With the S&P 500 falling more than 22% year to date, some investors may find their resolve tested. It can be disconcerting to see your holdings fare poorly, leaving you with little motivation to make additional investments.

But successful investors know that it's times like these when the seeds of future wealth can be planted. It's something Cathie Wood surely recognizes, in gobbling up shares of two stocks that have the potential to prosper prodigiously in the future. Patient investors may want to follow suit and sow growth stocks Rocket Lab (RKLB 1.08%) and UiPath (PATH 1.68%) in their own portfolios to reap the rewards down the line.

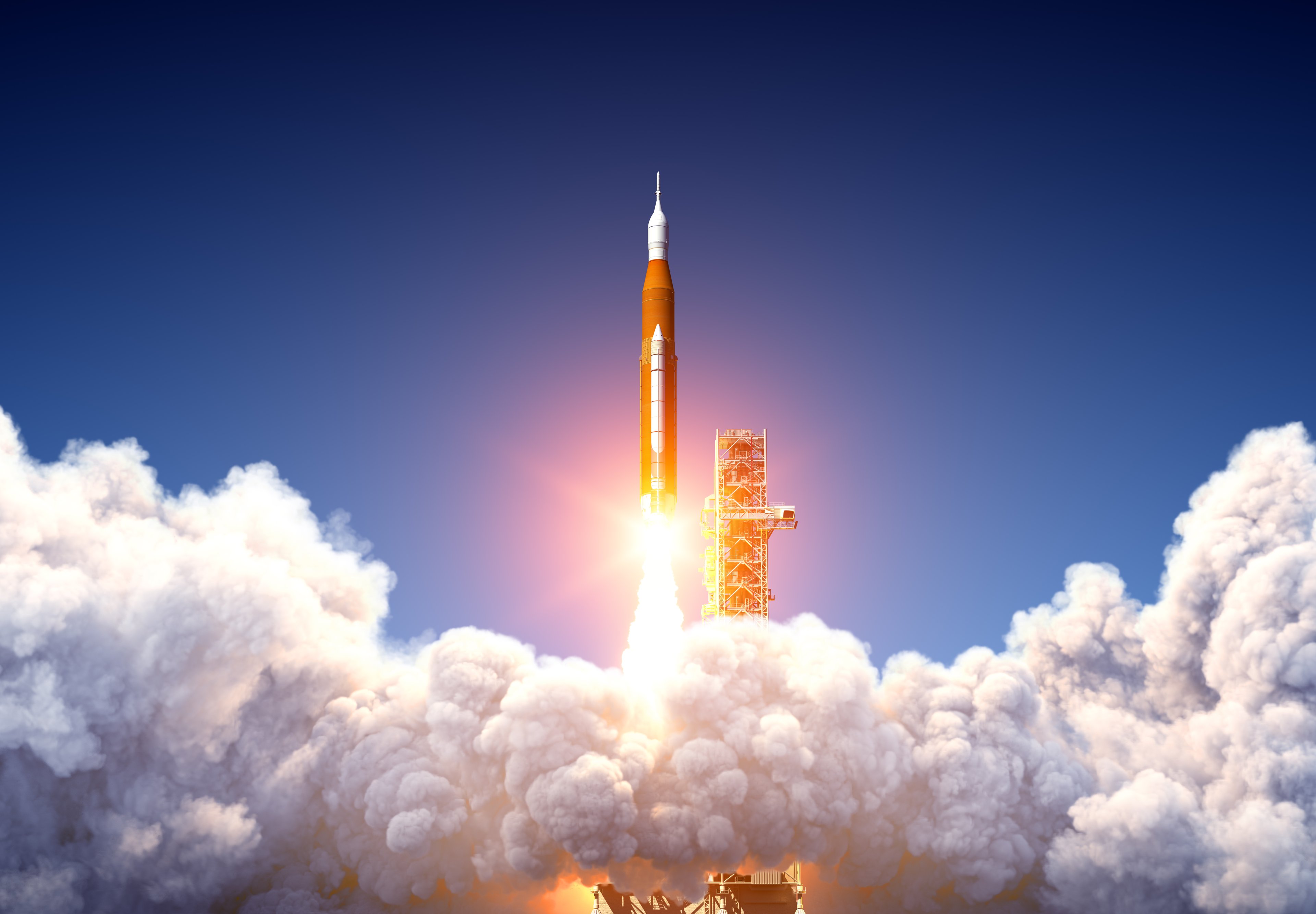

Take a flyer on a company flying to space

Rocket Lab first appeared in two of Wood's exchange-traded funds (ETFs) in late September, and the buying remained a priority in October. Last month, the ARK Innovation ETF (ARKK 1.22%) and ARK Space Exploration and Innovation ETF (ARKX 0.72%) both grew the positions they initiated in September, adding a combined 919,767 shares.

NASDAQ: RKLB

Key Data Points

As a leading space services business, Rocket Lab represents a space investment that's out of this world. After launching its Electron rocket 31 times over the past five years, Rocket Lab lays claim to the second most frequently launched rocket -- behind SpaceX -- into space. In addition to this feat, Rocket Lab has also deployed 150 satellites into orbit.

Operating in the final frontier offers the company massive potential -- something that Wood, undoubtedly, recognizes. In a recent investor presentation, Rocket Lab characterized its current total addressable market (TAM) at more than $380 billion, growing to $1 trillion by 2030.

An ample TAM is one thing, but it means little if the company is failing to sell customers on the value of its offerings. For Rocket Lab, however, this is hardly the case. As of June 30, 2022, Rocket Lab had a backlog of $531.4 million, representing a growth of over 190% from the backlog of $183.1 million it had at the end of September 2021.

NYSE: PATH

Key Data Points

Tread a bumpy path to riches

After plummeting nearly 82% through the first nine months of 2022, shares of UiPath have largely fallen out of favor with investors who fear how it will fare in fiscal 2023. During its fourth-quarter 2022 earnings report, management forecasted fiscal 2023 revenue and non-GAAP operating income of about $1.08 billion and zero to $10 million, respectively.

Management revised this outlook downward during the company's recent second-quarter 2023 earnings presentation, when it guided for revenue of about $1.005 billion and a non-GAAP operating loss of approximately $15 million.

This less auspicious view of 2023 hasn't deterred Wood from being downright greedy with UiPath's stock. Through the first 10 days of October, five of Wood's ETFs combined to buy 903,034 shares of UiPath.

Based on its current platform and offerings, UiPath estimates its TAM to be $61.1 billion. But the company isn't intent on stagnating. By growing its platform to include low-code application platforms and business process management solutions, for example, UiPath believes it has the opportunity to add $32.1 billion to its TAM. For some context, UiPath reported revenue of $892.3 million for fiscal 2022.

Looking at the company's growth potential is worthwhile, but it's equally important to recognize its accomplishments. UiPath, for instance, has fared well at securing and holding on to customers. The company determines this with its annualized renewal run-rate (ARR) metric, which it uses to help assess its "ability to acquire new subscription customers and to maintain and expand our relationships with existing subscription customers." From Q4 2020 to Q2 2023, UiPath has seen its ARR increase at a 55% compound annual growth rate.

Something to remember

Monitoring the stock picks of the most famous investors, like Cathie Wood, is a popular pastime among those of us on Main Street. It's critical to recognize, however, that successful investing is more complex than merely buying the same stocks as Wood, or other famous investors for that matter.

Nonetheless, Rocket Lab and UiPath certainly are compelling considerations for growth investors -- possible portfolio additions that are worth digging further into.