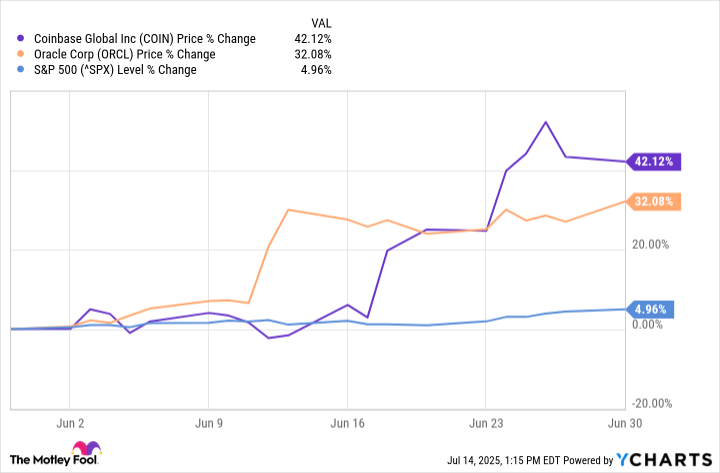

June was a great month for the S&P 500 index, which finished up 4.96%. It was its second-best monthly performance of the year (it gained 6.15% in May) and pushed the index's year-to-date (YTD) gains to 5.50% as of the end of the month.

Yet, some components of the S&P 500 far outstripped the index's solid gains last month. The two best-performing S&P 500 stocks in June were crypto currency exchange Coinbase Global (COIN 2.77%) and database software provider Oracle (ORCL 0.52%), up 42.12% and 32.08%, respectively.

Let's see why.

Coinbase finishing as the S&P 500's top performer was an ironic surprise, with it being the company's first full month included in the index. The three straight months of positive monthly gains are Coinbase's first since the fourth quarter in 2023. In light of a revenue-sharing agreement with fintech company Circle, Coinbase could have a new and profitable segment in the works.

Oracle's stellar month can be attributed to good news surrounding its cloud business. In its fiscal 2025 fourth quarter (ended May 31), its cloud infrastructure revenue grew 52% year over year (YOY) to $3 billion, and its total cloud revenue grew 27% YOY to $6.7 billion. Add in a new cloud deal that's expected to bring in $30 billion annually beginning in a few years, and investors are excited about Oracle's direction.