at this point. The company has raised its dividend payments through a pandemic, recessions, and all sorts of economic fluctuations over the past four decades.

The retail pharmacy chain is a trusted brand among its customers, and investors have also come to rely on its dividend. Today, Walgreens pays a quarterly dividend of $0.4775 every quarter. That's $0.01 higher than the $0.4675 quarterly payment it was making a year ago. In five years, the company has increased its dividend payments by 27%, averaging a compound annual growth rate of 5% during that time. Today, its yield sits at 4.3%.

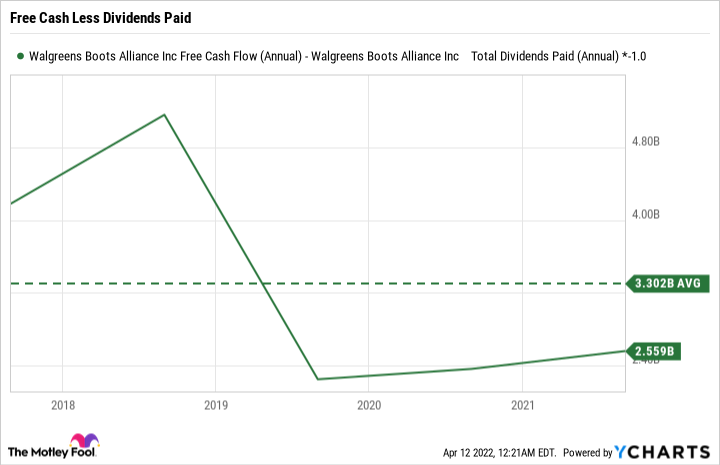

The company doesn't just have a strong track record for paying dividends, but its underlying financials also look solid. In each of its past five fiscal years (which end in August), Walgreens has reported a profit and generated positive free cash flow that has been strong enough to support its dividend payments:

Fundamental Chart data by YCharts

And there's no reason to expect a change in that pattern anytime soon since Walgreens projects that its adjusted per-share profit will continue to grow this fiscal year in the low single digits.

2. Canadian Imperial Bank of Commerce

Canadian Imperial Bank of Commerce (CIBC) doesn't have an impressive streak going like Walgreens, but it's still an incredibly safe dividend stock to own. Last year, it increased its payouts by more than 10%. Now paying 1.61 Canadian dollars per share every quarter, its annual yield is up to 4.4%, slightly higher than Walgreens' payout.

And like Walgreens, there isn't much risk here. In its most recent period, for the quarter ended Jan. 31, the bank's net income totaled CA$1.9 billion and rose 15% year over year. On a diluted per-share basis, that equates to CA$4.03, putting its payout ratio at an incredibly low rate of just 40%. The top Canadian bank has produced a profit margin of more than 25% in four of its past fiscal years (which end in October).

Not only is CIBC among the highest-yielding bank stocks in Canada but it also trades at a much cheaper forward price-to-earnings multiple than its peers:

CM PE Ratio (Forward) data by YCharts

There are plenty of good reasons to buy CIBC's stock today, whether you're looking for a top dividend investment or just a cheap value buy that you can hold in your portfolio for decades.