With stocks like Netflix, Nvidia, and Tesla continuously dominating headlines, investors can easily miss one of the roughly 6,000 publicly traded companies between the New York Stock Exchange and Nasdaq. One stock that doesn't get much fanfare but has crushed the market with a total return of nearly 230% since going public in late 2020 is Academy Sports and Outdoors (ASO 5.27%), a sporting goods retailer with 270 locations across 18 states.

Let's take a deeper look at what makes Academy a compelling under-the-radar growth stock you should consider for your next buy-and-hold investment.

What is Academy Sports and Outdoors?

Academy's journey began modestly in 1938 as a single tire shop in Texas. Over the years, it evolved from a military surplus store and ultimately transitioned into a sporting goods and outdoor retailer during the 1980s. It achieved the milestone of crossing the $1 billion mark in annual sales in fiscal year 2003 and has since maintained a steady growth trajectory, reaching $6 billion in annual sales by fiscal year 2022.

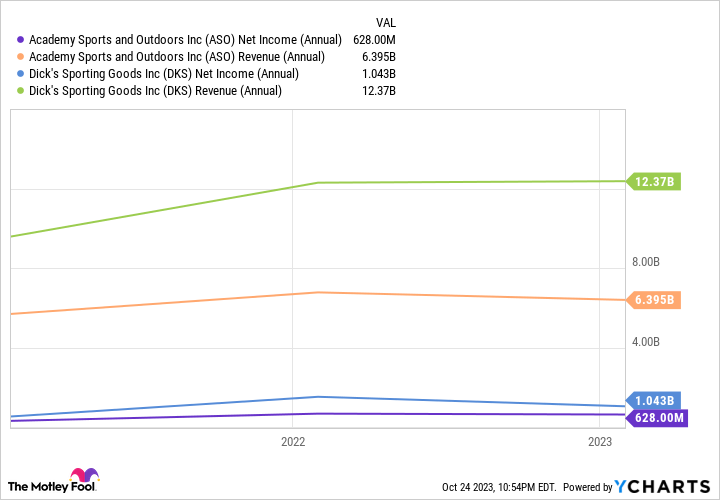

The company's 270 locations are in the South and Southeast, and management believes it can add 120 to 140 stores in current and adjacent states by 2027, representing a 44% to 52% expansion. For comparison, Academy's most direct competitor, Dick's Sporting Goods (NYSE: DKS), has 860 locations across 47 states, generating roughly $12.4 billion in annual revenue.

Academy has a strong balance sheet

In 2019, Academy had an outsized net debt (total debt minus cash and cash equivalents) of $1.3 billion, equating to a net leverage ratio of 4.1 times its net debt compared to its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA). In other words, in 2019, it would have taken the company 4.1 years of earnings to eliminate its debt, and that's before using its earnings for any other capital allocation strategies.

Management wisely used the funds from its initial public offering (IPO) in 2020 to cut down the net debt to $250 million, or a net leverage ratio of 0.25 times adjusted EBITDA.

As interest rates remain high, companies with a poor balance sheet can be forced to take out expensive debt that can weigh on earnings. Academy's management had the foresight to pay down its outsized debt at a time when it was much cheaper, resulting in a strong financial footing for the company today.

Academy is a shareholder-friendly stock

Academy is a dividend payer, with the company initiating a quarterly dividend in 2022 and raising it in 2023 to $0.09 per share, for an annual dividend yield of 0.8%. With that basement-level payout ratio (a key metric demonstrating the sustainability of dividends) of 4.75%, investors can reasonably expect management to raise it yearly.

Generally speaking, newly public companies will see their outstanding shares rise in the years following as employees exercise stock options and management focuses on growth instead of buying back shares.

That is not the case with Academy, as the company has repurchased 15% of its outstanding shares over the last three years. Reducing the number of outstanding shares increases the value of each remaining share by elevating the percentage of ownership per share.

And management recently shared that it expects the business to generate roughly $3.5 billion over the next five years in free cash flow to use on dividends, opportunistic share repurchases, and further debt reduction.

Image source: Getty Images.

Academy Sports and Outdoors is a cheap stock

Despite being a relatively new public company, Academy is a mature business with a stable business model, so investors can use its price-to-earnings (P/E) ratio to evaluate if it's a cheap or expensive stock. As of this writing, Academy traded at a P/E ratio of 6.5, meaning its stock price is only 6.5 times its trailing-12-month diluted earnings per share of $6.79.

Academy has historically traded at a low P/E, averaging roughly 6.9 since its IPO. Still, the company looks cheap when comparing it to its largest competitor, Dick's, with a P/E of 9.5 and the S&P 500's P/E of 19.2.

ASO PE ratio data by YCharts.

What could go wrong for Academy?

Before buying any stock, investors should assess potential risks associated with the business. Regular evaluation of these concerns is crucial to determine if there's any improvement over time. If management fails to address these issues, it could result in the market penalizing the stock. Conversely, if these concerns diminish, it could attract more investor interest, leading to meaningful stock gains.

For Academy, net sales and net income have each dipped recently from all-time highs. Specifically, for the first half of its fiscal 2023, the company generated $3 billion in net sales and $251 million in net income. For the same period of fiscal 2022, the company produced $3.2 billion in net sales and $339 million in net income, representing a year-over-year decrease of 7.4% and 6.7%, respectively.

Management has blamed the decline on consumers' financial health and less demand for bigger-ticket items compared to the pandemic. Yet, Dick's management recently noted its "consumer is doing very, very well," a statement backed up by its first-half results, which saw revenue grow 4.4% year over year to $6.1 billion. Dick's net income fell 5% during that period, as it is seeing similar pressure on its gross profit margin.

ASO net income (annual) data by YCharts.

Is Academy stock a buy?

Academy stock is down roughly 35% from its high in April this year, resulting in an industry-low P/E. Anytime a profitable company falls significantly, investors must determine whether its stock is a bargain or a value trap.

In Academy's case, if the company can grow net sales and net income once again with its lofty store expansion goals, long-term investors should expect the stock to rebound to new highs.