Cathie Wood is one of the most vocal bulls on Wall Street when it comes to innovative technologies like artificial intelligence (AI), robotics, and autonomous vehicles. Her firm, Ark Invest, runs a set of exchange-traded funds (ETFs) that invest in companies operating in those industries.

Earlier this year, Ark released the 2025 edition of its annual "Big Ideas" report, which featured updated forecasts for many of its favorite investing themes. In its look at the future of the logistics industry, the firm predicted there could be a whopping $860 billion revenue opportunity by 2030 for autonomous delivery robots, drones, and even trucks.

Serve Robotics (SERV 4.54%) is a small-cap company worth just $600 million, but it's trying to transform last-mile logistics with its autonomous food delivery robots. It has a major contract with Uber Technologies to launch 2,000 robots this year, but that might be the tip of the iceberg if Ark's forecasts prove close to accurate. Is the stock a buy right now?

Image source: Getty Images.

Breaking down the opportunity

Ark's $860 billion forecast is divided into three parts: $160 billion for food delivery, $280 billion for parcel delivery, and $420 billion for larger freight that would be delivered by autonomous trucks. Serve started with food delivery robots that navigate on sidewalks autonomously, but the company is moving into drones and other last-mile solutions that could eventually expand its reach into parcels.

Serve's latest Gen3 robots run on Nvidia's Jetson Orin platform, which provides the computing power they need to operate autonomously. Those Gen3 robots operate with level 4 autonomy, meaning they can safely travel on sidewalks within designated areas without any human intervention.

To capture the forecast $160 billion opportunity in autonomous food delivery by 2030 could require millions of robots operating all over the world. The 2,000 new Gen3 models that Serve will deploy this year under its deal with Uber Eats will help validate its business model and pave the way for a larger rollout. Around 250 hit the streets during the first quarter of 2025, with 700 more expected to be in use by the end of the third quarter, and the remainder coming online before the end of the year.

The new robots enabled Serve to expand its service into Miami and Dallas earlier this year. In June, the company also started operating in Atlanta.

NASDAQ: SERV

Key Data Points

Serve's revenue could soar, but it's losing truckloads of money

Serve's revenue stream is quite lumpy right now, which is typical for a company in the scale-up phase. In the first quarter, revenue plunged by 53% year over year to $440,465. However, that decline was entirely due to the fact that the comparison was being made against a year-ago period during which its revenue was inflated by a one-off licensing payment of $850,000 from its manufacturing partner, Magna International.

Moreover, Serve's first-quarter revenue was up by a whopping 150% from its result three months earlier (which wasn't distorted by unusual payments). This suggests there is some genuine momentum building in its delivery business. In fact, Wall Street's consensus estimate (provided by Yahoo! Finance) suggests Serve's 2025 revenue could come in at $6.8 million, which would be a 275% jump compared to 2024.

Then in 2026, analysts believe Serve's revenue will surge by another 648% to $50.6 million as more of its robots go into service.

But there's a glaring problem: Scaling an autonomous robotics business isn't cheap. Serve lost $13.2 million during the first quarter of 2025 alone, putting the company on track to exceed its 2024 net loss of $39.2 million by a wide margin. Even if Serve does deliver $6.8 million in revenue this year, that won't be anywhere near enough to offset the amount it's spending on line items like research and development.

The company has around $197 million in cash on its balance sheet, so it can afford to lose money at its current pace for at least a couple more years, but it will have to chart a path to profitability soon. If it doesn't, it might need to raise capital again, which would dilute existing investors and dent their potential returns.

Serve stock isn't cheap, but should investors buy it anyway?

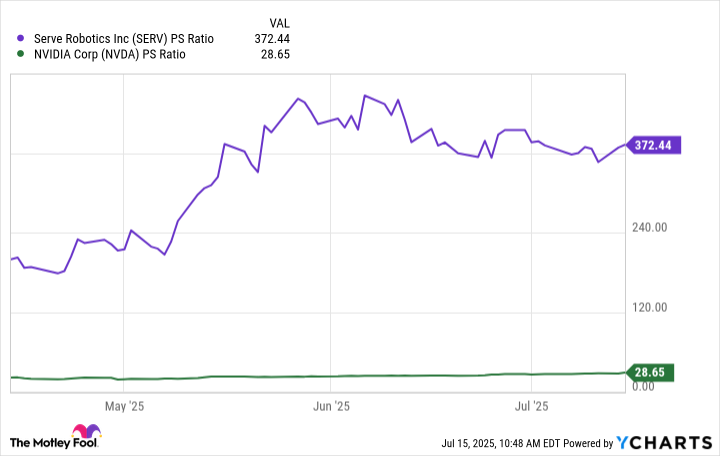

Serve stock trades at a sky-high price-to-sales (P/S) ratio of 368 as of July 15, which makes it a staggering 13 times more expensive by that metric than Nvidia. I'm going to be completely frank: Serve stock doesn't deserve to be trading at such a hefty premium, so it's difficult to make the case for buying it right now.

SERV PS Ratio data by YCharts.

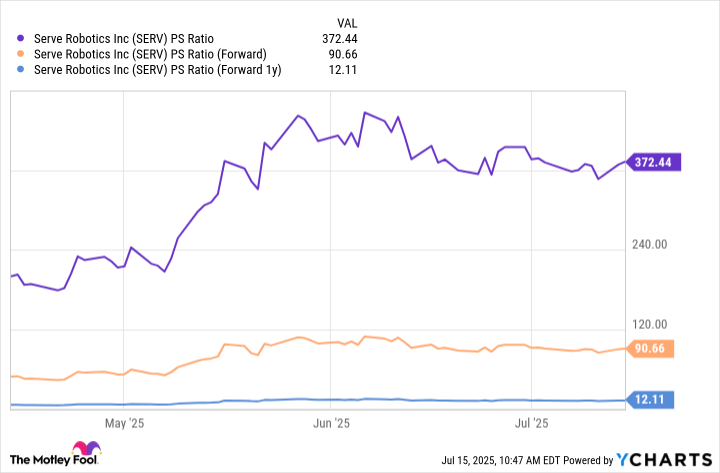

However, the stock looks a little more reasonable if we value it based on its expected future revenue. If we assume the company will bring in $6.8 million this year as Wall Street expects, that gives the stock a forward P/S ratio of 89.6 -- still expensive, but a little less ludicrous. If we base its valuation on Wall Street's 2026 revenue forecast of $50.6 million, that places its stock at a 1-year forward P/S ratio of 12, which might even be considered cheap for a company growing this quickly.

SERV PS Ratio data by YCharts.

But it's impossible to know whether Serve can deliver as much revenue over the next couple of years as Wall Street expects. Therefore, short- to medium-term investors should probably proceed with caution.

However, if Ark's 2030 forecasts for the autonomous logistics industry prove accurate, then investors who are willing to buy Serve stock today and hold onto it for at least the next five years or so could do well, despite its eye-watering valuation right now.