This year has been a terrible one for financial technology (fintech) companies. The industry went through a major hype cycle over the last few years, and now investors are experiencing an unsurprising hangover in their portfolios.

Upstart Holdings (UPST -4.37%) and Block (SQ -3.43%) are fintech stocks that investors loved in 2021 and have been down more than 70% over the past year. In fact, Upstart is down 91%, meaning that if you invested $100 in the stock a year ago, you'd have less than $10 left today. Ouch.

But for long-term investors, these short-term price drops can provide potential buying opportunities. So, which of these fintech stocks is the better buy today? Upstart or Block? Let's investigate.

1. Upstart: The long-term opportunity remains intact

Upstart is an artificial intelligence (AI) lending platform that helps financial institutions price loans for consumers. It is trying to replace traditional credit scores through better modeling and pricing for loans. The stock went public in late 2020 and started growing like a weed in 2021. For reference, in the second quarter of 2021, revenue grew a whopping 1,018% year over year as more people looked for cheap consumer loans through Upstart's banking partners. With low variable costs, Upstart started to generate strong profits, with an operating margin of 18.7% in Q2 2021.

Since Upstart is typically just an intermediary for other lenders, it makes money by earning a small fee on all loans that are priced through its platform. This means that high loan volume equals more revenue, all else being equal. A business model like this works great during an economic boom, but can look ugly if the world heads into a recession, which is likely happening today. Last quarter, the third quarter of 2022, Upstart's fee revenue decreased 15% year over year to $179 million. The company is also not profitable anymore, putting up an operating loss of $58.1 million last quarter.

Upstart is clearly tied to the credit cycle, which is why the stock has been down so much in 2022. Investors are also worried that Upstart's pricing AI hasn't been tested during a recession and might start underperforming traditional credit scores. There's no proof this has happened yet, to be clear, but that doesn't mean it won't happen over the next year or so, which will be a big test for the company.

But there are signs that Upstart's business will start growing again once the economy normalizes. Its bank and credit union partners consistently climb higher, hitting 83 last quarter compared to just 31 a year ago. The new automotive product continues to gain adoption and is now getting used at 702 dealers across the country, up from 291 a year ago. These partnerships should bring in more loan volume for Upstart.

It is hard to value Upstart stock since the company is not profitable anymore. But with a market cap of just $1.5 billion right now, the stock could look cheap a few years from now if it comes out of this economic downturn unscathed.

2. Block: So, do you like cryptocurrencies?

You may know Block better by its previous 2D name, Square. The company, started by Twitter founder Jack Dorsey, helped revolutionize payment processing by inventing the white credit card reader that could be attached to a mobile phone or tablet. Since then, it has expanded to become a robust payment and software provider for small businesses and has also built out a huge financial services application for consumers called Cash App. The Square business is a steady grower, hitting 29% year-over-year gross profit growth over the past three years. It brought in $783 million in gross profit last quarter.

Cash App has been the highlight of Block's business over the past few years, with gross profit growing 84% year over year for the past three years, hitting $774 million in gross profit last quarter. The app had 49 million monthly transacting customers in Q3, with more and more people starting to use its associated debit card: the Cash Card. Over the long term, Block is looking to make the Cash App more like a bank account, which could be quite lucrative from a profit perspective and further drive gross profit growth.

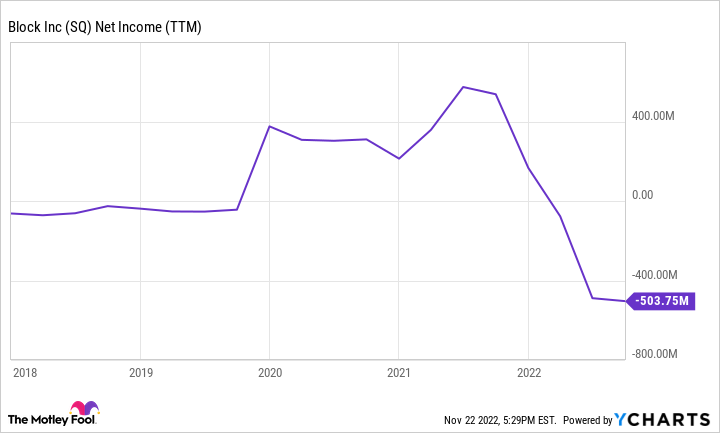

Looking at just the Cash App and its legacy Square payments business, Block is doing quite well at the moment. The problem comes with its forays into other businesses. These include the ill-fated acquisition of buy-now-pay-later firm Afterpay for $29 billion, an acquisition of money-losing music streaming business Tidal, and huge investments into the cryptocurrency industry with its Spiral and "TBD" segment (yes, that is the actual name of the business unit). Management also decided to buy Bitcoin for Block's balance sheet, which doesn't look like a great move at the moment. With all these money-losing segments outside the core Square and Cash App businesses, Block has gone from generating a profit to losing a lot of money. Over the last 12 months, it produced a net loss of over $500 million.

SQ Net Income (TTM) data by YCharts.

Which is the better buy?

Neither company is in a great situation at the moment, and I don't think I'd buy either stock at today's prices. But If I had to choose one, I'd buy shares of Upstart, given its lower market cap and huge potential to disrupt the lending market. Block's management team seems too distracted by high-risk cryptocurrency products and fixing its poorly planned acquisitions.