The U.S. consumer is strong. That's what Bank of America (BAC 0.66%) Chief Executive Officer Brian Moynihan told analysts during last month's third-quarter conference call. It was a reiteration of what he'd said several times earlier this year.

Mastercard (MA 0.54%) CEO Michael Miebach agrees, telling analysts that "consumer savings levels remained elevated" and that even though there have been shifts in what consumers are buying, "overall consumer spending has remained resilient."

The strength of the consumer is usually a good thing. But during times of inflation, such as now, it could be a problem. Here's why.

The data behind strong consumer spending

Through the first three quarters of this year, Bank of America's consumer customers have spent $3.1 trillion, up 12% from last year. And while spending slowed slightly in September, it was still up 10% from last year.

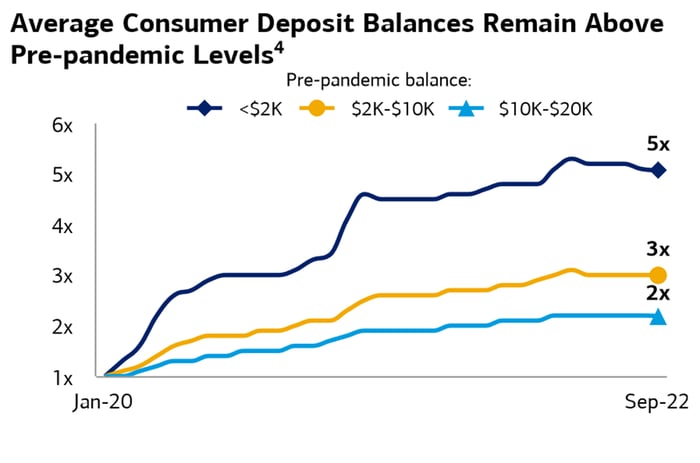

The bank noted that customer liquidity is strong as measured by deposit balances, which are up 7% from last year. Not only that, but delinquencies are still far below average. Late-stage delinquencies are 40% below pre-pandemic levels, and they would have to increase by 30% to approach the pre-pandemic five-year average.

Image source: Bank of America.

Visa (V 0.73%) CEO Al Kelly told investors that there had been some changes in consumer behavior, but they continue to increase spending. At Visa, consumer payments in the quarter were up 20% (in constant dollar terms) from last year. Spending got a boost from travel and entertainment, and in the U.S., credit card spending was up 17% from last year and 36% above pre-pandemic levels.

Why a strong consumer could be a negative thing right now

Generally, you want to see a healthy consumer with fewer delinquencies. However, a strong consumer could also present a problem during these economic times. Household deposits and savings remain elevated, which could make it more difficult for the Federal Reserve to put a lid on inflation.

Image source: Bank of America.

In a note, economists at Wells Fargo said consumers are likely to remain price insensitive as long as they can dip into their savings to pay for items. According to the bank, "consumers' spending is more or less unfazed not only by high inflation but also the rate hikes intended to get prices under control."

If consumer spending remains robust, that could continue to build inflationary pressures.

What it means for the economy and what you should do about it

We're living in strange times where good news is bad, and bad news is good.

If high consumer spending persists, the Fed may feel the need to keep hiking interest rates in its continuing battle against inflation. Since March, the Fed has raised its federal funds rate, or the overnight lending rate for banks, from a near-zero level to an upper limit of 4%. One of the Fed's biggest fears is that inflation becomes entrenched in the economy, and we end up with a decade of inflation similar to what happened in the 1940s and 1970s.

A slowdown in consumer spending could tip the economy into a recession. While this would present short-term pain, it could be good in the long run if it brings inflation down.

As long-term investors, we can't try to time when inflation will end or when the market will rebound. The best thing you can do during times like this is to consistently invest in great companies at good prices, focusing on those with strong balance sheets and good competitive advantages that can thrive no matter what the market does.