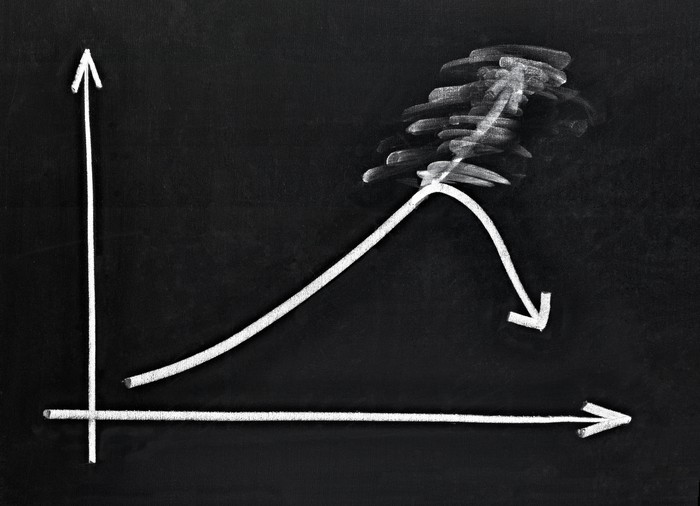

Apogee Enterprises (APOG 3.64%) stock, a specialist in architectural glass and metals, surged as much as 26% in early trading Friday before giving back most its gains and retreating to a 6% increase by 12:30 p.m. ET.

The reason: Earnings.

Image source: Getty Images.

Apogee Q1 earnings

In its fiscal Q1 2026 results, released this morning, Apogee beat analyst forecasts on both top and bottom lines. Sales for the quarter came in more than $20 million above consensus at $346.6 million. Earnings, adjusted for one-time items, were $0.56 -- 24% better than expected.

Turning to guidance, Apogee management said that it would generate sales of $1.4 billion or more this year and that (adjusted) earnings will range from $3.80 to $4.20 per share, well ahead of Wall Street's forecast for just $3.72 per share in profit.

NASDAQ: APOG

Key Data Points

Is Apogee stock a buy?

Terrific results and great guidance -- so why isn't Apogee holding on to its gains? Does anything in this news make Apogee stock less of a buy than it seems?

As a matter of fact, yes. Turns out, while Apogee's adjusted earnings were far more than expected, and its prediction for further adjusted earnings growth sounds good, the company's earnings as calculated according to generally accepted accounting principles (GAAP) were...a bit underwhelming.

Fact is, Apogee didn't earn any profit at all, as calculated according to GAAP. Rather, the company lost $0.13 per share for Q1, and Apogee's free cash flow was negative $27 million. Company CEO Ty Silberhorn also warned investors that "tariffs adversely impacted our first quarter results" and that the company has to take measures to "mitigate the impact of tariffs on the second half of the fiscal year."

All's not quite as well as it seems at Apogee stock. Tread carefully.