The tech-heavy Nasdaq Composite index has been in turnaround mode for the past three months -- up an impressive 31% over that span after a rocky start to the year. That's not surprising, as strong quarterly results from major technology companies seem to have boosted investor confidence in the sector.

Lumentum Holdings (LITE 5.54%) has been one of the beneficiaries of the tech stock rally. Shares of the company, which sells optical and photonic products that go into data centers and telecom networks to enable fast data transmission, have shot up by an impressive 75% in the past three months, putting them back within 10% of the peak they reached in January.

The good part is that Lumentum's rebound wasn't just a function of the broader market's rally, but also because of the company's healthy growth, which is being powered by its customers' increasing investments in artificial intelligence (AI) infrastructure. Better still, this stock is likely to deliver more upside to investors.

Image Source: Getty Images

Lumentum's products are playing a key role in AI data centers

Lumentum is witnessing terrific demand for its externally modulated lasers (EMLs), which are widely deployed in high-speed optical communications applications such as data centers and telecom networks. Their ability to transmit data over long distances at high speeds makes them ideal for deployment in AI data centers.

NASDAQ: LITE

Key Data Points

On Lumentum's May earnings call, CEO Michael Hurlston noted: "We set another record for EML chip set shipments this quarter and remain on track to more than double this business by the end of calendar 2025." At the same time, the company is going to further expand its production capacity of EMLs in an effort to meet the end-market demand.

That's the smart thing to do, considering that according to market research firm LightCounting, the optical transceiver market is expected to generate $10 billion in revenue in 2026 -- as compared to $5 billion in 2024 -- before rising to $20 billion in 2030.

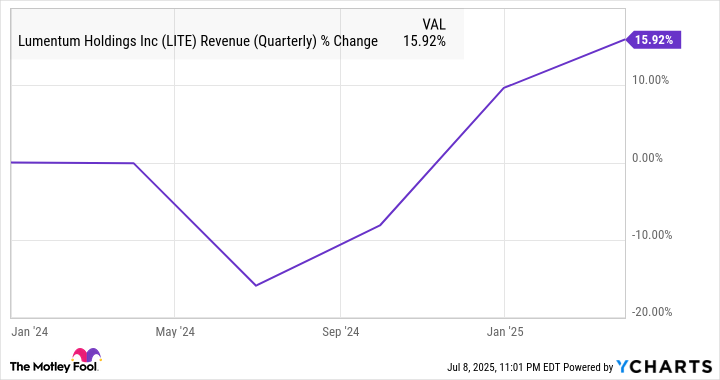

LITE Revenue (Quarterly) data by YCharts

The company's revenue in its fiscal 2025 third quarter increased by 16% year over year to $425.2 million. Its adjusted earnings per share jumped by more than 500% -- from $0.09 to $0.57 -- on the back of an improvement in manufacturing utilization rates as well as the higher margins of its laser components deployed in AI servers.

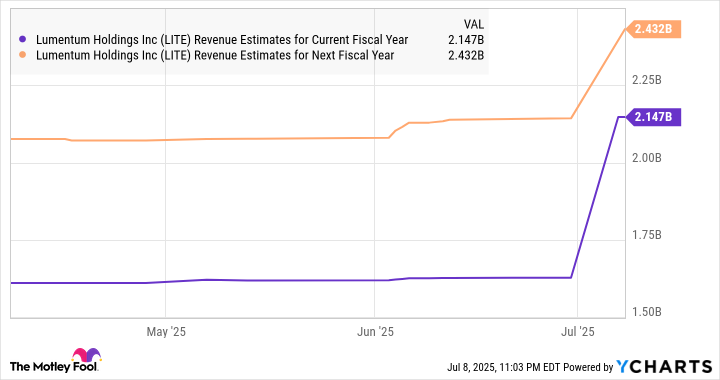

Analysts' consensus estimates are for a 20% increase in Lumentum's revenue this year to $1.6 billion. Importantly, its top-line growth is expected to remain solid next year as well, thanks to the improving demand for AI-focused optical components.

LITE Revenue Estimates for Current Fiscal Year data by YCharts.

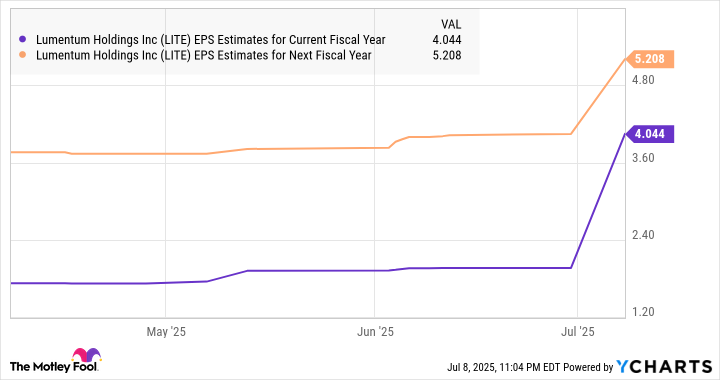

Even better, that top-line growth is expected to filter down to the bottom line as well. The analysts are forecasting a 94% increase in earnings in the current fiscal year to $1.96 per share.

LITE EPS Estimates for Current Fiscal Year data by YCharts.

That won't be surprising when we take into account the margin gains that its laser components deployed in AI data centers are delivering.

Why this AI stock is set up for more upside

What's worth noting is that Lumentum is trading at an incredibly attractive valuation despite the impressive growth that it has been clocking. It has a forward earnings multiple of 24, which is lower than the tech-laden Nasdaq-100 index's average forward price-to-earnings ratio of 29.

Even assuming Lumentum continues to trade at a discount to the broader index after a couple of years, if it delivers the healthy earnings growth that analysts are anticipating, its stock could fly higher. Based on a P/E ratio of 24, its projected earnings of $5.21 per share in its fiscal 2027 point toward a stock price of $125. That would be 37% above the current level.

However, don't be surprised to see this AI stock jumping higher than that, as the market could reward it with a premium multiple thanks to its strong earnings growth. That's why even after its impressive rebound over the past three months, investors should consider buying Lumentum before it possibly flies even higher.