Shares of Quantum Computing (QUBT 2.43%) are surging on Tuesday, up 4.2% as of 2:52 p.m. ET but up as much as 22.7% earlier in the day. The jump comes as the S&P 500 and the Nasdaq Composite both had modest gains.

Though there isn't a specific catalyst for the company today, positive news from another quantum company is bleeding into all quantum stocks.

NASDAQ: QUBT

Key Data Points

IonQ is buying Oxford Ionics

In a deal worth more than $1 billion, Quantum Computing's rival, IonQ, is purchasing the U.K.-based Oxford Ionics. The move will combine IonQ's hardware and software with Oxford Ionics' advanced semiconductors to further the company's quest to create a viable commercial quantum computer. As CEO Niccolo De Masi put it, the move allows the company to "set a new standard within quantum computing."

Investor enthusiasm spilled over into other quantum stocks, a relatively common occurrence for the nascent industry. As we've seen this year, positive news for one company is often taken as positive news for the whole field.

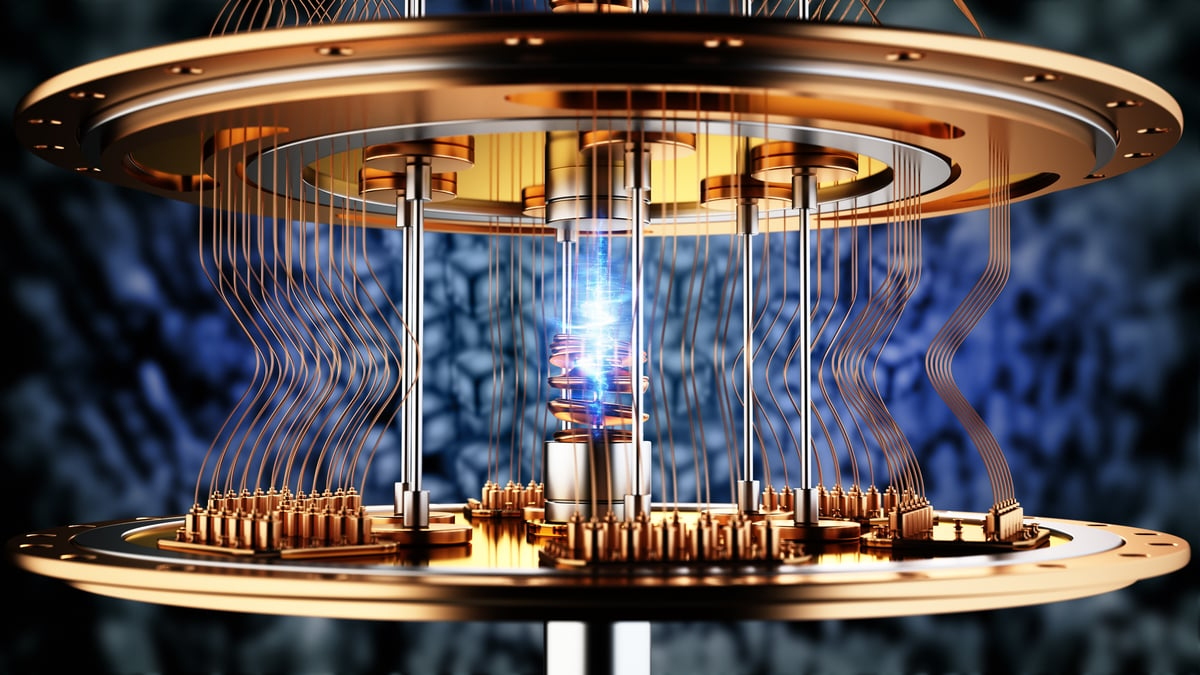

Image source: Getty Images.

A long road ahead

While this could help drive the technology forward, investors need to remain clear-eyed on how far away the industry is from delivering on the technology's promise. A truly commercially viable quantum computer could be more than a decade away. It could be even further away. It will be quite a long time before any company is able to produce a solution that is robust, powerful, and stable enough to generate a return on investment.

These quantum stocks, including Quantum Computing, are reaching valuations that make me nervous at this point in the technology's lifecycle. I would only consider investing if you have a particularly high risk tolerance. You need to be comfortable with waiting a decade or more for your investment to pay off and recognize that it's possible it never does.