As earnings season approaches, investors should review their portfolios and assess whether there is still upside left or if the next piece of news could be negative. This could apply to Apple (AAPL 0.46%), as investors have been fairly bearish on the stock for a good reason.

While the rest of the market has rallied from its lows in April and May, Apple's stock has remained relatively flat, down 15% for the year at the time of this writing. I think this lack of participation isn't a buying opportunity; it's a sign of things to come. As a result, it may be a good idea to unload shares before Apple's next quarterly earnings report on July 31.

Image source: Getty Images.

Apple has failed to be an innovator lately

Apple needs little introduction; it's the leading consumer technology brand and millions around the globe own its products. However, there's only a limited population, and Apple may have neared the saturation point for its product line.

Furthermore, Apple has failed to release any real game-changing features in recent years. It wasn't all that long ago when consumers would purchase a new iPhone each year for all of the new upgrades. Now, it's only incremental battery life and camera upgrades, with little true innovation.

On the AI front, Apple has been left behind by its Android peers, as Apple Intelligence, its take on AI, hasn't delivered anything noteworthy.

This is a telltale sign of a company that's relying on its prior success, and it's evident in Apple's financials.

Apple's growth has been very slow recently

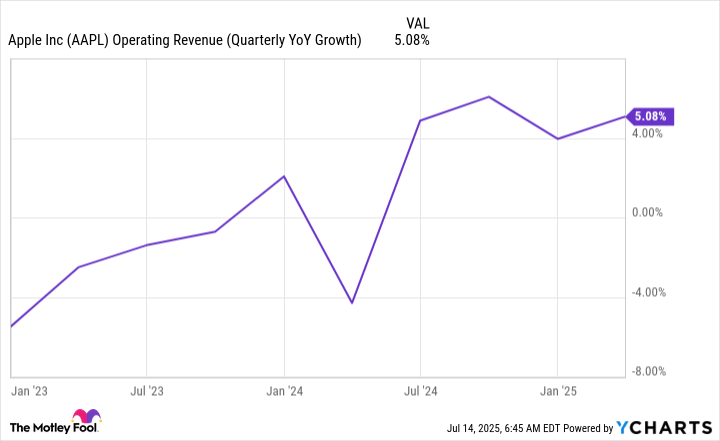

Apple's revenue growth has been poor over the past few years.

AAPL Operating Revenue (Quarterly YoY Growth) data by YCharts

With Apple's 5.1% increase last quarter looking like a huge improvement from prior quarters, that's not a great position to be in. However, for a mature company like Apple, investors care more about earnings per share (EPS) growth than revenue growth. Apple can repurchase shares and improve margins to squeeze out faster earnings growth than revenue growth, but those days may be limited as well.

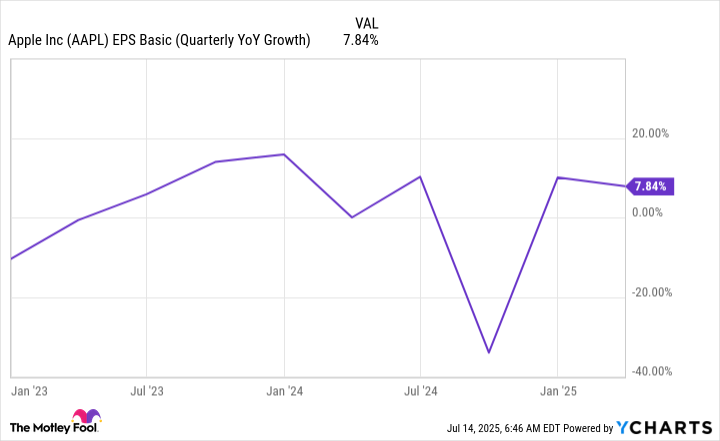

AAPL EPS Basic (Quarterly YoY Growth) data by YCharts

Apple has repeatedly delivered quarters with less than a 10% EPS growth rate, which suggests it may underperform the market over the long term, given the market's long-term average growth rate of around 10%. Despite Apple continuously delivering slower-than-average growth, its stock trades at a hefty premium to the market.

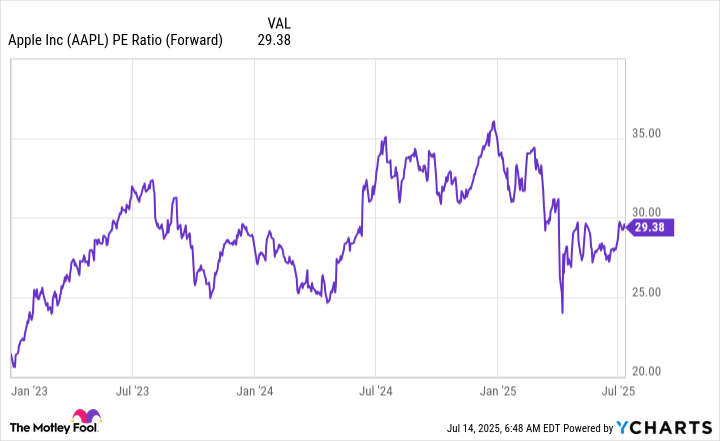

AAPL PE Ratio (Forward) data by YCharts

Although Apple's valuation has come down, its 29.4 times forward earnings is still far more expensive than the S&P 500's 23.7 times forward earnings.

This suggests that the market is overpaying for Apple's stock, and its third-quarter fiscal year 2025 earnings announcement on July 31 could serve as another wake-up call for investors. There wasn't much that happened in the quarter that could have boosted Apple's sales, and with tariffs likely squeezing its margins, the odds of the stock moving lower are far more likely than it moving higher.

Investors should consider moving on from Apple stock. It has been on a great run and produced phenomenal returns, but there are many other stocks with stronger growth that look like better places to be invested in right now.