Berkshire Hathaway (BRK.A -0.17%) (BRK.B 0.15%) owns dozens of stocks in its massive and closely watched portfolio, many of which were selected by CEO Warren Buffett himself. Here are three in particular that look interesting -- they aren't the cheapest stocks in Berkshire's portfolio, but they are excellent businesses that are worth a look for patient long-term investors.

An incredible business in any environment

Visa (V 0.22%) is the largest payments network in the world. There are 4.26 billion Visa-branded cards in the world between debit and credit cards, and Visa facilitates the movement of nearly $13 trillion of annualized payment volume.

There are a couple of key points that make Visa an excellent business. First, this is a business that is always needed. Sure, consumer spending can decline during recessions, but from a long-term perspective, Visa's payment volume should keep up with inflation and then some as the world continues to gradually transition into a cashless society.

Second, Visa is a very profitable business with a huge margin of safety. There aren't many businesses this size that can claim a 53% net profit margin over the past 12 months.

Visa is not a cheap stock. It recently hit a 52-week high and trades at 27 times forward earnings. But you get what you pay for.

A unique homebuilder with lots of upside

The real estate market is extremely slow right now, with existing home inventories at generational lows and many buyers staying on the sidelines due to high mortgage rates. But it has been a surprisingly strong environment for homebuilders, as they can control their available inventory and offer incentives to buyers that mitigate the impact of high interest rates.

NVR (NVR 1.15%) uses a somewhat different business model than most major homebuilders. Instead of buying large tracts of land and gradually selling lots to buyers, NVR holds options on land but doesn't buy any until it is ready to build a home for a buyer. This asset-light approach allows the company to deliver stellar returns on equity and gives it an edge in slow market environments.

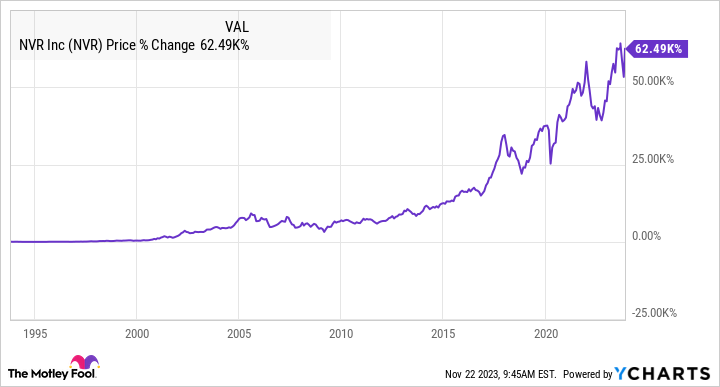

The proof is in the numbers. Since going public in 1993, NVR's stock has gained 62,500% (not a typo). NVR currently trades for less than 15 times forward earnings, a premium to peers but a historically cheap valuation. And as the real estate market starts to normalize, NVR could be a big beneficiary.

Bank stocks are cheap -- even Buffett's favorite

When all the banking industry turbulence happened earlier this year, Warren Buffett sold several financial stocks, but there's one he stuck with: Bank of America (BAC -0.39%). Berkshire owns 13% of Bank of America, making it the second-largest investment in its stock portfolio.

Bank of America has rebounded a bit from its lows but remains about 20% below its 52-week high and trades for 9% below its book value. But despite what the stock price has done, the bank has been performing very well. Net income rose by 10% in the third quarter on strong results throughout the business; deposits actually grew sequentially, reversing a recent trend; and credit quality remains quite strong.

Three excellent businesses at attractive prices

To be sure, these aren't the cheapest stocks in Berkshire's portfolio, but they are three examples of excellent businesses at attractive prices. They aren't likely to double your money quickly, but should deliver strong returns for patient investors over long periods of time. That's why Berkshire owns them, and why they're worth a closer look for your portfolio.