Airbnb (ABNB 0.01%) is seeing a sharp recovery in its business over the last year as travel demand has picked up. In the first quarter, the company reported its highest-ever nights and experiences booked on the platform. But that strong performance is not translating into higher stock prices.

Since the beginning of April, Airbnb's stock price has fallen almost 50%. This sharp drop is correlated with the sharp rise in U.S. gas prices, which have increased 16.5% over the last three months.

Apparently, stock traders are concerned about the near-term demand in travel with energy prices soaring. What's unusual here is that investors have punished Airbnb more than hotel stocks. This is likely due to Airbnb's higher valuation. Compared to Marriott International and Hyatt Hotels, Airbnb is more expensive on a price-to-sales basis, where it trades at a sales multiple of 8.8. That is about three to four times the sales multiple of Marriott and Hyatt.

It's common for the most expensive stocks to fall hardest when investor sentiment turns negative, but Airbnb doesn't look that expensive on a price-to-earnings (P/E) basis. Airbnb's forward P/E is 33 based on analysts' earnings estimates for 2022. When factoring in Airbnb's faster historic rate of revenue growth, that is a fair premium over Marriott's forward P/E of 23.

Airbnb has more than doubled its revenue since 2017, while Marriott and Hyatt are still trying to get back to pre-pandemic revenue levels. One advantage for Airbnb is the almost limitless availability of places to stay on its platform (currently totaling around 7 million). This can help the company capture more demand and outperform other travel stocks over the long term.

Airbnb is well-positioned for long-term growth

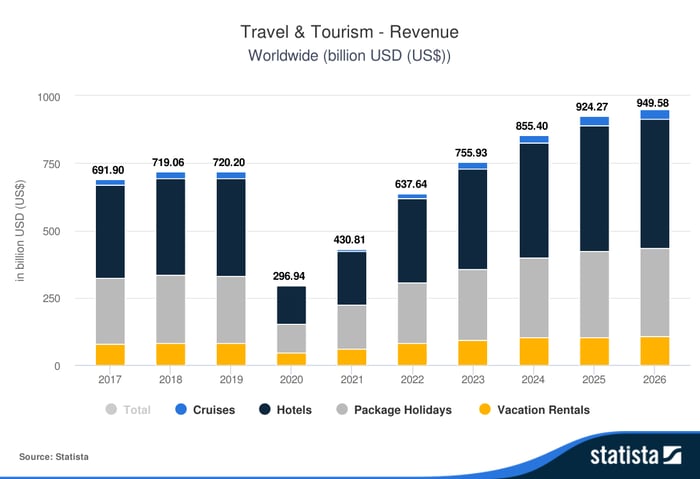

Airbnb is operating with a big tailwind behind it. The travel and tourism market is expected to grow at an annualized rate of 10.5% through 2026, according to Statista. This would put the value of the travel and tourism market at $949 billion. Currently, the largest segment of spending is hotels, with a projected $312 billion in 2022. The balance is comprised of package holidays, vacation rentals, and cruises.

Given the strength of the Airbnb brand and the unique destinations it offers, it's reasonable to assume that it can grow faster than competitors. Airbnb has over 4 million hosts on its platform, and the top source of new hosts are former guests. People stay in an Airbnb, and the positive experience naturally incentivizes them to try hosting themselves.

As new people join, it significantly expands the number of rooms available for guests, especially during peak travel times during the year. This dynamic of its business helps lift demand, which is an advantage over the big hotels in places that experience high demand during holidays or special events.

The number of hotel rooms added worldwide was 340,667 in 2021, according to Statista. The number of hotel rooms added annually is expected to increase by 25% to 428,037 in 2022, before reaching 447,575 by 2023. Airbnb is in a better position to capture growing demand, since it isn't limited to room capacity, which can cause hotels to miss out on extra revenue.

At the Morgan Stanley Technology, Media, and Telecom Conference in March, CEO Brian Chesky said the company has never experienced a single night in its history that was even close to sold out.

Chesky elaborated further on what this means for Airbnb during the first-quarter earnings call in May.

The challenge of most travel companies is that a lot of people try to go to the same place, the same city on the same day and cities essentially like [online travel agencies] typically get sold out. So, like a lot of people try to go to New York City on New Year's Eve and there's only so many places to stay in New York and so you tend to get sold out.

Airbnb has the advantage of growing supply from millions of hosts who are on the frontlines and can immediately respond when they sense a pickup in local tourism. Airbnb should be able to grow faster than the broader travel and tourism market, and that's why Airbnb remains a great investment.