Should you buy stock in a company with a good chance of missing its full-year guidance and one that could cut its much-admired dividend (currently yielding 6.6%)? Usually, that's the last thing investors should want to do. But in the case of UPS (UPS 1.57%) and its upcoming second-quarter earnings announcement on July 29, it makes sense. Here's why.

The market doesn't believe UPS will sustain the dividend

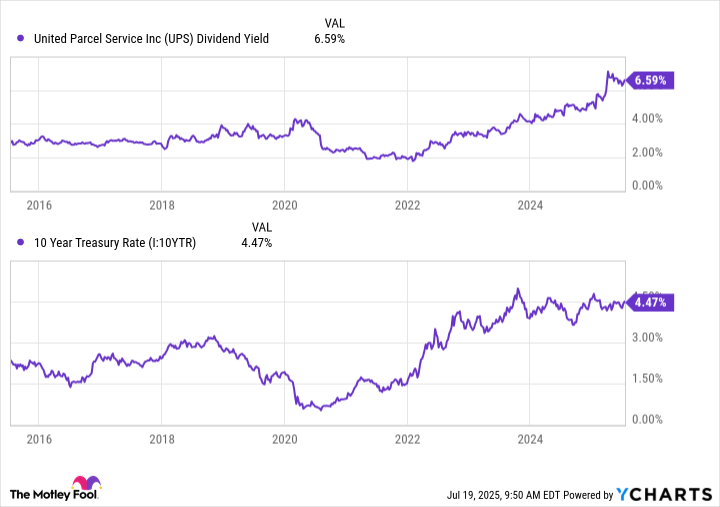

UPS's dividend yield is 6.6%, and the 10-Year Treasury yield is about 4.5%. Outside of the COVID-19-led crash in 2020, there's never been a period when the spread between UPS yield and the risk-free rate was this high.

Data by YCharts

This is the market's way of indicating that it believes the dividend is at risk and may well be cut.

A silver lining

But here's the thing: A dividend cut might just be what the company needs. As previously articulated, UPS has excellent underlying growth prospects from investing in its healthcare, and small and medium-sized business revenue. In addition, the plan to reduce low or even negative margin deliveries for Amazon by 50% from the start of 2025 to mid-2026 makes perfect sense for a company focused on maximizing profitability in its network.

Image source: Getty Images.

It would free up cash for investment in these activities, as well as ongoing investments in technology to improve its network -- they could even be accelerated. It would also reduce the uncertainty surrounding the stock and encourage investors to focus on its growth opportunities, rather than stressing about the sustainability of its dividend.

As counterintuitive as it may sound, if UPS is forced to cut its full-year guidance over concerns about raised tariffs and trade conflicts, then reducing the dividend could be a positive move; and investors should, at the least, monitor events closely even if they don't plan on buying in before the earnings report.