Given the Nasdaq Composite bear market and S&P 500 correction, investors may be surprised to learn that several name-brand companies are breaking out toward new all-time highs. Procter & Gamble (PG 0.53%), Johnson & Johnson (JNJ 0.08%), and Coca-Cola (KO -0.32%) are all less than three percentage points away from their all-time highs. What's more, all three Dow Jones Industrial Average components are Dividend Kings, meaning they have raised their dividends for at least 50 consecutive years.

Here's why all three stocks could be worth buying now.

Image source: Getty Images.

1. P&G is dealing with inflation like a champ

Procter & Gamble (P&G) is feeling the effects of inflation, whether that is through higher input costs, shipping costs, or foreign exchange expenses. The company is guiding for total fiscal 2022 (ending June 30) after-tax headwinds of $3.2 billion, an increase of $400 million compared to its guidance provided in January when it reported its second-quarter fiscal 2022 results. P&G said that its fourth-quarter fiscal 2022 (April through June) results would bear the brunt of the $400 million increase -- showing that even companies with supply chains as sophisticated as P&G are not immune to rising costs.

PG data by YCharts.

However, what separates P&G from other companies is that it can absorb a $3.2 billion headwind and still grow its top and bottom line while returning an estimated $18 billion to shareholders through stock buybacks and dividends.

P&G is an easy-to-understand business that can do well during economic growth cycles or even during contractions. And with 66 years of consecutive dividend increases, it is one of the longest-tenured Dividend Kings. P&G only has a dividend yield of 2.3%. But investors should keep in mind that the dividend could be a lot higher if P&G chose to return value to shareholders solely through dividends instead of stock repurchases and dividends. However, stock repurchases reduce the outstanding share count and increase earnings per share. So in this way, P&G's massive buybacks are a benefit that should be taken into consideration, along with the track record for paying and raising the dividend.

2. J&J remains inexpensive despite its stock price run-up

Johnson & Johnson (J&J) got caught up in the COVID-19 vaccine conversation along with Pfizer and Moderna. But J&J is an incredibly diverse healthcare business that does just about everything. It makes popular over-the-counter consumer health products like Tylenol, Neutrogena, and Listerine. But it also develops medical technology and devices for orthopedics, surgery, vision, and other solutions. And finally, J&J makes parametrical products, like its COVID-19 vaccine and treatments for various therapeutic areas.

J&J is an attractive Dividend King for a number of reasons. For starters, it has a 2.5% dividend yield. It also is known to make sizable dividend raises, not the bare minimum, to keep its status as a Dividend King. For example, J&J's most recent dividend raise bumped its quarterly payout from $1.06 up to $1.13 -- a $0.07 raise. For the last 10 years, J&J has made at least a $0.04-per-share quarterly dividend raise per year -- which is why its dividend has doubled over the last decade.

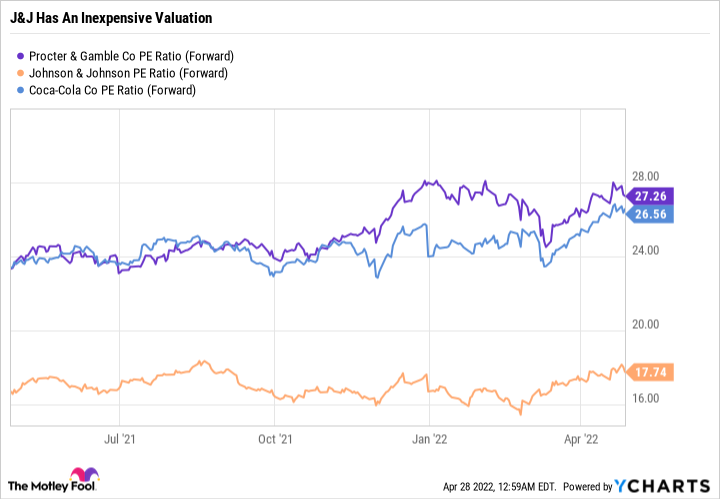

Despite being near its all-time high, J&J has the lowest forward price-to-earnings (P/E) ratio of the three stocks on this list.

PG PE Ratio (Forward) data by YCharts.

Add it all up, and J&J is an industry leader with a diversified business, a dividend you can count on, and an inexpensive valuation.

3. Coca-Cola continues to post impressive numbers

Like P&G, investors often flock to Coca-Cola during times of economic uncertainty. The move is warranted, as Coca-Cola continues to prove it can put up excellent results even during tough times. Coca-Cola released its first-quarter 2022 earnings on Monday, and they did not disappoint. A high operating margin paired with strong revenue and adjusted earnings growth shows that the company has pricing power that is helping it to combat inflation.

KO Revenue (Quarterly) data by YCharts.

Coca-Cola reported its highest quarterly revenue in five years, close to a five-year high in normalized diluted earnings per share (EPS), and got its operating margin back above the 30% threshold.

Coca-Cola is about as defensive of a dividend stock as you can get. But with a 2.7% yield and 60 years of consecutive dividend increases, it is a stock that investors can count on for a steady passive income stream.

Get paid to wait with quality dividend stocks

Investing in equal parts of P&G, J&J, and Coke gives an investor an average dividend yield of 2.5% and exposure to industry leaders in sectors of the economy that should do just fine during a recession. After a period of four years, an investor could expect a $10,000 investment to earn at least $1,000 in passive dividend income.

Aside from a source of passive income, all three companies have kept pace with the S&P 500 over the last five- and three-year time frames and are beating the market over the last year. All three companies are unlikely to wow investors with outsized returns over the long term. But when it comes to sleeping well at night, they are all great options worth considering now.