Quantum Computing (QUBT +2.40%) stock is seeing a round of substantial sell-offs in Monday's trading. The company's share price was down 10.6% as of 1 p.m. ET, amid gains of 0.7% for both the S&P 500 (^GSPC +0.33%) and the Nasdaq Composite (^IXIC +0.84%).

Quantum Computing opened today's trading with a valuation pullback due to news that the company is moving to issue and sell new stock. The bearish pressure has intensified following news of rising geopolitical risk factors.

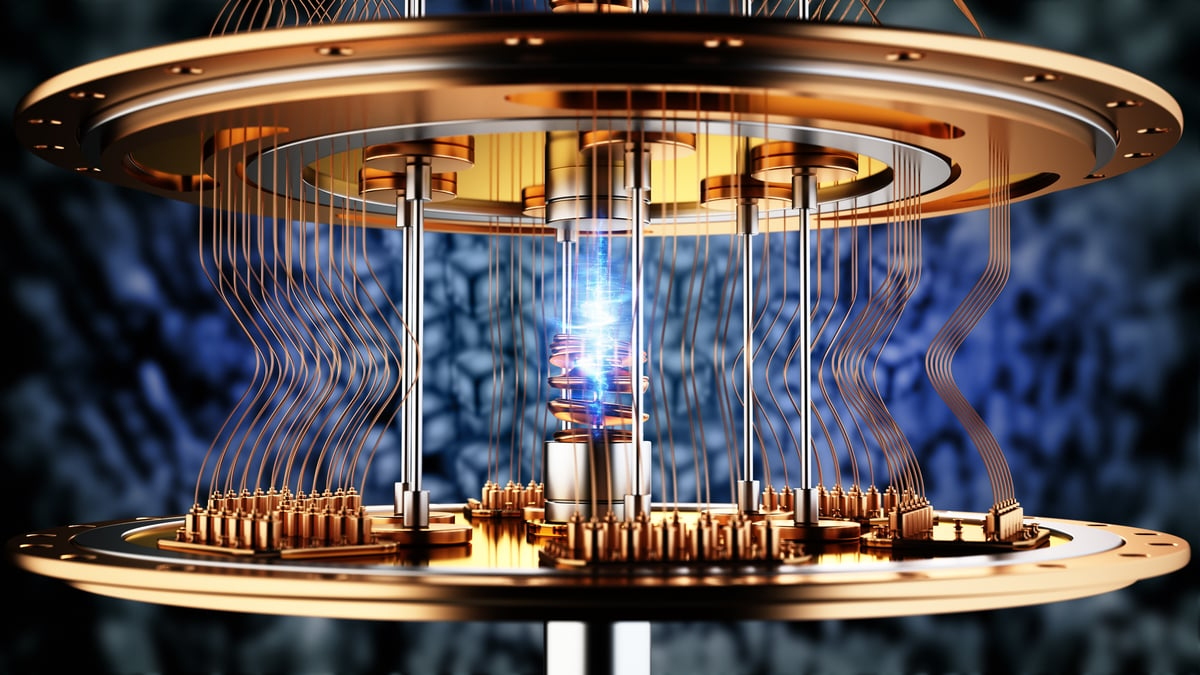

Image source: Getty Images.

Quantum Computing stock sinks on new share sale

Before the market opened this morning, Quantum Computing revealed that it had sold a significant amount of new stock through a private offering. Per the recent announcement, the company will be selling slightly more than 14 million shares of common stock priced at $14.25 per share to a group of institutional investors. The deal is expected to generate $200 million in cash for Quantum Computing, and the company plans to use the funds to accelerate its commercialization initiatives, facilitate potential merger-and-acquisition moves, and strengthen its overall financial footing. The new stock sale is expected to take place around June 24.

NASDAQ: QUBT

Key Data Points

What's next for Quantum Computing stock?

The announcement of Quantum Computing's upcoming stock sale has understandably raised concerns among investors. Even after a substantial sell-off today, the sale price for the 14 million shares of new stock is still roughly 16% lower than its current trading price. While it's not unusual for companies to offer stock at a discount when selling a large amount of shares through private placement, the deal highlights valuation risks and concerns.

In addition to stock dilution from the new share sale, geopolitical dynamics could be a significant source of volatility for Quantum Computing in the near term. Following a U.S. bombing strike on nuclear development facilities in Iran over the weekend, Iran is reportedly responding with missile strikes on U.S. bases in Qatar and Iraq today. As a growth-dependent stock with a speculative outlook, Quantum Computing could see outsized volatility if geopolitical conditions become increasingly unstable.