General Electric's (GE 0.99%) progress continues. The stock is up a whopping 49% in 2023, and its latest results saw management raise the low end of its guidance range after a good quarter. That's the headline news, and it's good, but there's some even better news if you dig into the weeds of the earnings report. Here's the lowdown.

General Electric's excellent first quarter

GE is set to be split into two companies early next year, with GE Renewable Energy and GE Power combined and spun off as GE Vernova and GE Aerospace representing the remaining company. GE Aerospace is, undoubtedly, GE's strongest business, but to ensure a successful spinoff of GE Vernova, the power and renewable energy businesses must be in good shape. Fortunately, the evidence from the first quarter is that all three businesses are making excellent progress on their medium-term aims.

Starting with the headline data from the first quarter:

- GE revenue rose 17% organically on a year-over-year basis.

- GE's free cash flow (FCF) of $102 million represents the first positive first quarter of FCF since 2015.

- Management raised the low end of its full-year earnings-per-share guidance (from a range of $1.60-$2.00 to $1.70-$2.00) and the low end of its full-year FCF guidance (from $3.4 billion-$4.2 billion to $3.6 billion-$4.2 billion).

- Orders rose 26% in the first quarter, driven by a 14% increase at GE Aerospace and 94% at GE Renewable Energy.

The headline news is positive, but within it are even more positives that investors shouldn't overlook, and they center on GE Aerospace and GE Renewable Energy.

GE Aerospace is solving its problems

The segment reported 25% revenue growth and a strong margin performance of 19%, leading to a 46% increase in operating profit to $1.3 billion. That's impressive enough, but two more things about the aerospace business's performance in the quarter caught my eye.

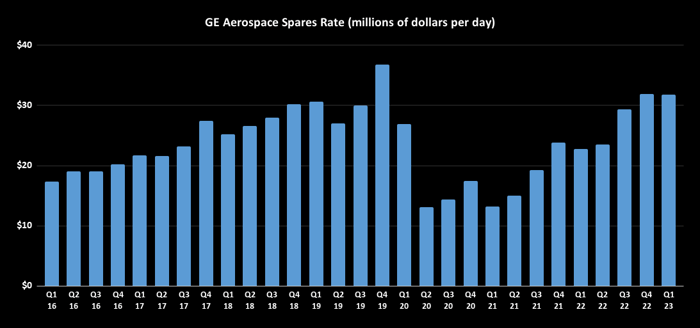

First, GE Aerospace's spare parts rate -- a key indicator of the trend in its business -- continues to grow strongly on a year-over-year basis. In fact, this is the first quarter it has exceeded the level of the same quarter in 2019, the year before the pandemic hit. The rate represents "commercial externally shipped spare parts and spare parts used in time and material shop visits in millions of dollars per day."

As commercial flight departures continue their recovery, it's more likely that airplanes will need servicing and "shop visits," leading to strong growth in services revenue.

Data source: GE SEC filings.

Second, GE is making good progress on its target of ramping LEAP engine deliveries by 50% to 1,700 in 2023. The LEAP engine is used in both the Airbus A320neo family and the Boeing 737 MAX. Since both these aircraft manufacturers are looking to ramp aircraft production aggressively, it's important that GE steps up deliveries. The good news is that LEAP engine sales were up 53% to 366 in the first quarter, and it appears GE is overcoming the supply chain issues that have dogged the aerospace sector over the last year.

GE Renewable Energy: Here comes the recovery

Given that GE Power is now a solid earnings and cash-flow generator, GE Renewable Energy is the swing factor in GE Vernova's earnings. The business's orders grew a whopping 94% in the first quarter, driven by two large orders in grid solutions -- high-voltage direct current to connect new renewable sources to the grid. In addition, CEO Larry Culp said onshore wind "equipment orders also increased with North America growing more than threefold."

Image source: Getty Images.

Given the improving onshore wind demand environment, GE's renewed focus on competing only in its most profitable markets, and its greater pricing discipline in the industry, the business will likely return to profitability. Indeed, Culp reaffirmed the target of GE Renewable Energy turning profitable in 2024.

General Electric marches toward 2024

All told, ongoing growth at GE Aerospace and the recovery at GE Renewable Energy (supported by solid earnings and cash flow at GE Power) promise to keep GE on track for a successful spinoff of GE Vernova in early 2024. As such, GE remains an attractive stock for investors.