Berkshire Hathaway's (BRK.A 0.98%) (BRK.B 0.98%) Warren Buffett prefers to invest in businesses with significant competitive advantages over their peers. That's because such businesses produce reliably growing profits over time. One such company in Berkshire Hathaway's portfolio is the healthcare products distributor McKesson (MCK 1.81%). Buffett's Berkshire owns a 2.3% stake in McKesson, worth nearly $1.2 billion.

This raises the following question: Should dividend growth investors buy the stock right now? Let's dive into McKesson's fundamentals and valuation to decide.

A wide economic moat

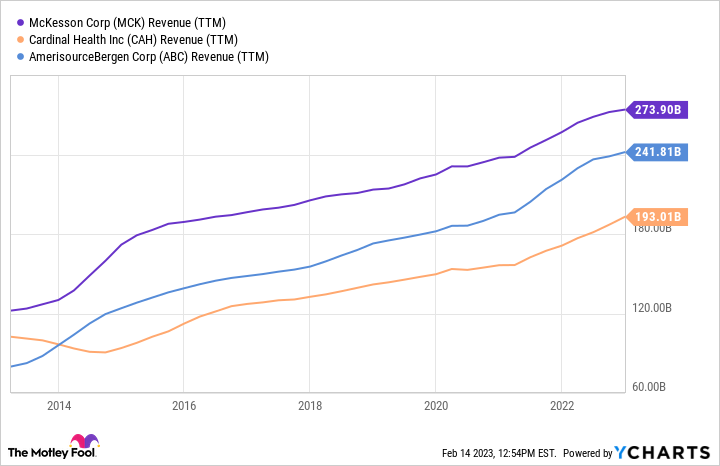

MCK Revenue (TTM) data by YCharts

Over the course of its nearly 200 years in business, McKesson has established itself as the dominant medical distribution company in the world. For context, the company's trailing 12-month revenue of $273.9 billion is far ahead of the $241.8 billion generated by AmerisourceBergen (COR 1.57%) and the $193 billion of revenue from Cardinal Health (CAH 1.63%).

MCK Profit Margin data by YCharts

Because of the investments that the company has made in improving its supply chain over the years, McKesson also unsurprisingly enjoys superior net profit margins over its peers. The company's recent 1.2% profit margin was far better than AmerisourceBergen's 0.7% profit margin and Cardinal Health's negative 0.7% profit margin.

With such razor-thin profit margins, it's easy to see how unmatched size and scale can lead to a significant competitive advantage in this industry. McKesson can win over business from its competitors because of the greater control that it has when negotiating expenses with vendors, and its leading position within the industry.

I can't definitively argue that these factors were solely what drew Buffett and his holding company to McKesson because I'm not a mind-reader, but I believe it played a part in the buying rationale. That's because the Oracle of Omaha has offered the following advice to investors in the past: "Look for companies with high profit margins." And if we read between the lines, McKesson certainly does fit this requirement relative to its peers.

Strong operating results

McKesson recorded $70.5 billion in revenue during the fiscal 2023 third quarter (ended Dec. 31), which was up 2.7% over the year-ago period. This top-line growth was driven by a 12.5% year-over-year increase in U.S. pharmaceutical segment revenue to $61.9 billion for the quarter. Increased volume of specialty pharmaceutical products (meaning more expensive and higher margin) and overall market growth were the two major growth catalysts for the segment and was only partially offset by branded-to-generic drug conversions.

This significant growth within the company's predominant segment was largely neutralized by a 53% drop over the year-ago period in international segment revenue to $4.4 billion in the third quarter. The precipitous decline in segment revenue was the result of divestitures of McKesson's European businesses. That explains how the company's total revenue grew at a low-single-digit clip during the quarter.

McKesson's non-GAAP (adjusted) diluted earnings per share (EPS) surged 12.2% higher year over year to $6.90 for the third quarter. This was the result of a 0.3 basis point expansion in non-GAAP net margin to 1.38% in the quarter for one. Secondly, share repurchases pushed McKesson's diluted outstanding share count down by 7% during the quarter. This is why adjusted diluted EPS growth outpaced revenue growth for the quarter.

Looking out over the next five years, McKesson's growth prospects are promising: Analysts anticipate that the company's adjusted diluted EPS will grow by 11.9% each year during that time. Putting this into perspective, that is much higher than the medical distribution industry average earnings growth forecast of 9.6%.

The dividend can keep growing

McKesson's 0.6% dividend yield is underwhelming compared to the S&P 500 index's 1.6% yield. But the company's above-average earnings growth coupled with a modest dividend obligation should result in massive future dividend growth.

It is expected that McKesson's dividend payout ratio will be just 7.8% for the current fiscal year ending next month. This gives the company the capital needed to further expand and improve upon its supply chain network, repay debt, and repurchase shares. That's why I am confident that McKesson will deliver dividend growth in the teens annually for at least the next few years. This is another feature that likely attracted Buffett to this particular stock.

McKesson stock is still a sensible value

Up a staggering 36% over the last year, McKesson stock is no longer trading at a no-brainer valuation. But the stock still looks to be a buy for dividend growth investors.

McKesson's forward price-to-earnings (P/E) ratio of 13.9 is in line with the medical distribution industry average forward P/E ratio of 13.5. Given the rapid growth potential of the company, this slight premium valuation is arguably justified.