Arm Holdings (ARM 2.63%) stock has underperformed the technology sector of late. It is trading down about 16% from its all-time high set in mid-2024, while the tech-focused Nasdaq Composite index is trading at or near all-time highs despite enduring a tough time earlier this year.

However, a closer look at Arm's stock price chart tells us that it is regaining its mojo once again. Shares of the company have jumped 56% in the past three months, outpacing the Nasdaq Composite's 28% gains. Importantly, the stock could get a solid boost when it releases its fiscal 2026 first-quarter results after the market closes on July 30.

Now, Arm stock is trading at a more attractive valuation than it was a year ago, thanks to the 16% dip. That's why now may be a good time to start accumulating Arm, as it seems primed for more upside in the second half of 2025 and beyond.

Image source: Getty Images.

Arm's robust growth has made the stock relatively cheaper

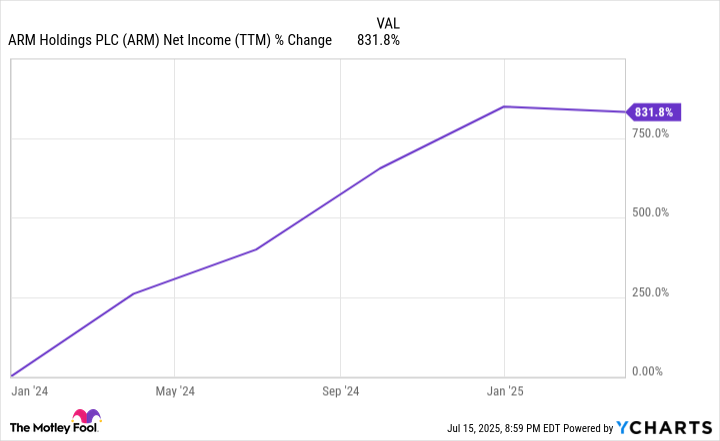

Even though Arm's stock price has headed south in the past year, the company's earnings have been growing at an impressive pace in the past 18 months. This is evident from the following chart.

Data by YCharts.

This is why Arm can now be bought at a relatively cheaper valuation. It is trading at 193 times earnings right now, which is almost a third of its price-to-earnings ratio at the end of June 2024. Additionally, its forward earnings multiple of 79 tells us that analysts are expecting a nice jump in the company's earnings going forward.

Of course, Arm's valuation remains at lofty levels when we consider that the U.S. technology sector has an average earnings multiple of 51. But the company is capable of justifying its valuation by clocking healthy levels of earnings growth, thanks to the fast-growing adoption of its latest chip architecture that's contributing positively toward its margins.

The company is capable of delivering terrific bottom-line growth

Arm licenses its chip architecture and intellectual properties (IP) to semiconductor companies that use them to design chips. The company gets its revenue from licensing agreements that it enters into with customers, along with royalties that it gets from each chip that is manufactured using its design.

NASDAQ: ARM

Key Data Points

The good part is that the demand for Arm's IP and chip architecture has improved following the advent of artificial intelligence (AI). That's not surprising, as processors designed using Arm's architecture are said to be better at tackling advanced AI workloads while being power-efficient at the same time, as per third-party analysis.

This explains why there has been a whopping 14x jump in the number of customers using Arm-based chips in data centers in just four years. Cloud computing giants such as Alphabet's Google, Amazon, and Microsoft are developing custom AI processors for their data centers using Arm's IP. The company has also seen a significant jump of 12x in the number of start-ups using its architecture for designing chips in the past four years.

Arm's terrific progress in the data center market can also be attributed to a big spike in the number of applications that processors developed using its architecture can run. The company points out that the number of applications that can run on Arm-based chips has doubled since 2021, on the back of a 1.5x jump in the number of developers making those applications.

As such, it's easy to see why Arm is confident of increasing its share of data center central processing units (CPUs) to 50% by the end of 2025, which would be more than triple last year's reading. The British company also expects to corner 50% of the PC CPU market by 2029, which would be a sixfold jump compared to last year.

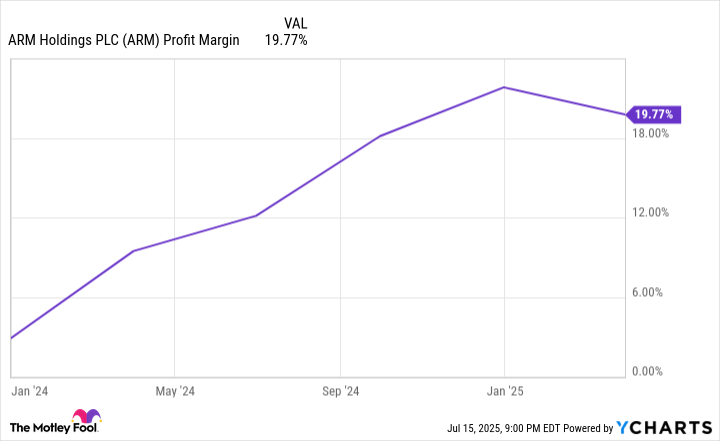

Even better, the royalties that Arm commands for its latest Armv9 architecture are reportedly double those of the previous generation. This is the reason why there has been a nice jump in the company's margin profile in the past 18 months.

Data by YCharts.

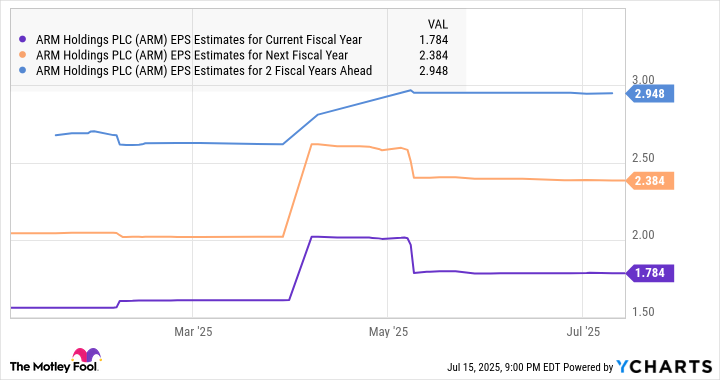

Arm is capable of clocking healthy earnings growth levels going forward, and that's precisely what analysts are expecting from the company.

Data by YCharts.

However, don't be surprised to see Arm's earnings growing at a faster pace than analysts' expectations, thanks to a combination of market share gains and the higher royalty rates for its AI-focused chip designs. Investors looking to add a growth stock to their portfolios can consider buying Arm, as the argument above indicates that it is set to soar higher on the back of an improvement in its earnings power.