Investing in exchange-traded funds (ETFs) makes it super easy to collect passive income. Many funds have income-focused strategies, which enable investors to sit back and watch the income flow into their accounts.

The Schwab U.S. Dividend Equity ETF (SCHD 0.48%), Vanguard Utilities ETF (VPU 0.50%), and Vanguard Real Estate ETF (VNQ +1.22%) are three of the top dividend ETFs. Each fund should be able to deliver reliable passive income in the decades ahead, making them great ETFs to buy this June to collect income for the rest of your life.

Image source: Getty Images.

The top 100 dividend stocks

The Schwab U.S. Dividend Equity ETF tracks an index (Dow Jones U.S. Dividend 100 Index) that focuses on companies that pay quality, sustainable high-yield dividends. It screens companies based on several dividend quality factors, including yield and five-year dividend growth rate.

The fund's focus on higher-yielding stocks provides investors with a higher current income stream. Over the trailing 12 months, the fund has an income yield of around 4%. That's about 3 times higher than the S&P 500's dividend yield (which is around 1.3%).

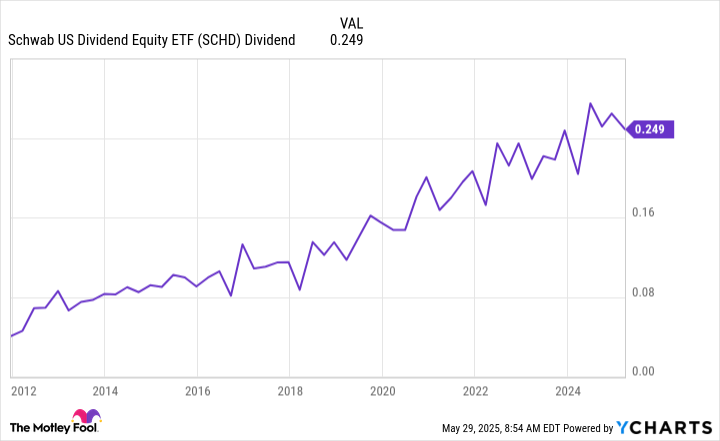

The ETF also aims to hold stocks with solid records of increasing their dividends, which should continue. As a result, the fund has steadily paid out higher distributions to its investors over the years.

SCHD Dividend data by YCharts.

The fund's current holdings have increased their dividends by more than 8% annually over the past five years. Its balanced blend of yield and growth positions this fund to provide investors with lots of passive income in the decades ahead.

Powerful dividend stocks

The Vanguard Utilities ETF holds companies that operate in the utilities sector. These companies distribute electricity, water, or gas to customers under government-regulated rate structures or long-term contracts. Because of that, they generate stable and growing cash flow. That supports their ability to pay above-average and steadily rising dividends.

This ETF currently holds 68 utilities. These companies stand to benefit from the expected surge in power demand over the coming decades. According to some forecasters, catalysts like AI data centers, the onshoring of manufacturing, and the electrification of everything could boost U.S. power demand by 55% by 2040. That should drive up power prices and fuel growth opportunities for utilities to build more power plants and electricity transmission lines.

Those growth drivers should give these companies plenty of power to continue increasing their higher-yielding dividends, which should enable the fund to steadily pay higher distributions to its investors. It currently has a 2.9% yield.

The easy way to be a landlord

The Vanguard Real Estate ETF invests in real estate investment trusts (REITs). These entities invest in commercial real estate, such as office buildings, warehouses, and apartments. Those properties produce rental income, the bulk of which REITs must distribute to investors to remain in compliance with IRS regulations. (They don't pay income taxes at the corporate level if they distribute at least 90% of their taxable net income to shareholders.) As a result, REITs tend to pay high-yielding dividends (the ETF currently has a 3.6% income yield).

The fund currently holds 158 real estate stocks. Many of these companies have a long history of growing their dividends. Two factors drive dividend growth in the REIT sector: rising rental rates and investments to grow their portfolios. Many long-term leases feature rental escalation clauses, while other property types have shorter-term leases that enable landlords to sign new leases at higher market rates as they expire.

Meanwhile, many REITs invest capital to expand their portfolios by developing new properties, completing redevelopment projects, and acquiring properties, portfolios, or other REITs. These drivers increase their rental income, enabling them to grow their dividends. That positions this ETF to steadily distribute more cash to its investors.

Easy ways to generate passive income

The Schwab U.S. Dividend Equity ETF, Vanguard Utilities ETF, and Vanguard Real Estate ETF hold companies that tend to pay higher-yielding dividends. Further, many of these companies aim to steadily increase their payouts. Because of that, they are great ETFs to buy this June to set yourself up to potentially collect a lifetime of passive income.