Successful businesses disrupt entire industries. And in that process, they can make shareholders a ton of money.

Think about Netflix, which upended the home video rental market with its direct-to-consumer DVD business, then killed DVDs altogether with its introduction of streaming video in 2007. Since 2007, Netflix shares have risen a remarkable 13,000% -- meaning an initial investment of $10,000 investment would be worth over $1.3 million as of this writing.

Finding disruptors like Netflix isn't easy -- but they are out there. Here are two stocks I think have real disruptor potential.

Image source: Getty Images.

Duolingo

First up is Duolingo (DUOL 1.51%). I love this stock, and not just because it is up 241% over the last year.

Duolingo operates an online learning platform that helps people learn foreign languages. But what sets Duolingo apart is how it makes language learning fun. It utilizes "gamification" -- turning assignments into levels, vocabulary lessons into stories, and match games into quests. It's all designed to keep users coming back for more learning.

Meanwhile, users are burning through their free power-ups and mulligans. When those run out, they can purchase more one at a time, or subscribe to unlock more features -- including unlimited do-overs.

It's a great model, and it's paying off big-time.

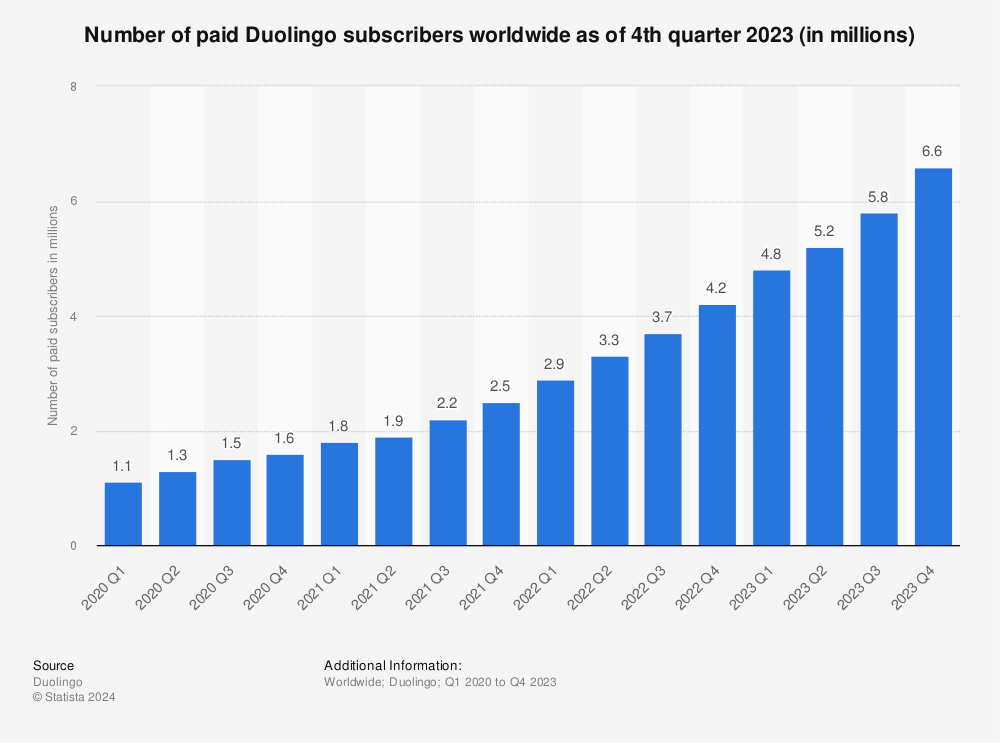

Duolingo's paid subscribers have grown from 1.1 million in 2020 to over 5.8 million as of its most recent quarter (the three months ended Sept. 30). That growth is critical for Duolingo, as about 77% of its total revenue comes from subscriptions.

In short, Duolingo is generating buzz for its platform, attracting casual users, and converting them to subscribers. And since no one has fluency in every language around, there's an endless amount of learning available once a user becomes a subscriber. For all those reasons and more, Duolingo has the potential to disrupt the language-learning industry and grow its share price for many years to come.

e.l.f. Beauty

Second is another mid-cap stock that's enjoying an incredible run: e.l.f. Beauty (ELF -3.50%). Shares are up 162% over the last year, as e.l.f. (which stands for "eyes, lips, and face") has come out of nowhere to challenge the cosmetics establishment. The company produces cosmetics and skincare products, including mascaras, moisturizers, primers, lip glosses, and foundations.

But what sets the company apart is its rapidly growing sales. In its most recent quarter (ended Sept. 30), it reported eye-popping year-over-year revenue growth of 76%.

Image source: e.l.f. Beauty Q2 FY2024 Earnings Presentation.

Thanks in part to its appeal with teens (the company ranked No. 1 in Piper Sandler's Taking Stock With Teens Survey in fall 2023) and partly to its lucrative partnership with Target, the company is rapidly gaining market share. According to Nielsen, within Target, e.l.f. is now the top-selling color cosmetics brand, while nationally, e.l.f. ranks third, with 10.3% market share.

Behind much of this success is the company's digital marketing strategy, which relies on a combination of social media ads, testimonials from influencers, and viral campaigns on platforms such as TikTok. Granted, competitors will try to copy e.l.f.'s strategy, but given how popular the company's products have become, it may be too late for larger competitors to put a lid on this up-and-coming brand.

In any event, e.l.f. has the potential to upend the $300 billion cosmetics industry, and therefore, it's a stock investors need to keep a close eye on.