Stock market volatility is back. The Nasdaq Composite is down over 5% in April and over 13% year to date. And that's after rebounding by over 13% in the second half of March. Volatile sessions can be confusing and are often the result of investors not knowing how to weigh risks.

To be fair, there is a lot of uncertainty right now. The S&P 500 doubled between 2019 and the end of 2021 -- bringing valuations into question. Inflation, the ongoing supply chain shortage, and the lingering effects of the COVID-19 pandemic are disrupting business and causing a lot of companies to rethink pricing to protect their margins.

One of the few sectors of the economy that seems less uncertain is, surprisingly, oil and gas. High energy prices have been one of the key drivers of inflation, not a victim of it. Years of underinvestment paired with rising demand and geopolitical risks have led to a tight supply of oil and gas -- which benefits producers.

Here's why Chevron (CVX 0.34%) and ConocoPhillips (COP -0.59%) stand out as two of the best dividend-paying energy stocks to buy now.

Image source: Getty Images.

A balanced energy investment

The investment thesis for Chevron is centered around its consistently healthy balance sheet, its low cost of production and diversified business model, and its 36 consecutive years of paying and raising its dividend -- making it one of the few energy Dividend Aristocrats.

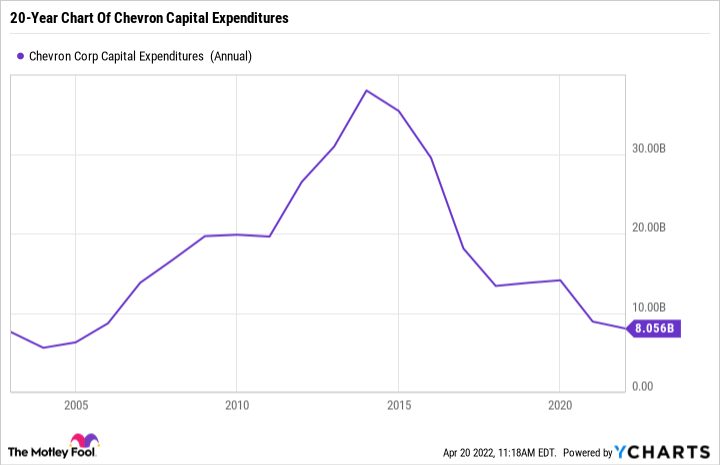

Chevron deserves credit for its use of capital, particularly when it comes to cutting capital expenditures (capex) and making timely strategic acquisitions. Chevron's capex has decreased a staggering 74% in the last 10 years. This decline is partially due to Chevron's position in the investment cycle. But it is also because of the company's strategic shift to focus on generating strong free cash flow and limiting its use of debt.

Chevron averaged $32.07 billion in annual capex between 2011 and 2015. Between 2016 and 2020, it averaged just $13.67 billion per year. And in 2021, Chevron had just $8.06 billion in capex -- the lowest since 2004.

CVX Capital Expenditures (Annual) data by YCharts.

Oil and gas companies are notorious for overinvesting at the top of a cycle and underinvesting at the bottom. Chevron passed on buying Anadarko Petroleum and allowed Occidental Petroleum (OXY -0.27%) to overpay for the company in 2019. The Anadarko investment was probably worth it in the end for Occidental, but given Occidental's stock suffered a 90% drawdown in 2020, it's safe to say that it could have gotten a much lower price for Anadarko if it had just waited a year.

Chevron played the waiting game to perfection and got an excellent deal on Noble Energy -- an exploration and production company -- closing the deal in October 2020. It then made Noble Midstream Partners a wholly owned subsidiary of Chevron in May 2021. Both of those deals look brilliant in hindsight, given the current industry environment.

Despite the temptation to begin ramping production and spending to take advantage of higher oil and gas prices, Chevron has done an excellent job of staying disciplined and letting the cash flow pour in. It continues to make selective acquisitions, such as its agreement to buy Renewable Energy Group, which was announced on Feb. 28, 2022. The deal will bring Chevron closer to hitting its low-carbon goals.

In sum, Chevron is a well-run oil and gas company that isn't taking too many risks, has the free cash flow needed to support future dividend raises, and can perform well even if oil and gas prices fall substantially from here.

A competitive asset portfolio

Like Chevron, ConocoPhillips is also disciplined and financially prudent relative to its peers. ConocoPhillips is notorious for passing on investment opportunities that don't meet its strict low-cost criteria. But like Chevron, ConocoPhillips will also pounce on opportunities at the right time.

ConocoPhillips made two huge deals last year. In January 2021, it completed its merger with fellow upstream producer Concho Resources -- which substantially lowered its cost structure.

In December, it completed its acquisitions of Shell's Delaware basin position for $9.5 billion in cash. The deal increased ConocoPhillips' Permian/Delaware basin production by more than 35% -- making it one of the largest producers in the region. In the fourth quarter of 2021, ConocoPhillips averaged 818,000 barrels of oil equivalent production out of the Lower 48 (continental U.S.) -- 59% of which came from the Permian region.

ConocoPhillips' investments have lowered its cost of production and, thus, the price that oil needs to be for it to break even. ConocoPhillips estimates that its breakeven is roughly just $30 per West Texas Intermediate crude barrel -- giving it a wide margin of error in case oil prices fall.

Even after ConocoPhillips' stock's run-up, its price-to-earnings (P/E) ratio is just 16.5, and its price-to-free-cash-flow ratio is 11.4 -- which goes to show how much the company is cashing in on higher oil and gas prices (and how beaten down its stock price was).

COP PE Ratio data by YCharts.

Granted, ConocoPhillips' P/E ratio could rise if earnings cool off from lower oil and gas prices. But if the boom lasts longer than expected, it will give ConocoPhillips a lot of extra cash to grow its business or buy back its own stock -- which will reduce the outstanding share count and bolster earnings per share.

Strong sources of passive income

Chevron has a dividend yield of 3.5%. ConocPhilips' dividend is a little more complicated. The company used to pay a steadily rising ordinary quarterly dividend. But in December, it initiated a three-tier capital return program that consists of an ordinary dividend, share repurchases, and a quarterly variable return on cash (VROC).

The ordinary dividend was $0.43 per quarter per share in 2020 but ConocoPhillips has since raised it to $0.46 per share per quarter. Since December, it has already issued two VROC distributions of $0.20 per share and $0.30 per share. ConocoPhillips is expected to pay at least $1.84 per share in ordinary dividends this year but that doesn't include what is likely to be another ordinary dividend raise and $1 per share to $2 per share in VROCs, bringing its forward yield closer to 3% or 4%. Again, ConocoPhillips' yield is going to depend on oil prices and its operating cash flow. But given the base the ordinary dividend provides and the upside potential of VROCs, ConocoPhillips is definitely an attractive dividend stock to consider now.

Two well-rounded oil and gas giants

One of the easiest things to do in the stock market is to buy a great company when it's dirt cheap. But one of the hardest things to do is buy a stock that has gone up a lot and is near a 52-week high, even if it's still a good value. Chevron and ConocoPhillips are still good values. Both companies did excellent jobs limiting their losses during the 2020 oil and gas downturn and positioning themselves to succeed in a higher-price environment. However, ConocoPhillips has comparatively higher upside if oil and gas prices keep roaring higher, but it also has higher risk since its business is more concentrated in one part of the integrated oil and gas value chain, whereas Chevron is much more diversified.