Alphabet (GOOG 0.77%) (GOOGL 0.76%) has an important date coming up on the calendar: July 23. After the market closes on that day, it gives investors an update on Q2 results, and I think these figures could be the catalyst Alphabet stock needs to send it soaring.

Alphabet is currently one of the most disliked big tech stocks on the market, and has a fairly cheap valuation compared to its peers and the broader market. The market is particularly concerned about one item, and if Alphabet provides investors with good news on this front, the stock could be ripe for a surge.

Image source: Getty Images.

Alphabet trades at a deep discount to its peers and the broader market

Alphabet has multiple companies underneath its umbrella, but the largest (and most important) is Google Search. Coincidentally, this is also the segment that investors are the most worried about, which is why the stock trades at a discount to its peers.

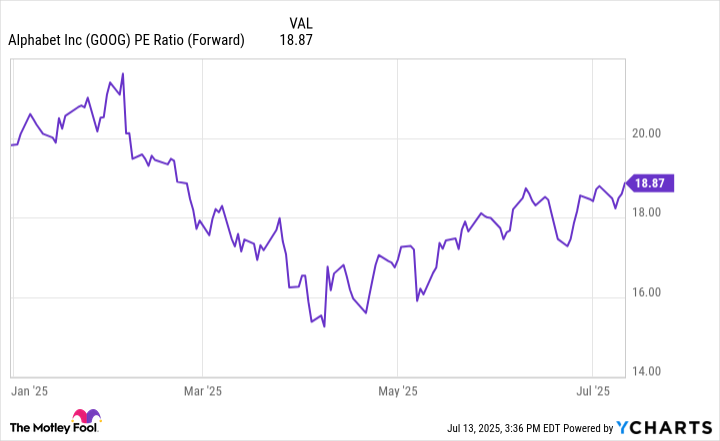

GOOG PE Ratio (Forward) data by YCharts

Although it's recovered from its lows, Alphabet's stock still trades for less than 19 times forward earnings, which is far less than every other big tech stock trades for. Furthermore, the S&P 500 trades for 23.7 times forward earnings, so it's valued at a significant discount to the broader market. This conveys deep fear about Alphabet's future, as its past has been quite strong.

In Q1, Alphabet's revenue increased 12% year over year, while diluted earnings per share (EPS) rose an impressive 49%. Those are strong results, and if any other big tech company posted earnings like that, they'd have a premium valuation. However, investors are worried about Google's potential to lose market share.

The primary concern on Wall Street is that Google Search is poised to be disrupted by generative AI. More consumers are starting to use generative AI instead of Google Search, which could cause its ad revenue on the platform to decline. We've already seen some effects of this occur, as Google's search engine market share fell below 90% for the first time since 2015. Additionally, rumors suggest that various generative AI firms are set to launch artificial intelligence (AI)-first web browsers that would threaten Google Chrome.

These are all massive headwinds for Google Search, but they haven't shown up in the results yet.

All the Google Search fears haven't materialized yet

In Q1, Google Search's revenue rose 10% year over year. That's in line with where a mature business should be growing, and at least from a financial standpoint, all the fears seem to be unfounded.

One thing that could be occurring is confirmation bias, where Wall Street analysts and other people in the tech realm have replaced Google with generative AI, but they've forgotten about the vast majority of the population that is never going to make the switch to generative AI because the traditional Google Search techniques ingrained in their internet behavior works just fine for them. Furthermore, Google implemented AI search overviews, which provide a generative AI-powered overview of the Google Search results.

For the vast majority of the population, this could be enough AI to keep them on the platform, which will cause Google Search to maintain its dominance.

I think this is the most likely outcome, and with each passing quarter of Google Search posting strong results (which I believe it will do in Q2), this thesis will start to become more widely accepted.

However, if you see Google Search revenue start to slip, don't be surprised if the stock sells off drastically, as it would be a confirmation of the bear case. I don't think that will happen, and I firmly believe that Alphabet is a great buy today because of the bearish sentiment that has yet to impact Alphabet's financial results.