Ford Motor Company (F 1.52%) and other legacy automakers are making the transition to electric vehicle (EV) sales, but it's been no joyride. Manufacturing a battery-powered car with sophisticated software that's integral to operations is a very different process compared to internal combustion engine (ICE) mechanics. While Ford ramps up production, every EV that rolls off the production line of this mighty American automaker loses money.

Considering the losses it's absorbing, it may be concerning for some investors that Farley recently touted a fourfold increase in Ford's EV sales in 2023 to some 400,000 units. Thankfully, Ford still predominantly makes ICE vehicles, which it turns a profit on.

Given the current situation, is Ford a solid investment?

NYSE: F

Key Data Points

Ford still makes a few bucks

Let's dig a little deeper into Ford's EV losses. The company reported Model-e (the EV unit that handles all-electric models like the Mach-E and F-150 Lightning) revenue of $2.5 billion but EBIT (earnings before interest and tax) losses of $1.8 billion during the first half of 2023. More concerning is that Ford is in the midst of a price war in the fast-growing EV space -- a tactic that involves price cuts to try and capture market share.

The price war's main battle involves industry pioneer and tech-savvy Tesla (TSLA 0.24%), which cut its own prices earlier this year and reported a resulting sizable dip in operating profit margins. But it's also going up against new EV models from start-ups like Rivian (RIVN 2.29%), as well as other old automakers like General Motors (GM 0.11%), to capture the public's current EV enthusiasm.

For Ford, establishing itself as a leader in this battle is key, especially as the F-150 pickup line has long been the primary breadwinner for the company. Rivian's trucks (or are they more like an SUV?) have had a pothole-filled journey to commercialization. Tesla's Cybertruck is finally beginning production. And of course, longtime rival GM will have electric versions of its trucks too. Ford decided to slash the price of the F-150 Lightning to make sure it gets some traction.

This likely means the Model-e losses could actually get a lot worse before they get better as the EV transition charges up. It does help that Ford is handily profitable everywhere else. Through the first half of 2023, the Michigan-based manufacturer hauled in $86.4 billion in revenue and generated net income of $3.7 billion -- a net income margin of 4.3%, or an 8.3% margin before interest and tax payments.

The endgame for legacy automakers

Ford CEO Jim Farley and his company will have their work cut out for them. On the last earnings call, Farley talked about altering previous plans on EV production, cutting the target production level from 600,000 units by the end of 2023 down to 400,000. The company now plans 600,000 units a year by the end of 2024. Ford had also previously held itself to a 2 million EVs-by-2026 goal, but that has now been monster truck-smashed by Farley.

Given how deep the EV losses have been, that's probably a good thing. Tesla CEO Elon Musk has referred to ramping up EV manufacturing as "production hell," and not even experienced players like Ford are exempt.

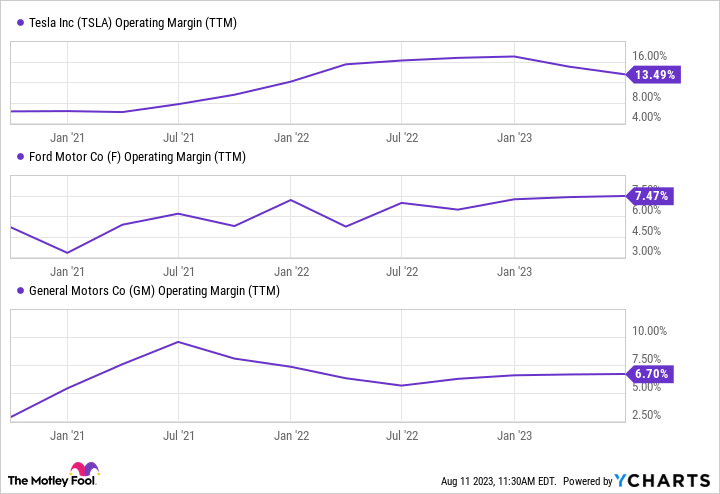

So what's the endgame? It's not survival for Ford, but rather balancing EV growth with overall profitability. And long term, profitability could be lucrative. Tesla has already demonstrated what automaker profit margins could look like when EVs are the sole focus, and they're quite good -- even in a price war. Tesla's operating margins peaked at nearly 20% in the first quarter of 2022, more than double its legacy U.S. counterparts.

Data by YCharts.

Thus, Ford's stock price falling after announcing its EV revision may look like a buying opportunity, especially as Farley appears to be trying to chart a path toward a more profitable future. But there's risk in driving too slow, with all the competition out there. Losing market share could throttle a transition to EVs, which could further delay higher long-term profitability. Having lower profit margins than competitors doesn't exactly make for a resilient business for the long haul.

Plus, even with its EV aspirations, Ford isn't exactly a growth company. Rather, the real reason to own this auto stock is for the dividend (currently yielding nearly 5% a year). It looks like a good payout, but with interest rates shooting higher since early 2022 (thanks to the U.S. Federal Reserve's inflation fight), there are now safer places to stash cash and get a steady payout nearing 5%.

Of course, Ford stock could simply be too cheap to ignore right now, at 6.4 times Wall Street's expected 2024 earnings. But as the saying goes in the investment world, "It might be cheap for a reason." There's simply not enough info right now to accurately project Ford's profits, given the EV race it's in.

I'm rooting for Ford, but personally, I'm doing so from the stands rather than behind the wheel with some of the company's stock. Investors mulling a Ford stock purchase should be mindful of the risks before deciding.