There's not much point in buying a passive-income stock like AbbVie (ABBV 2.13%) if it's going to fail to deliver its quarterly dividend into your account. Even reliable companies can sometimes run into problems that require them to level off or even slash their payment.

As it turns out, there is indeed a risk that within the next few years, AbbVie's shareholders get left high and dry instead of getting refreshed with cash as usual. Let's evaluate the situation and determine whether anxiety about this company's dividend is warranted or whether it's overblown.

Why some investors might be worried

AbbVie just celebrated its 10th birthday since its spinoff from Abbott Laboratories at the start of 2013. In each of those 10 years, the company hiked its dividend, causing the payout to rise by 270% and ensuring the continuation of its status as a Dividend King that it inherited from Abbott Labs. Management plans to keep hiking the dividend in the future, which makes the issue of its sustainability all the more important.

At the moment, its forward dividend yield is above 3.6%, and it pays out around 73.7% of its earnings as dividends. With a relatively high payout ratio like that, it's easy to see why investors might get concerned about the wisdom of continued hikes. A sharp earnings downturn could easily require the company to pay out more in dividends than its earnings bring in.

But it's important to keep that figure in context. Competitors like Bristol-Myers Squibb, Sanofi, and Johnson & Johnson all have payout ratios above 60%, so AbbVie is hardly alone in having a somewhat limited overhead to keep hiking dividends in the absence of earnings growth.

As long as it keeps commercializing new medicines and working to widen the approved indications for its existing medicines to increase the size of their addressable markets, it's reasonable to expect its earnings to continue to grow. And with nine regulatory submissions for new drugs planned for 2023 alone, several new income streams are close to guaranteed to launch in the near term.

Still, if the payout ratio continues to rise over time despite growth, it'll be a red flag for shareholders that the dividend is in danger, so the concern isn't one that can be explained away; it's a genuine risk. Furthermore, Wall Street analysts estimate on average that the pharmaceutical giant's revenue and earnings will shrink slightly in 2023 as a result of the loss of exclusivity of one of its most lucrative medicines, Humira. But, management expects the company to recover and return to sales growth in 2024 and 2025, so if it can maintain the dividend or grow it at a slower pace through then, the payout will probably be in the clear.

Another issue that's likely bugging investors is the company's debt load of nearly $70 billion. It's true that such a debt burden looms large in comparison to its assets. It's also true that being highly leveraged could make borrowing money more expensive, imperiling its earnings down the line.

But, since early 2021 AbbVie is aggressively deleveraging, with its trailing-12-month (TTM) debt repayment standing at $11.3 billion. And only $9.2 billion of its debt load is due within a year as of Q3, which won't be a problem with its more than $21.9 billion in TTM free cash flow (FCF) in 2021.

Expect more payouts in the future

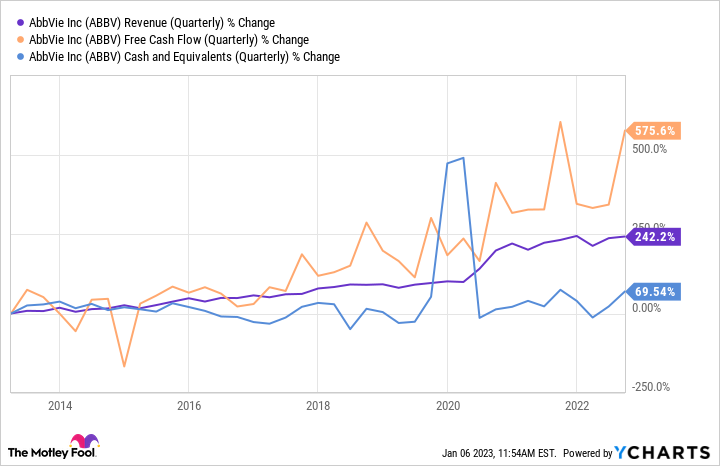

Despite AbbVie's limited overhead for additional dividend hikes and its upcoming headwinds from the loss of Humira, it will probably be able to keep paying its dividend for the foreseeable future. If you don't believe that, check out this chart:

ABBV Revenue (Quarterly) data by YCharts

As you can see, its quarterly FCF and its cash holdings have only grown stronger over time, which is remarkable because it means that hiking the dividend by so much in the last 10 years didn't actually prevent the business from accumulating loads more money.

Likewise, its recent actions of paying down its debt haven't stopped it from stacking bills. Right now, it has more than $11.8 billion in cash, so it has quite the war chest to dip into if the next couple of years see more difficulty than management anticipates.

In short, investors can have moderate to high confidence that AbbVie's dividend will continue to be a reliable source of passive income, and that's yet another factor making the stock an attractive purchase.