The S&P 500 is the stock market's most followed index by a large margin. It tracks the performance of 500 of the largest American companies on the stock market, and is often used to gauge how the overall market (and U.S. economy) is performing.

One issue that's been coming up with the S&P 500 lately is how concentrated it has become. The index is weighted by market cap, so larger companies make up a larger percentage of the index and its performance. This isn't new; it's always been that way. However, megacap tech companies have begun surging in valuation, making it a lot more top-heavy than usual.

Image source: Getty Images.

For perspective on how concentrated the S&P 500 has become, Apple, Microsoft, and Nvidia are the index's top holdings, and they account for over 18% of the index. The top 10 holdings account for over 34%. The S&P 500 is one of the smartest investments the average person can make, but the concentration is becoming an issue worth paying attention to now.

That's why an equal-weighted S&P 500 exchange-traded fund (ETF) like the Invesco S&P 500 Equal Weight ETF (RSP +0.28%) is a great option to consider.

Invest in the same companies, with much less concentration

Unlike the standard S&P 500, this equal-weight ETF gives roughly the same amount of weight to all the S&P 500 companies. It allows you to invest in the same companies, but be much less reliant on the performance of megacap tech companies. Here are the top 10 holdings in the standard S&P 500 and how much they account for in the equal-weight ETF:

| Company | Percentage of S&P 500 | Percentage of Equal-Weight ETF |

|---|---|---|

| Apple | 6.76% | 0.21% |

| Nvidia | 6.22% | 0.22% |

| Microsoft | 5.65% | 0.21% |

| Amazon | 3.68% | 0.20% |

| Meta Platforms | 2.55% | 0.20% |

| Alphabet (Class A) | 2.07% | 0.09% |

| Berkshire Hathaway | 1.96% | 0.19% |

| Broadcom | 1.91% | 0.21% |

| Alphabet (Class C) | 1.67% | 0.11% |

| Tesla | 1.61% | 0.19% |

Data source: Invesco and Yahoo Finance. Percentages as of July 11.

Instead of these megacap companies making up over a third of the index performance, they only make up just over 2% in the equal-weight ETF. That reduces a lot of risk, especially when the tech sector is slumping.

Results show there are benefits to being diversified

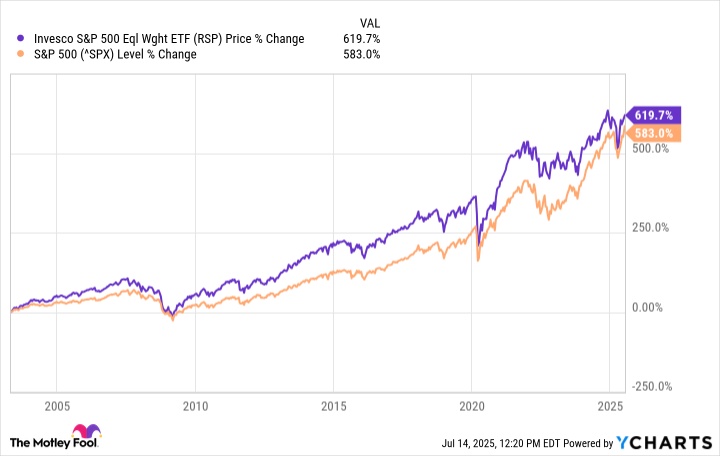

Over the past decade, big tech stocks have carried a lot of the weight for the S&P 500, and it has worked out in its favor. In that span, the S&P 500 is up 198%, while the equal-weight ETF is up around 127%. However, the equal-weight ETF has outperformed the S&P 500 since its April 2003 inception.

This doesn't inherently make this ETF a better option -- and past success doesn't guarantee future success -- but it does show that being diversified has its benefits and doesn't mean sacrificing gains.

Don't lose sight of what sectors make up the most of your portfolio

If there were a single investment I'd recommend for the average person, it would be an S&P 500 ETF. The concentration doesn't mean you should avoid it altogether, but you need to be mindful of how concentrated your portfolio becomes.

Most brokerage platforms will allow you to see your portfolio broken down by sector or industry. If the S&P 500 is a larger part of your portfolio (as it is with mine), keep an eye on how much you're leaning on the tech sector and consider complementing it with stocks and ETFs that focus on other sectors.

NYSEMKT: RSP

Key Data Points

In either case, a $2,000 investment in this ETF could prove to be a good choice, especially during the current environment when there is a lot more uncertainty in the stock market and U.S. economy than in previous years.