It can be helpful for shareholders in General Electric (GE 0.99%) to follow what its competitors are doing. When the competitor happens to be an archrival like Siemens Energy (SMEG.F 0.81%), it's an even better idea.

GE's German rival in power and renewable energy just disappointed the market with its earnings preannouncement on Jan. 19. But the devil is in the details, and those details are positive for GE. Here's why.

What Siemens Energy preannounced

The company competes directly with GE in its power businesses and through its Siemens Gamesa Renewable Energy (SGRE) ownership. Thus, what it says has direct relevance to the two businesses that make up GE Vernova -- GE's energy-focused business that will spin off in early 2024.

The headline takeaway from last Thursday's first-quarter 2023 earnings preannouncement (Siemens Energy's financial year runs to the end of September) is management's slashing of its earnings expectations in 2023. While the comparable revenue growth outlook is maintained at 3%-7% (a pretty wide range in any case), management cut its profit margin before special items outlook to 1%-3% from 2%-4%, and it now expects a net loss for the full year.

In addition, for the first quarter, Siemens Energy is set to announce a loss of 384 million euros ($417.28 million), compared with the analyst consensus for a loss of just 32 million euros.

A Siemens Energy issue

The reason comes down to a substantive charge taken at SGRE relating to "an evaluation of the failure rate of the installed fleet, during which Siemens Gamesa detected a negative development of failure rates in specific components resulting in higher warranty and service maintenance costs than previously estimated," according to the press release.

While the issue highlights the highly complex environment for the supply chain (GE Renewable Energy and the other leading player in wind energy in the West, Vestas Wind Systems, have also suffered from supply chain issues), it is a company-specific issue and not one that reads across to GE and Vestas.

Green flags for GE (and Vestas)

Instead, there was plenty of good news for GE within the preannouncement.

- Orders, revenue, and profit in the power-focused businesses that compete with GE were significantly ahead of analyst consensus expectations, and management maintained its revenue and profit expectations for the full year.

- The average selling price of SGRE orders rose sharply and indicates that the leading wind power companies are successfully pushing through price increases.

Siemens groups its power-focused business under gas services (gas and steam turbines, generators, and pumps), grid technologies (transmission, grid stabilization, switchgear/transformers, and grid automation), and "transformation of industry" (conversion technologies, industrial steam turbines compressors, and compression systems).

Gas services (which competes directly with GE Power) orders came in at 3.8 billion euros compared with the consensus for 2.9 billion euros. While gas and steam turbine orders can be lumpy and it's important not to get too excited by one quarter's orders, it's still a net positive.

However, investors are entitled to get excited by the whopping 6.3 billion euros worth of orders at grid technologies (GE's comparable grid solutions business is part of GE Renewable Energy, and power conversion is part of GE Power) compared with the analyst consensus for 2.8 billion euros in orders. It's a very strong number and suggests GE Renewable Energy will report good orders in its grid solutions ($2.1 billion in revenue in the first nine months versus the overall segment's $9.6 billion) business.

Wind power companies are increasing their pricing

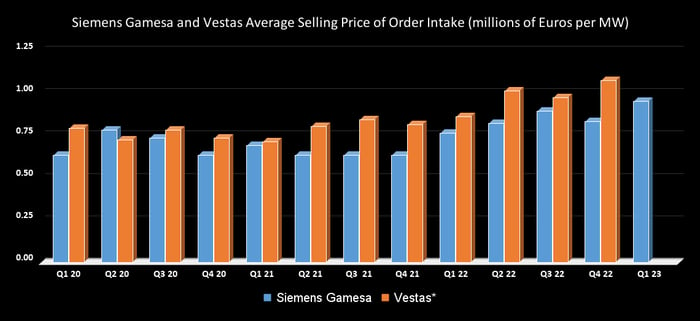

The key to GE's turnaround plan in its renewable energy business (and that of SGRE, for that matter) is to refocus on its core end markets and focus on its most profitable end markets while increasing pricing. All three leading players in the West are trying to increase pricing to offset surging raw material costs and complex supply chain challenges -- constructing, assembling, and transporting wind turbines is not an easy task at the best of times. But, as you can see below, it's working, and Vestas and SGRE now have very positive order pricing trends. Expect GE to report similar.

Data source: Company presentations. Vestas' figures adjusted to the nearest Siemens Gamesa quarter. MW = megawatt.

Looking ahead to General Electric's results

All told, based on Siemens Energy's announcement, there's a reason for investors to expect positive news from GE in power and renewable energy. The problems at SGRE are part of a long line of operational issues that management seeks to resolve, but its end market outlook, at least on pricing, is improving. If that translates to improvement at GE, then GE Renewable Energy could turn profitable again sooner than many think it will.