Your financial plans change in retirement, when those paychecks stop and you begin depending on your hard-earned retirement savings to pay your living expenses.

Some people slowly withdraw their savings, often selling their investments to generate that income. That's fine, but I prefer companies that pay dividends. They reward shareholders for owning their stock, allowing them to realize dividend income without having to sell their shares. Keeping your money invested means it continues to compound.

However, retirees must be cautious about what they invest in, as they likely don't have the time or means to rebuild their savings if something goes wrong.

Retirees should consider investing in the Schwab U.S. Dividend Equity ETF (SCHD 0.10%). I'll outline three reasons below.

Image source: Getty Images.

1. It provides simple, straightforward diversification

The Schwab U.S. Dividend Equity ETF is an exchange-traded fund, a bucket of individual stocks that trade under a single ticker symbol.

NYSEMKT: SCHD

Key Data Points

Some ETFs are constructed based on a specific theme or investment strategy, while others replicate stock market indexes. The Schwab U.S. Dividend Equity ETF follows the Dow Jones U.S. Dividend 100™ Index. It represents 103 individual holdings. So, when you invest in the Schwab U.S. Dividend Equity ETF, you're actually investing in a tiny piece of dozens of individual companies.

The ETF covers various stock market sectors, including:

| Market Sector | Percentage of Schwab U.S. Dividend Equity ETF |

|---|---|

| Energy | 21.08% |

| Consumer Staples | 19.06% |

| Health Care | 15.68% |

| Industrials | 12.45% |

| Financials | 8.36% |

| Information Technology | 7.87% |

| Consumer Discretionary | 7.86% |

| Communication Services | 4.8% |

| Materials | 2.8% |

| Utilities | 0.04% |

Data source: Schwab Asset Management. Chart by author.

The 10 largest individual holdings in the ETF are:

| Company | Percentage of Schwab U.S. Dividend Equity ETF |

|---|---|

| 1. Texas Instruments | 4.37% |

| 2. Chevron | 4.26% |

| 3. ConocoPhillips | 4.21% |

| 4. Merck & Co | 4.07% |

| 5. Cisco Systems | 4.05% |

| 6. Amgen | 3.97% |

| 7. AbbVie | 3.95% |

| 8. PepsiCo | 3.92% |

| 9. Bristol Myers Squibb | 3.84% |

| 10. Home Depot | 3.80% |

Data source: Schwab Asset Management. Chart by author.

As you can see, investors get a wide range of companies in various industries, so there isn't one straw that can break the metaphorical camel's back. Additionally, the ETF has significantly lower technology exposure than the broader market (S&P 500). This can be ideal for retirees, as technology stocks tend to be more volatile than other market sectors.

These are well-established companies with a broad track record of paying and raising their dividends. Retirees generally want to avoid taking much risk, and this ETF checks that box nicely.

2. It provides solid dividend income immediately

Retirees have many options for dividend and investment income, but it's hard to beat the Schwab U.S. Dividend Equity ETF's combination of dividend yield and safety.

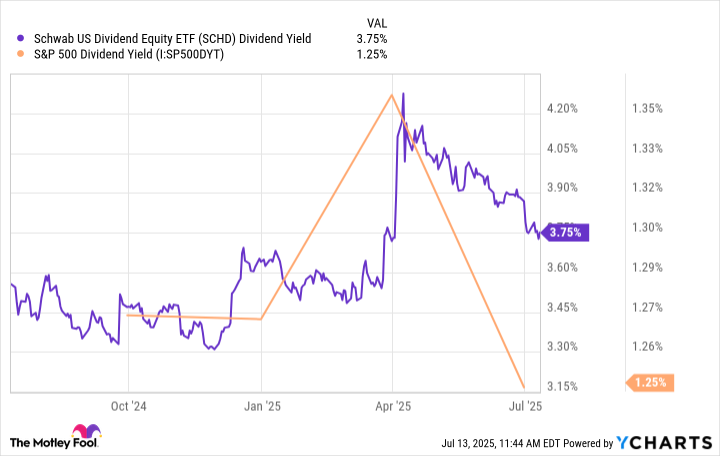

The ETF's dividend yield is currently 3.75%, well beyond what the broader stock market offers.

Data by YCharts.

Are there stocks with higher yields? Yes! But often, those higher yields come with more risk. The yield is simply a reflection of the share price versus the dividend amount. Typically, a dividend yield is high because investors, through the stock's price action, are commanding a higher return due to some factor, often a lack of growth or troubles in the underlying company.

Homing in on the highest yields you can find frequently backfires, causing significant losses when the company cuts its dividend or continues to struggle. The ETF's diversity mitigates that risk, and the yield is still almost 4%.

3. Your dividend income will likely grow faster than inflation

Inflation is your greatest enemy in retirement. It steadily erodes your money's purchasing power. The best way to combat it is to grow your money faster than the inflation rate, which historically averages a low single-digit percentage annually.

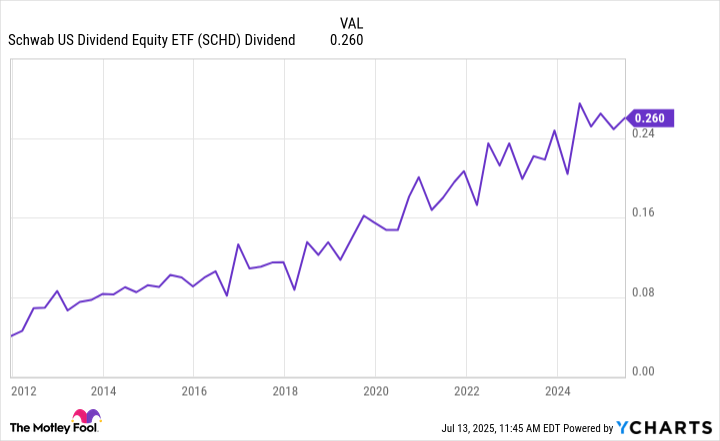

The Schwab U.S. Dividend Equity ETF checks this box, too. The ETF's dividend has grown by approximately 541% since late 2011.

Data by YCharts.

These dividends don't come from thin air. The companies the ETF holds are growing their earnings over time, enabling them to raise their dividends. That's the beauty of investing in quality, blue-chip dividend stocks. Fortunately, the Schwab U.S. Dividend Equity ETF makes it easy. Any retiree looking for dividend income should take a close look at the ETF for their portfolio.