Nvidia (NVDA 1.28%) was the perfect stock to ride the demand for artificial intelligence (AI) computing in 2023. The graphics processing unit (GPU) leader saw its growth explode throughout the year. Revenue was up 206% year over year in the fiscal third quarter. That enormous growth spurt sent the stock up 238% in 2023.

It's not common for large companies like Nvidia with billions in annual revenue to suddenly experience this level of growth. Obviously, the demand for AI chips is massive, but investors are probably wondering how much more upside the stock could have in 2024. After all, Nvidia's guidance is pointing to slowing growth.

Here's what you should know about Nvidia's growth outlook before deciding to buy the stock.

Key risk factors to watch in 2024

Most of the stock's gain was in the first half of the year. Since the end of June, Nvidia shares have risen just 16%. There are a few factors weighing on the stock as we look ahead to 2024.

Chip export restrictions to China by the U.S. government have created some uncertainty for Nvidia's near-term momentum. The U.S. expanded these restrictions to Vietnam and other countries recently, where revenue has comprised up to a quarter of Nvidia's data center business. However, management expects strong growth in other regions to more than offset this headwind in the short term.

Another risk factor is the limited supply of AI chips and efforts by other tech companies to design their own processors. Google parent Alphabet, Microsoft, and Intel, among others, have their own chips that deliver a better price-performance ratio than Nvidia's costly H100 and H200 GPUs. However, none of these alternatives have been a match for the horsepower provided by Nvidia's data center chips, which have become the standard for all the major cloud service providers.

The greatest near-term challenge might come from Advanced Micro Devices, which just launched new data center GPUs designed for AI workloads. But AMD expects these GPUs to generate only $2 billion in revenue in 2024, which isn't much next to Nvidia.

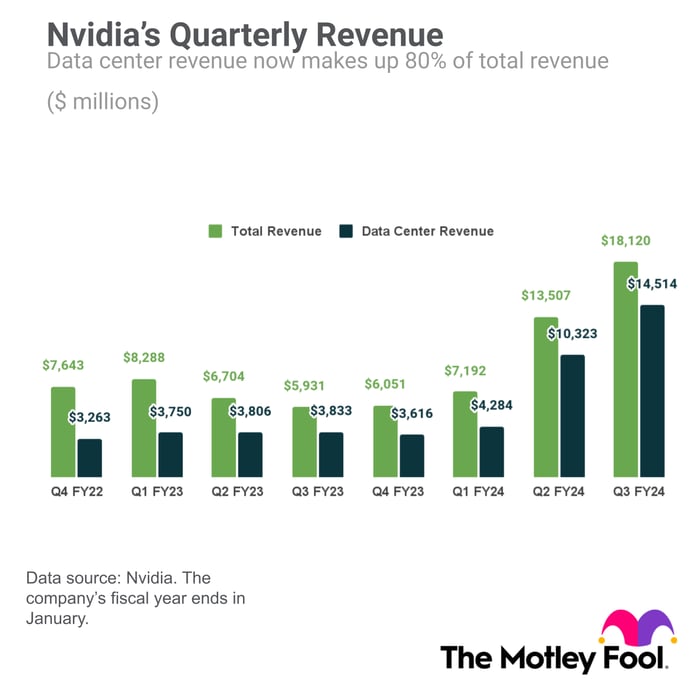

Nvidia's data center revenue was over $14 billion in the fiscal third quarter alone, representing an annualized rate of $56 billion.

Nvidia expects total revenue to be approximately $20 billion in fiscal Q4, compared to just $6 billion in the year-ago quarter. The massive jump in revenue has been a godsend for the company's profits. As we'll see, this factor alone could justify further gains for the stock in 2024.

Growth is slowing, but the stock's valuation is attractive for long-term investors

Nvidia's guidance shows a lower rate of increase over the previous quarter. The market is anticipating slowing growth next year. However, the stock still looks undervalued considering Nvidia's growth in profits.

Advanced AI chips produce higher margins than other chip sales. The favorable mix shift to higher-margin chips is juicing Nvidia's bottom line, where earnings per share jumped 1,274% year over year last quarter.

The stock trades at just 25 times forward earnings estimates. Nvidia's forward P/E is a bargain for a company serving a fast-growing AI market.

AI is one of the biggest growth opportunities in decades. It's becoming fundamental to products and services that consumers use every day. Nvidia is a blue chip AI stock everyone should consider tucking away in their nest egg.