Rocket Lab USA (RKLB 1.08%) is emerging as a compelling under-the-radar play in the modern space race. SpaceX dominates headlines, but investors still cannot buy stock in the leading launch company in public markets.

Rocket Lab has carved out a spot as the second-most utilized launch provider in the U.S., specializing in small satellite launches with its Electron rocket. The company is pushing forward with its larger Neutron rocket, expected to launch this year, as it looks to capture a bigger slice of what McKinsey projects could be a $1.8 trillion space economy by 2035.

Rocket Lab offers high growth potential as it expands into a full-blown space-services business. Here's what investors have to look forward to from Rocket Lab during the next five years.

NASDAQ: RKLB

Key Data Points

Its Neutron rocket could be a game changer

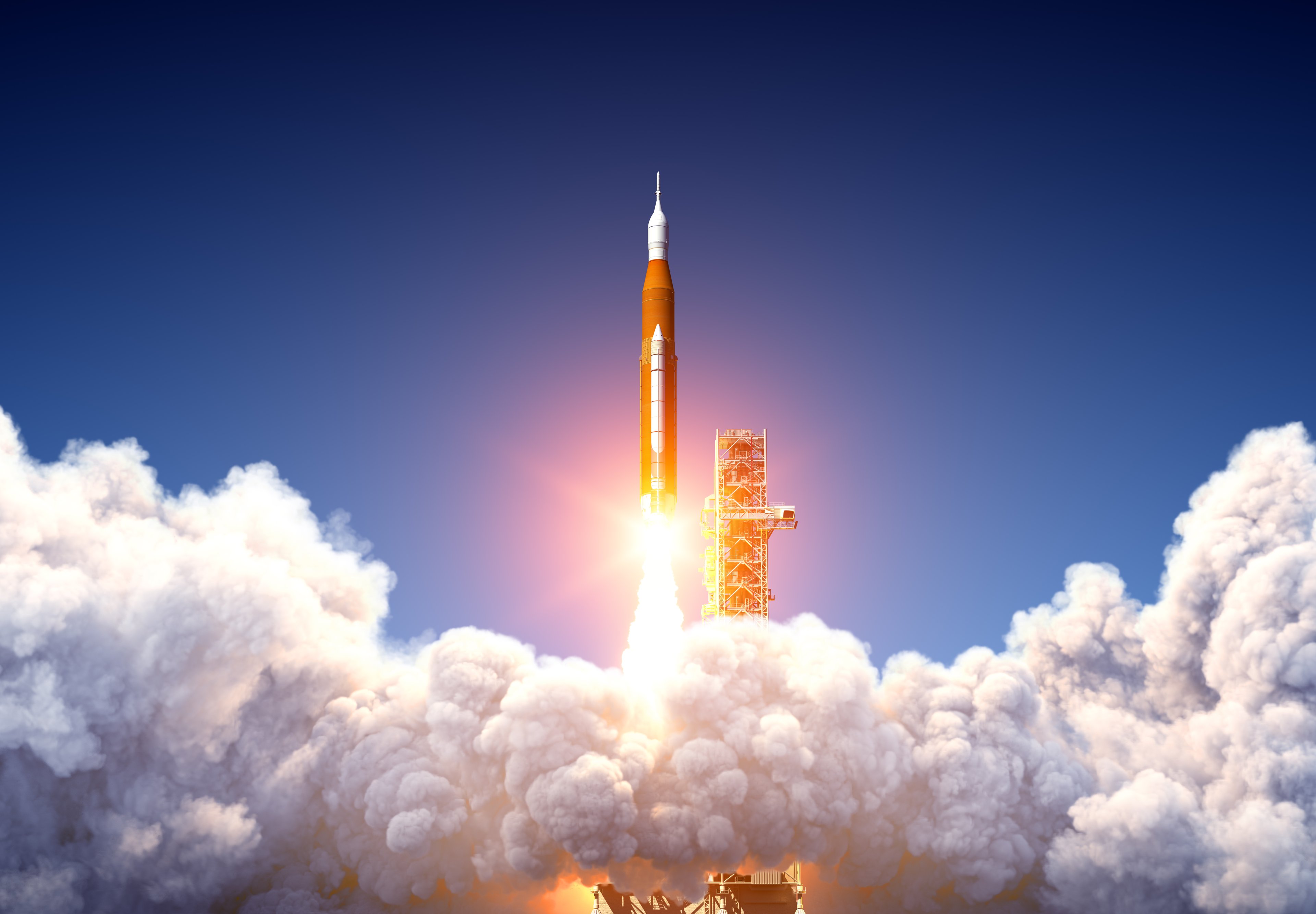

Rocket Lab USA is entering a critical phase as it seeks to establish a foothold in the space economy, providing space-launch services and satellite systems. One significant contributor to its future success will be the development and launch of the Neutron rocket. This medium-lift launch vehicle is designed to support larger missions, which will not only allow Rocket Lab to accommodate bigger payloads but also increase profitability and margins per launch.

Currently, Rocket Lab's Electron rocket is limited by its smaller size and capacity for lighter payloads, which restrict the company's ability to secure contracts for larger projects. The Neutron rocket is designed to carry payloads of up to 13,000 kilograms -- a 60-fold increase compared to the Electron rocket. With this enhanced capability, Rocket Lab can better compete with SpaceX, which dominates the U.S. launch market.

Image source: Rocket Lab USA.

Rocket Lab plans to launch the Neutron rocket in the second half of this year. However, some analysts express skepticism about this timeline. For instance, Bleecker Street Research, an investment firm that is short Rocket Lab stock, believes it may not be until mid-2026 or even 2027 until the Neutron rocket takes off. A delay in the launch would likely weigh on the stock in the near term, which is what Bleecker Street is counting on. That said, management still believes the rocket's debut is on track for the second half of this year.

Rocket Lab's goal to pursue "every part of the space value chain"

Rocket Lab's Electron rocket will continue to play a crucial role in deploying satellite constellations, with six missions planned for Japanese satellite maker iQPS in 2025 and an additional two missions scheduled for next year. Additionally, Rocket Lab aims to launch eight Gen-3 satellites for BlackSky by 2026.

Launches are one part of the puzzle. Rocket Lab's grander vision is to be a comprehensive end-to-end space-services provider. This will help position it as a leading prime contractor in the space industry, with a strong emphasis on developing satellite constellations.

One key move to further this was its acquisition of Mynaric AG, a company specializing in laser optical communications terminals. This acquisition enables Rocket Lab to scale up production of critical components for satellite-to-satellite connectivity. Mynaric is already a subcontractor for Rocket Lab on high-value contracts, such as the $515 million prime contract with the Space Development Agency (SDA).

Rocket Lab is expected to finalize its acquisition of Geost in the latter half of 2025, pending regulatory approval. This acquisition will bolster Rocket Lab's integrated capabilities in launch services, spacecraft, and payload delivery, establishing the company as a competitive force in U.S. national security missions. The acquisitions are part of the company's broader plan to pursue "every part of the space value chain," according to Chief Executive Officer Peter Beck.

Image source: Getty Images.

What's next for Rocket Lab

As of March 31, Rocket Lab had a backlog of $1.07 billion. This represents the estimated value of work to be performed, and 56% of this backlog is expected to be recognized as revenue during the next 12 months, with the remainder expected to be recognized the next year. To put the size of this backlog into perspective, Rocket Lab's revenue last year was $436 million.

Looking further down the road, its Neutron rocket has been selected for onboarding to the U.S. Space Force's National Security Space Launch (NSSL) Phase 3 Lane 1 program. This is a multi-award, firm-fixed-price, indefinite-delivery/indefinite-quantity (IDIQ) contract worth as much as $5.6 billion, with an ordering period extending through June 2029 and the potential for an additional five-year ordering period through 2034.

Is Rocket Lab USA right for you?

The next five years are crucial for Rocket Lab, as it will launch its medium-lift rocket, continue to deliver satellite launches, and expand its space-systems business. That said, achieving and sustaining profitability and positive free cash flow remains a challenge in the near term, given its ongoing investments in testing and getting its Neutron rocket ready for prime time.

There is some risk to the stock, especially at today's valuation with a price-to-sales (P/S) ratio of 38 and a forward P/S ratio of 28.5. The stock is far from cheap and reflects high investor optimism around the company and its longer-term growth prospects. Analysts project that Rocket Lab may not be profitable until 2027.

Given this backdrop, Rocket Lab is vulnerable to large price swings, especially if the timeline around its Neutron launch doesn't unfold as planned. For this reason, Rocket Lab is a growth stock best suited for aggressive investors looking to bet on the growing space economy with a long-term outlook in mind.