I love buying dividend stocks in a market correction because low pricing means I can earn higher yields. Dividend stocks were absolutely shattered last year as rising interest rates and market volatility put pressure on certain companies. Several of these stocks have rallied since the start of the year, but some are still down, including two of the largest real estate investment trusts (REITs) by market capitalization, American Tower (AMT 1.09%) and Public Storage (PSA 0.30%).

These stocks are leaders in their respective industries. Given their size, financial position, and performance history, they rarely go on sale. But right now, they both sit down 12.3% and 16.5%, respectively, over the past year.

Here's a closer look at the two companies and why their stocks are both screaming buys right now.

1. American Tower

American Tower is a leading infrastructure real estate investment trust (REIT) that owns and leases over 225,000 communication assets. Its cellphone towers, antennas, and data center facilities are located across six continents and numerous countries. The REIT plays an integral role in keeping the world connected.

The company has been managing against a growing number of headwinds over the last year. Tenant consolidation, high inflation, foreign currency volatility, and rising interest rates have all affected its operating costs and eaten into earnings. The continued roll-out of 5G technology in international markets and the acquisition of data center REIT CoreSite at the end of 2021 helped the company combat these headwinds and still post strong earnings for the full year.

American Tower management predicts these short-term headwinds will continue to impact the company in 2023, which is the main reason the stock is down 15% this year. But even with these challenges, the REIT's long-term outlook still looks incredibly strong. Demand for its assets should only increase as data consumption and smartphone usage grow. Plus new technologies like artificial intelligence and cloud-based services will need data centers to safely store and transmit data. In other words, its services won't be rendered obsolete.

The stock trades around 20 times its adjusted funds from operations (AFFO). This metric, which works similarly to earnings per share, indicates the company is fairly priced for its performance and long-term growth opportunities. Today it pays a dividend yield of 3%, and it has raised its payouts every quarter for the last 10 years, equal to a 500% increase.

2. Public Storage

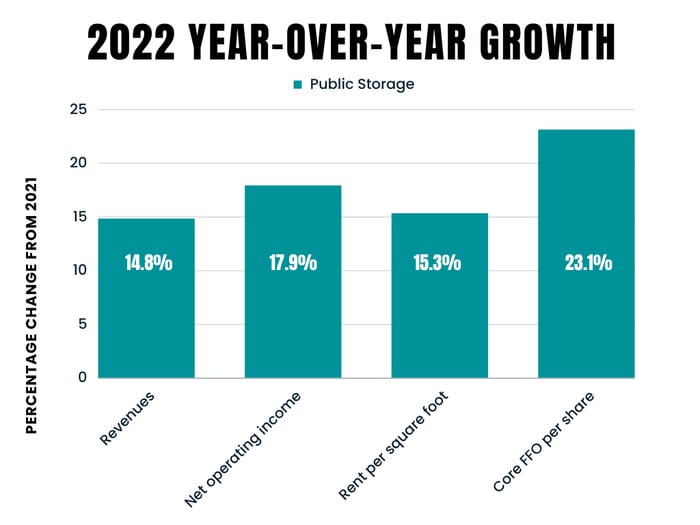

Public Storage's stock is rallying after its fourth-quarter and full-year 2022 earnings beat analysts' projections. The largest self-storage REIT, with interest or ownership in over 2,800 self-storage facilities, reported fantastic growth in its revenue, net operating income, and core FFO per share compared to the year prior.

Data source: Public Storage's Q4 and full-year 2022 earnings. Chart by author.

The strong performance is partly due to Public Storage's acquisition efforts over the last few years, in which it spent over $8 billion and grew its portfolio by 26% since 2019. But it's also related to higher rental rates for its storage units. Occupancy in its properties dipped slightly since last year, it's now at 95%. But rates for its units remain up, which is helping offset the marginal rise in operational costs.

A lot of REITs struggle in today's rising interest rate environment. Higher rates equate to more interest paid on assets being managed, which eats into earnings. Thankfully, Public Storage has maintained low debt ratios historically, meaning rising interest rates don't impact the company as much as other REITs. It also has an A credit rating, which gives it more favorable terms for the debt it does carry. Right now its ratio of debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) is around 3.3 times, which is far better than the REIT average of 5 times.

Its dividend yield of 2% may not seem super juicy compared to some other high-yielding REITs, but investors can rest easy knowing it's well covered (it's just 72% of core FFO) and that they are gaining access to the leading self-storage REIT. Getting this REIT at a discounted price is just a bonus.