As a rule of thumb, the bigger a company is, the more difficult it will be for it to grow quickly. One apparent exception to that rule, though, is the tech behemoth Microsoft (MSFT -1.27%). Despite being a $2 trillion market-cap company, it still found a way to increase its revenue significantly over the last year.

Is this as good as it gets for Microsoft? Or is the world's third-largest public company by market cap likely to keep delivering market-beating returns for investors?

Microsoft's cloud division continues to drive results

During the fourth quarter of its fiscal 2022, which ended June 30, Microsoft's revenue rose 12% year over year. However, multiple factors affected profitability, and net income only increased by 2%.

The headline numbers, of course, don't tell the whole story. Matters become clearer when you break the results -- delivered on July 26 -- down by segment.

| Segment | Fiscal Q4 2022 Revenue | Growth (YOY) | Fiscal Q1 2023 Growth Projection (YOY) |

|---|---|---|---|

| Productivity and business processes | $16.6 billion | 13% | 12% to 14% |

| Intelligent cloud | $20.9 billion | 20% | 25% to 27% |

| More personal computing | $14.4 billion | 2% | 1% to 4% |

Source: Microsoft. YOY = Year over year.

Starting with its smallest segment, more personal computing, it makes sense that it hardly grew. That business includes consumer discretionary devices like Surface laptops and tablets and Xbox gaming consoles. Note also that this was the segment for which management gave the widest revenue growth range, reflecting its uncertainty about how strong consumers' financial situation will be in the back half of this calendar year.

The intelligent cloud unit continues to be a monster, and its revenue growth is projected to accelerate even as many businesses tighten their belts. This strength is a testament to the fact that businesses have come to see their cloud transitions as vital. Investors should pay close attention to this space. Within this segment is Azure, Microsoft's cloud computing service. Its revenues rose 40% year over year -- faster than its primary competitors Amazon Web Services (AWS) at 33% growth and Alphabet's Google Cloud at 36% growth during their comparable quarters. Although still behind in terms of market share, Microsoft is catching up to AWS, and will be a force to be reckoned with in this space.

Perhaps the most surprising result in Microsoft's productivity and business products division was that LinkedIn's revenue grew by 26%. The professional networking platform's sales are primarily driven by premium subscriptions and advertising, which shouldn't be as strong during difficult economic periods. Nevertheless, its strength last quarter reflects LinkedIn's relevance in the advertising space, and its results shouldn't be ignored. Finally, commercial Office (9%) and Dynamics (19%) products saw solid growth, which is impressive when many businesses cut spending.

These results helped drive positive investor sentiment in the days after the quarterly report was released, as they indicate many businesses are still executing despite the current macroeconomic headwinds.

With all of that being said, is Microsoft stock a buy now?

Expensive valuation for a giant

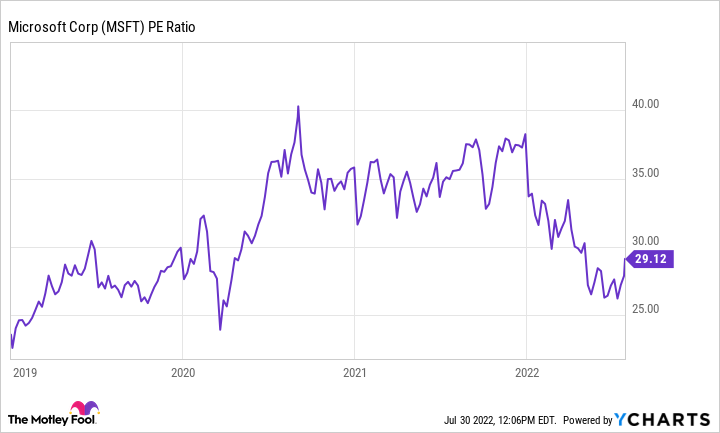

From a price-to-earnings ratio standpoint, Microsoft is still trading largely above its pre-pandemic valuations.

Data by YCharts.

Additionally, a ratio of almost 30 times earnings is quite expensive for a company that's only growing sales at 12%. If Microsoft's management misreads the environment and delivers disappointing fiscal 2023 Q1 results, the stock will likely get whacked due to its premium valuation.

This is the primary reason why I haven't opened a position myself. However, if you're an existing shareholder, there's no reason to sell, as Microsoft delivered investors everything they could ask for.

In the meantime, Microsoft pays a small dividend that, at the current share price, yields 0.86% and repurchases a decent amount of its stock ($8.8 billion in its fiscal Q4 and $32.7 billion over fiscal 2022).

Microsoft is an essential stock in this market, and it just gave investors some great news that has been absent for the past few months. However, with it trading for nearly 30 times earnings in a rising interest rate environment, there is too much risk and not enough upside for me to feel good about purchasing the stock right now.