Sometime in the last 12 months, shares of cannabis producer Tilray Brands (TLRY 2.63%) hit a high of $23.04. On June 9 of last year, to be precise. At yesterday's close, the stock traded at $4.06, which means the share price would have to more than quintuple to trade in the neighborhood of last June's prices. Such a move would, however, require a major catalyst.

The big challenge facing the cannabis industry is that there isn't much happening in the space for investors to get excited. Though there have been moments of hype as new bills were floated in Congress, no laws have been passed that has changed the status quo. Put briefly, federal decriminalization, or legalization, of marijuana doesn't appear imminent.

That leaves Tilray, like other Canadian-based pot companies, standing at the door, waiting for a chance to get into the U.S. market. And as that wait stretches out, its market cap has sunk to just $2 billion, which leads to an obvious question for investors: With such a large slide behind it, has Tilray stock become a good bargain?

Image source: Getty Images.

Its valuation is low compared to its peers

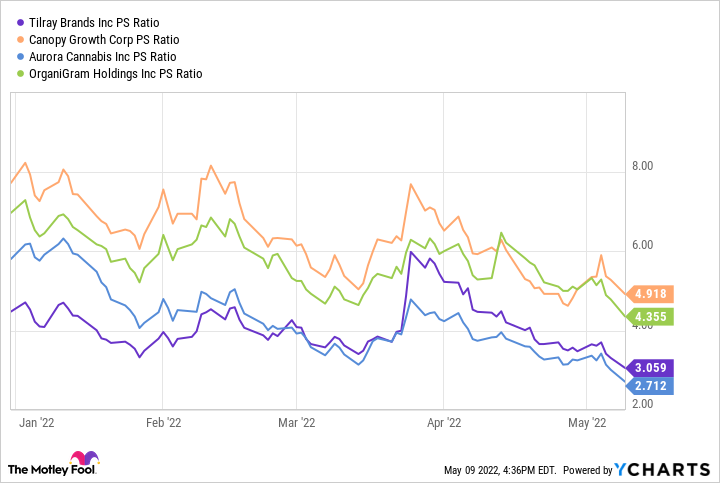

Most Canada-based cannabis companies aren't profitable. And while Tilray posted positive net income in its most recent quarter, that was mainly due to non-operating items. A better way to compare pot stocks is by looking at their valuations with respect to revenue. Looking at price-to-sales multiples, Tilray does appear to offer better value than its key rivals.

Data by YCharts.

Trading at just over three times sales, the stock appears cheaper than Canopy Growth and OrganiGram.

The former, especially, is a key rival of Tilray, as both have been aggressive with respect to developing agreements that will aid them when they're finally able to enter the U.S. market. In addition, Canopy Growth -- beyond having alcoholic beverage giant Constellation Brands as a key investor -- has contingent deals in place with marijuana companies Acreage Holdings, TerrAscend, and Wana Brands. But it can't close on them unless the federal ban on cannabis in the U.S. is lifted.

Tilray, meanwhile, acquired a majority position in the convertible notes of multi-state operator MedMen last year, which it likewise will be able to exercise if the U.S. federally legalizes marijuana.

Despite its status as an industry leader and its opportunities in the U.S. market, the market doesn't seem too impressed by Tilray. While its sales multiple isn't at an all-time low, it hasn't been this low since before 2021, prior to its acquisition of low-cost marijuana producer Aphria.

Data by YCharts.

Investors have paid much higher premiums for pot stocks

While there's an argument that Tilray's stock is undervalued, I'm more inclined to the counterargument that investors may simply no longer be willing to pay the high multiples they used to for pot stocks. For the expected level of growth, the market appears to attribute a premium to Canopy Growth. In fact, Tilray trades at an even lower price-to-sales multiple than the average holding in the sector benchmark Horizons Marijuana Life Sciences ETF. The average stock in the ETF trades at a P/S ratio of 4.9. Even as recently as 2021, it wasn't uncommon for Canopy Growth to trade at more than 20 times revenue.

Data by YCharts.

Arguably, Canopy Growth has been the leader in the Canadian cannabis market and, thus, worth a premium.

Is Tilray's stock likely to soar?

There's little doubt that Tilray's stock will jump if there's some meaningful movement in Congress to decriminalize marijuana in the U.S. But it seems unlikely to me that investors will again be willing to pay 20 times revenue for a pot stock when there are bigger names in the U.S. generating more than $1 billion in annual revenue.

Given the potential growth opportunities for Tilray, if and when the U.S. legalizes marijuana, it's not hard to imagine a path for the stock to double from where it is now. That said, the company's overly aggressive forecasts and questionable deals would make me more inclined to avoid it and buy Canopy Growth instead. That's a less risky stock given the company's partnership with Constellation, and it will also benefit from the legalization of marijuana in the U.S.